Flatbed carriers have moved around 42,000 fewer truckloads of steel this year compared to the first six months of 2022, based on data from the American Iron and Steel Institute (AISI). Excluding 2020, when global demand crashed, year-to-date steel production tonnage is the lowest since 2018. The AISI reports steel output in the U.S. in the week ending July 5, 2023, increased by 1.2% compared with the same time frame in 2022. Year-to-date production through the end of June was 42,486,000 net tons, down 2.9% from the 43,743,000 net tons during the same period last year.

Steel tonnage in the two major steel-producing regions increased in the week ending July 5. In the Great Lakes region, production was up 1.2% w/w (7,000 tons), while in the Southern region, production was up 0.8% w/w (6,000 tons). The Midwest region reported lower volume, down 0.95% w/w ( 2,000 tons), while the smaller Western region reported 3.2% higher volume (2,000 tons). State-level data to the end of May shows Indiana ranked first in tonnage after reporting a 0.6% m/m increase – volumes are now up 6% y/y. Ohio was ranked second in tonnage, down 2.9% y/y. Texas moved to third in tonnage, down 10.7% y/y.

May steel imports were down 2.6% m/m and 13.5% y/y. The most significant suppliers were Canada (628,000 net tons, down 6% m/m), Mexico (282,000 net tons, down 20%), Brazil (239,000 net tons, up 12%), South Korea (219,000 net tons, up 30%) and Germany (103,000 net tons down 4%).

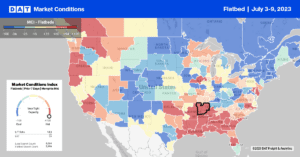

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

Indiana accounts for around 24% of the nation’s steel production, primarily in the Gary freight market. At $2.67/mile, average state rates are $0.19/mile higher than the previous week (after dropping for the previous five weeks). Outbound flatbed linehaul rates paid carriers $2.62/mile last week, and for short-haul loads to Madison, WI, rates averaged $3.08/mile.

Capacity continued to tighten in Atlanta, where rates jumped $0.10/mile to $2.59/mile. Short-haul loads to Birmingham paid carriers $678/load or $4.61/mile, while loads south to Lakeland paid $2.51/mile. Outbound average linehaul rates in Birmingham increased by $0.03/mile to an average of $2.63/mile. Statewide average linehaul rates in Florida increased by $0.03/mile to $1.74/mile last week, identical to 2020. Solid gains were reported in the Jacksonville flatbed market, where rates increased by $0.08/mile to $1.86/mile.

Load-to-Truck Ratio (LTR)

Flatbed spot market volumes were at the lowest level in seven years at the halfway mark of the shipping year following last week’s 34% drop in volume. Load posts are 77% lower than the previous year and 41% lower than in 2019. Carrier equipment posts were down 28% last week, resulting in last week’s flatbed load-to-truck (LTR) ratio decreasing from 8.74 to 7.95.

Spot Rates

After mainly being flat in May and June, flatbed linehaul rates have decreased by $0.07/mile in the last month following last week’s $0.02/mile decline. At $2.09/mile, the national average flatbed spot rate is $0.39/mile lower than the previous year and around $0.09/mile higher than in 2017 and 2019.