Since last October, the number of long-haul interstate carriers leaving the trucking industry has been around twice the rate of those joining the industry. The long-haul freight market is in the process of rebalancing. In the absence of any significant increase in demand, changes in the number of trucks in the market will become the more critical data point to watch in the second half of 2023.

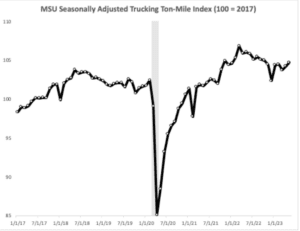

We are, however, entering a period when truckload demand initially flattens out before starting to increase as we get closer to peak shipping season ahead of major retail sales events in the fourth quarter. For truckload carriers seeking to gauge demand, the trucking ton-mile index (TTMI) produced by Prof. Jason Miller at Michigan State University is the most reliable indicator of for-hire truckload demand. TTMI is calculated as a weighted geometric mean for 41 freight-generating sectors across mining, manufacturing, wholesaling, retailing, and warehousing.

Miller has suggested for months that the truckload sector is at or near the bottom regarding the freight recession based on TTMI’s 0.5% month-over-month (m/m) increase. Miller stated, “We are still in a deep freight recession, with volumes down 1.3% from May 2022. This is a steeper year-over-year [y/y] decrease than almost every month of the 2019 freight recession in trucking, with the one exception of October 2019 (when freight volumes were substantially impacted by a strike at General Motors).” Looking further down the road, Miller suggests ton-miles will be mostly flat through 2023 and are unlikely to rise by a meaningful amount until 2024.

Compounding the gloomy outlook is continued softness in manufacturing, excluding pharmaceuticals and hi-tech products. Miller noted that one of the steepest declines has occurred in paper manufacturing – activity is down 9% y/y. Paper is the fourth-most significant sector generating ton-miles for trucking firms in TTMI’s Commodity Flow Survey.

Other truckload demand indicators to watch

Other truckload demand indices worth watching include the monthly Cass and ATA Tonnage indices. The Cass shipments index for June fell 1.6% m/m and 4.7% y/y, noting that declining actual retail sales trends and ongoing destocking remain the primary headwinds to freight volumes. However, dynamics are shifting as real incomes improve, and the worst of the destocking is in the rearview.

The June ATA For-Hire Tonnage Index increased by 2.1% sequentially after rising by the same amount in May. Compared with June 2022, the index was 0.8% lower. “While the tonnage index increased in May and June, it remains in recession territory,” said ATA Chief Economist Bob Costello. “The index continues to fall from a year earlier and is off 1.9% from its recent peak in September 2022. A multitude of factors have caused a recession in freight, including stagnant consumer spending on goods, lower home construction, falling factory output, and shippers consolidating freight into fewer shipments compared with the frenzy during the goods-buying spree at the height of the pandemic. However, the magnitude of the year-over-year declines is improving, perhaps pointing to a bottom in the freight market.”