New manufacturing orders contracted for the 11th consecutive month in July, according to the Institute for Supply Management (ISM) Purchasing Managers Index (PMI). The July New Order Index reading came in at 47.3%, up 1.7% m/m. New order level contraction slowed compared to June as ISM survey panelists’ companies continued to deal with uncertain customer demand. Cardboard manufacturing is one of the sectors falling in line with overall manufacturing output. According to the Fibre Box Association, soft demand for corrugated linerboard — what most cardboard boxes are made from — has fallen in line with previous recessions, though it hasn’t quite reached the depths of the 2008-09 downturn.

A separate survey of independent North American box manufacturers shows demand for cardboard boxes falling to 2019 levels after declining by 4% last year. Weaker cardboard box demand signals weaker demand for physical goods that motor carriers haul, partly explaining the soft market conditions observed in 2023. Another analysis of the e-commerce industry by Professor Jason Miller of Michigan State University shows that retail activity has now fully reverted to levels of the pre-COVID 2018-2019 trendline based on the most recent Census Bureau data for Q2 2023.

According to Miller, “The drop in e-commerce as a percent of retail trade sales likely suggests we will see continued softness in the manufacturing sectors that support e-commerce, such as paperboard mills that make raw paperboard and paperboard container manufacturers that make corrugated boxes. As such, trucking companies that haul paperboard or corrugated boxes shouldn’t plan for increases in freight volume any time soon.”

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

Tropical Storm Hilary left behind a trail of debris and destruction as it made its way through California, washing out some major railroad tracks. The ports of Los Angeles and Long Beach were fully operational last week, while BNSF appears to have made it through the storm in good shape. However, Union Pacific’s high-volume lane between Los Angeles, El Paso, and the Midwest experienced service interruptions due to bridge washouts adjacent to Interstate 10 between Banning and Indio, California. Repairs may take two weeks to get both tracks back to total operational capacity.

Any shifting of long-haul freight volume from intermodal to truckload due to Hilary failed to materialize with capacity easing following last week’s $0.07/mile decrease in California. Outbound average rates were $2.01/mile, identical to 2019. The Stockton and San Diego markets reported a slight change in capacity – rates increased by $0.01/mile to $1.72/mile in Stockton and were flat at $1.84/mile in San Diego after dropping for the previous three weeks. In the larger Los Angeles and Ontario markets, rates fell for the fourth week to $1.77/mile and $1.85/mile, respectively.

In other Top 5 markets, capacity tightened in Chicago, where outbound spot rates increased $0.02/mile to $1.97/mile after dropping for the previous three weeks. Atlanta spot rates decreased by a penny per mile to $1.55/mile, while in Elizabeth, NJ, rates continued to fall, hitting $1.42/mile. A similar downward trend was reported in the Dallas/Fort Worth metroplex, where outbound spot rates averaged $1.38/mile. Statewide outbound average rates in Texas – at $1.43/mile – are only $0.01/mile higher than in 2019.

Load-to-Truck Ratio (LTR)

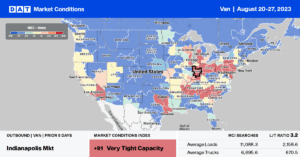

Dry van spot market load posts continue to climb as shippers pre-position freight ahead of the long Labor Day weekend. Volumes increased 5% week-over-week (w/w) and 4% month-over-month (m/m), although they were around 25% lower than last year. CVSA’s Brake Safety Week had little impact on carriers; they mostly kept their wheels rolling rather than taking time off. Carrier equipment posts decreased by around 1% w/w, resulting in last week’s dry van load-to-truck ratio (LTR) increasing from 2.74 to 2.91.

Linehaul Spot Rates

The recent dry van linehaul rate slide was halted last week, with the national average remaining relatively flat at $1.58/mile. Dry van spot rates have dropped $0.14/mile since July 4, identical to the historical average decrease between Independence Day and Labor Day. Last week’s national average was $0.33/mile lower than last year and just $0.03/mile higher than 2019. Compared to DAT’s Top 50 lanes (which remained at $1.90/mile last week), the national average was $0.32/mile lower at $1.58/mile.