In 2020, the COVID-19 pandemic sent shockwaves through every industry. While most have regained some sense of normalcy, the transportation and logistics sector continues to experience lingering effects that significantly impact shippers, carriers, and brokers. This June, DAT hosted “A Logistics Jam Session” with Dr. Chris Caplice, Chief Scientist at DAT, and Anbu Kuppusamy, Director of Transportation & Supply Chain Transformation Analytics at the J.M. Smucker Company. They discussed the current state of the industry and how procurement and the spot market — two critical pieces of the transportation and logistics puzzle — have evolved from the pandemic.

Today’s unique transportation and logistics market

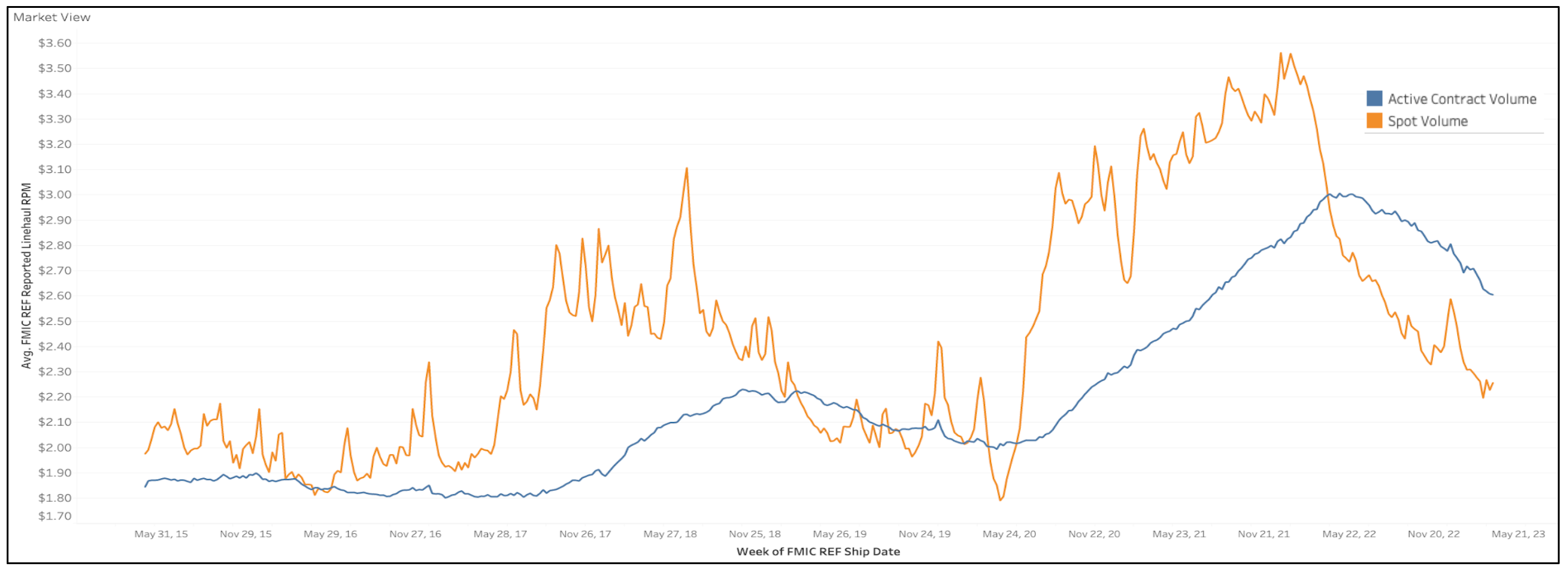

The transportation and logistics industry is cyclical. Over the past several decades, contract and spot market volume has fluctuated but, historically, contracts comprised about 60-80% of long-haul dry van capacity while the spot market constituted about 11%.

These numbers change dramatically during times of turmoil. During the 2018 transportation crisis, the spot market usage surged to 20% before leveling out at its usual baseline. The pandemic, on the other hand, drove a more significant spike, propelling the spot market use rate to 25%. However, there was a key difference: rates never returned to their normal levels, falling only slightly from their 2020 peak.

Today, the spot market accounts for about 20% of freight volume. Even more surprising is that, while spot rates typically sit much higher than contract rates during these times of turmoil, today we’re seeing something entirely different. The market is currently inverted, with spot rates trailing contract rates significantly.

Furthermore, we’ve been facing this inversion for over a year — an unusually long time for this cycle — and the gap between contract rates and spot rates is only growing. At DAT, we see this as a freight recession and, due to this, procurement is becoming more continuous and the spot market is becoming more popular.

The freight recession: changes in procurement

The procurement process has featured one of the most profound shifts we’ve seen across the transportation and logistics industry over the past three years. A poll conducted during the Jam Session found that, prior to the pandemic, 66% of attendees (including the team at Smucker’s) primarily engaged carriers in annual contracts during the procurement process. In some cases, shippers even established contracts that only oversaw a handful of lanes per year.

However, the onset of COVID-19 led to increased intermediate volume and activity, prompting a shift towards continuous procurement that experts predict will persist beyond the short term to become a more standard practice. According to a poll conducted during the Jam Session:

- 29% of shippers report running bids on a semi-annual basis.

- 26% say they stick to annual contracts.

- 24% say their approach varies.

- 11% say that they operate quarterly.

For instance, Smucker’s adapted their procurement process during the pandemic years and continues to run bids semi-annually instead of annually. Furthermore, if benchmarking data indicates favorable rates, Smucker’s will selectively retain existing contracts with carriers, rather than initiate new bids.

The evolution of the procurement landscape and the increased intermediate volume and activity has prompted a shift towards continuous procurement strategies like more frequent mini-bids and spot market usage.

The freight recession: changes in the spot market

In addition to changes around procurement, there have been significant shifts to the spot market. As discussed, spot market use is currently twice its typical rate. There are two likely reasons for this:

- Shippers are bypassing typical routing guides by going directly to spot.

- Shippers have adjusted their processes to put less emphasis on contracts.

Smucker’s, for example, has adopted a reduced contracting approach. They no longer pursue contracts for low-volume lanes, like those that only saw ten to twelve loads annually. Today’s market renders such lanes unsuitable for contracts, reflecting the shifting dynamics.

The power of analytics in today’s market

Amidst the changes to procurement and spot market usage, good data is paramount for shippers like Smucker’s. Benchmarking data, in particular, has become a key tool to empower companies as they engage their C-suite and foster a deeper understanding of industry dynamics. Given the current market’s uncertainties, data-driven insights provide valuable context, giving businesses more understanding of their positions in the market. This transparent approach to shipper-carrier negotiations ensures that rates remain in alignment with market conditions, even in unique circumstances.

It’s impossible to say definitively when things might return to normal for freight. As shippers and carriers adapt to these changes, embracing the most up-to-date and comprehensive data, like that offered by DAT, allows them to chase the market and keep up with shifting rates.

For more information on how DAT iQ’s full range of freight analytics solutions can help you navigate changes in procurement and the spot market, visit data.dat.com/Empower_iQ.