Higher levels of commercial construction activity are offsetting the well-documented slowdown in residential construction. Boosted by new developments for electric vehicles, schools, e-commerce warehouses, manufacturing plants, and more recently, infrastructure projects, flatbed and specialized carriers are seeing more robust than expected demand this year.

According to the U.S. Census Bureau, construction spending for non-residential projects reached record-high levels, 23% higher in March than the previous year and 13% higher than the prior peak in March 2020. In contrast, residential spending is just 2% higher than the last year and declining rapidly. Since the height of the pandemic-fueled residential construction boom in May 2022, residential spending has dropped 12%.

For truckload carriers, this has translated to fewer loads of lumber, roofing products, and appliances in the single-family home market, offset by more loads of commercial building products. Looking at future demand for commercial projects, the Construction Backlog Indicator produced by the Association of Builders and Contractors reported an 8.7-month backlog. This was an improvement from February’s reading of 9.2 months. For factories, energy projects, and other industrial jobs, the backlog was 9.3 months, down from 10.4 months in February.

Find loads and trucks on DAT One, North America’s largest on-demand freight marketplace.

All rates cited below exclude fuel surcharges unless otherwise noted.

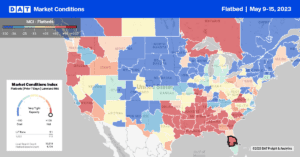

Louisiana flatbed rates are similar to 2018 at $2.61/mile last week. Load posts were up 19% last week in Shreveport, which took the number one spot from Houston for spot market volume. Available capacity was sufficient to meet demand – spot rates dropped $0.25/mile to $2.75/mile, down $0.55/mile from the high of $3.30/mile record two weeks ago. Jackson, MS, took the number three spot for volume last week, and even though volumes were 8% lower, short-haul capacity was tight, driving up spot rates by $0.27/mile to $2.93/mile.

In Little Rock, capacity tightened on 17% higher w/w volume, with spot rates up $0.10/mile last week to an average outbound rate of $2.69/mile, up $0.21/mile in the previous month. In the Pacific Northwest, regional capacity was very tight in Medford, where spot rates surged to $3.19/mile, up $0.17/mile in the last month. Loads from Medford to Stockton at $3.28/mile are $0.20/mile higher than in April and the highest since last August.

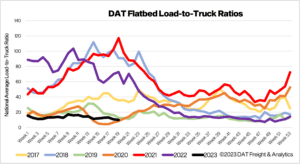

Flatbed spot volumes dropped 8% last week and are following the same seasonality path as in 2019. Load posts are 81% lower than the previous year and around half what we’d typically expect to see in Week 19. Carrier equipment posts were up 2% last week but at the highest level in seven years resulting in last week’s flatbed load-to-truck(LTR) ratio decreasing from 10.75 to 9.79.

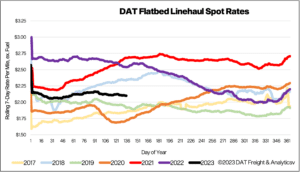

After being flat at around $2.16/mile for most of April, flatbed spot rates have started May with two successive weeks of declines. Following last week’s $0.01/mile decrease, the national average flatbed spot rate ended last week at $2.13/mile. Linehaul rates are $0.44/mile lower than last year, $0.23/mile lower than in 2018, and $0.19/mile higher than 2019.