According to the nation’s supply chain executives in the latest Institute for Supply Management (ISM) Manufacturing Purchasing Managers Index (PMI), economic activity in manufacturing contracted in March for the fifth consecutive month following a 28-month period of growth. At 46.3%, the March Manufacturing PMI is at its lowest level since May 2020, when it registered 43.5%. The ISM PMI is a diffusion index with the properties of leading indicators with a reading above 50% indicating that the manufacturing economy is generally expanding; below 50% indicates that it is generally declining. For flatbed carriers looking for demand indicators, the March result also reported New Orders dropped 2.7% from 47.0% in February to 44.3%.

The March ISM survey showed all subcomponents of its manufacturing PMI below the 50 thresholds for the first time since 2009. “Manufacturing is pulling back, but the service sector was still chugging along in February,” said Chris Low, chief economist at FHN Financial in New York. “As long as it remains well above 50 when reported on Wednesday, the broad economy should be fine. Nevertheless, the health of manufacturing is related to the health of the overall economy.” According to Tim Fiore, Chair of the Institute for Supply Management, “of the six biggest manufacturing industries, two — Petroleum & Coal Products; and Machinery — registered growth in March. New order rates remain sluggish as panelists become more concerned about when manufacturing growth will resume. Supply chains are now ready for growth, as panelists’ comments support reduced lead times for their more important purchases.”

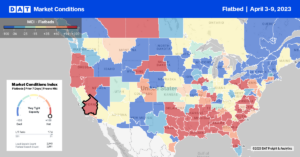

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

Like dry van and reefer equipment types, flatbed capacity was also slightly tighter in California last week at $2.15/mile for outbound loads, which is identical to 2019. Driven by solid gains in Ontario, the state’s second-largest flatbed spot market, rates were up for the fourth week, increasing by $0.09/mile to $2.04/mile. Capacity in San Francisco was much tighter following a last week’s $0.11/mile increase to $2.49./mile on a 7% lower volume. In neighboring Stockton, capacity was also tight – rates increased by $0.06/mile to $2.24/mile on a 22% lower volume.

At $2.33/mile, outbound linehaul rates in Texas remained the second-highest in seven years following last week’s $0.01/mile increase. Rates increased in Houston, the largest flatbed market in the state, up by $0.05/mile to $2.41/mile on a 23% lower volume. Loads from Houston to Ft. Worth were paying $2.93/mile, $0.13/mile higher than in March but $0.54/mile lower than the previous year. Loads 750 miles southwest to El Paso, at $2.31/mile, were $0.40/mile lower than in March, while loads to Lubbock in the Permian Basin oilfield were flat at $2.72/mile.

Load-to-Truck Ratio (LTR)

March is typically when flatbed spot market activity surges yearly, reaching as high as 25% of all loads moved. So far, volumes have steadily fallen, following last week’s 17% decrease. Load posts are also around 34% higher than in 2020, while capacity loosened following a 6% w/w increase in carrier equipment posts. The net result was the flatbed load-to-truck (LTR) ratio decreased by 22% w/w from 14.46 to 11.27, the second lowest in seven years and only surpassed by 2020.

Spot Rates

After a solid first quarter, flatbed spot rates have lost ground in the last two weeks following another penny-per-mile decrease. At $2.17/mile, the national average is $0.51/mile lower than the previous year and $0.13/mile lower than in 2018.