As shippers seek to contend with the ever-evolving transportation market landscape, the evolution of data is causing major shifts to the procurement process.

On May 8, 2023, DAT Chief Scientist Dr. Chris Caplice gave a presentation at the Gartner® Supply Chain Symposium/Xpo 2023 discussing the rise of data analytics and its impact on transportation procurement. In this first edition of the DAT iQ SME Speaker Series, we’re recapping the key takeaways to help shippers navigate procurement and build more comprehensive portfolios.

Breaking down technological and economic modes

Shippers, carriers, and brokers all use various “technological modes” – meaning specific transportation solutions that move people or products through a unique combination of infrastructure, vehicles, controls, and governance systems. These can include tractors and trailers, planes and trains, and ships and barges.

While there are a variety of technological modes, trucking is the largest, accounting for about 70% of all transportation. However, under the umbrella of trucking, there are different modes that dictate strategy. The most prominent among them are:

- Consolidated modes operate like bus routes, with set pickup cycles and drop-off points. Trucks operating in consolidated modes make predetermined stops at various terminals before arriving at the final destination. Due to the complexities of this option, barriers to entry for consolidated modes are high. However, the overall costs decrease as the business’ inventory volume increases.

- Direct modes operate more like taxis. They move specific cargo directly from point A to point B. This option has a much lower barrier to entry – since all you need is one technological mode to get from A to B. However, unlike consolidated modes, it’s about scope rather than scale; the cost of going from point A to B depends on what’s coming out at point B.

The problem with procurement

The procurement process for shippers, carriers, and brokers begins with an annual RFP, a reverse auction where carriers are awarded the rights to haul freight on lanes for a set period. Then, shippers feed carriers and rates into the routing guides in their transportation management systems (TMSs). Finally, shipments are put into the routing guide and the primary carrier for that lane (the carrier who won the RFP) has the shipment tendered to them. If the primary carrier rejects the load, it goes to an alternative carrier or the spot market.

“This is how it’s supposed to work,” said Caplice. “But if it worked perfectly, I wouldn’t be talking today.”

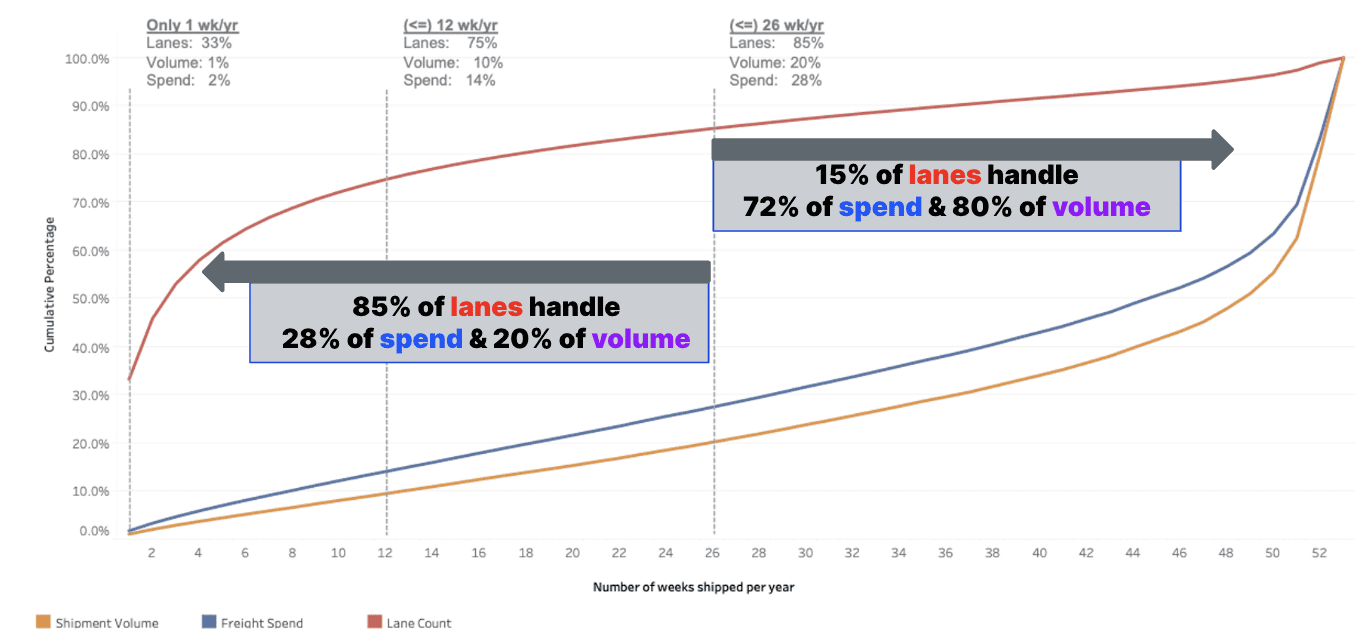

The procurement process is a near-perfect illustration of the Pareto Principle: 80% of the output from a given situation or system is determined by 20% of the input. In the transportation logistics industry, 85% of lanes handle 28% of the spend and 20% of the volume. On the flip side, that also means 15% of the lanes handle 72% of the spend and 80% of the volume.

The distribution between these two lanes is far from even – most lanes operate with little volume, while a few lanes carry the bulk of the loads. The current model makes falling back on contract rates rather than playing the spot market tempting, but it’s that very model that promotes rate vulnerability and makes spot market options a necessity. And shippers can either prepare for this inevitability or not. Shippers should consider that, as volume increases, a larger percentage should go to the spot market, particularly the lanes with less volume that typically face lower primary acceptance rates.

Understanding spot rates and contract rates

The distinction between spot market and contract rates can be challenging because they assess the same factors. The difference is the timeline on which they evaluate those factors – like weather and climate. The spot market (the weather) changes daily, making rates volatile and dependent on various factors in real-time. Contract rates, on the other hand, move slower and are set in advance to cover a specific period. Like the climate, contract rates may change eventually but it’s not likely to happen all at once.

However, just as one should plan for climate but prepare for the weather, shippers should look to utilize both spot and contract rates in a holistic, balanced portfolio. Since spot rates are variable, they’re useful for lanes with low and infrequent volume if accompanied by a third-party index – like DAT iQ – that can be utilized as a guardrail.

Contract rates stemming from RFPs are best for reliable, high-volume lanes that require control. While they bring a company stability, it’s important to remember that contract rates are not a one-size-fits-all solution. They are not binding in capacity or volume. As more lanes are pushed to spot, contract lanes will become more common and tighten up.

The rise of the spot market

Shippers are increasingly recognizing the strategic benefits of using the spot market. According to Dr. Caplice’s presentation, in 2017 the average spot usage rate was around 11%. But when routing guides failed during the 2017 and 2018 crises, spot rates doubled to 20% before dropping back to their average in the spring of 2019. Then, during the pandemic, spot rates spiked higher than before – to 25% – and have yet to normalize. Since the height of the pandemic, rates have barely dropped below 20%.

Although routing guide failure has remained low, more and more shippers are skipping contract rates altogether, going to the spot market as their first choice. This is likely due to the expanded accessibility of real-time data within transportation logistics, which makes it easier to capitalize on advantageous spot rates.

3 final takeaways

- The truckload transportation market is always in flux. It’s rarely a stable or flat market, and it will consistently cycle between tight and loose. These shifts require shippers to carefully monitor both spot and contract rates to stay competitive.

- Today’s shippers should prioritize balance in their portfolios. Doing so when procuring and managing their transportation helps companies make the most of contract, spot, and dynamic rates and relationships.

- Successful portfolio management requires strategic and operational market data. Strategic data helps decision-makers to better understand their place in the market and get a handle on segmentation while operational data provides real-time dynamic pricing.

To learn more about DAT iQ shipper solutions, visit our website or reach out to one of our experts to get started on your freight analytics journey.