Halloween is next Tuesday, October 31, culminating in peak pumpkin shipping season for reefer carriers, especially out of midwest freight markets in Illinois. This year’s commercial Midwest Region pumpkin crop was in doubt over the summer following 50 days in May and June without rain, raising concerns the crop would not germinate. Despite a challenging growing season, growers are harvesting a good crop this year. According to John Ackerman from Ackerman Farms, who grows 30 acres or about 30,000 pumpkins in Morton, IL, “Fortunately, we got a decent set of rains in late June, early July, and it saved the crop. There are a few varieties that I didn’t think came out as good as I wanted them to, but in general, I’ve been pleased with what we have.”

According to the USDA, Illinois is the top-producing pumpkin state in the U.S., producing 40% of the nation’s pumpkins growing. In 2021, farmers in the top six pumpkin-producing States harvested more than 1 billion pounds (23,000 equivalent truckloads) of pumpkins combined. Leading in pumpkin acreage harvested and yield, Illinois produced 652 million pounds (15,000 equivalent truckloads) in 2021, more than the other five most productive States combined. Indiana produced 181 million and California 157 million—while Michigan, Texas, and Virginia each produced about 100 million pounds.

In Morton, IL, known unofficially as the “Pumpkin Capital of the World,” large quantities of pumpkins go into products like pumpkin pie and pumpkin bread for consumption worldwide. According to Leigh Ann Brown, executive director of Morton Chamber of Commerce, a major contributor to Morton’s reputation as the pumpkin capital, besides ideal soil and weather conditions, is the Nestlé Libby’s plant, which produces 85% of the world’s canned pumpkin.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

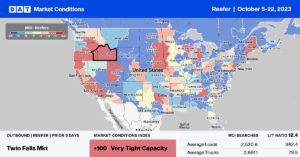

In Morton, IL, loads post jumped 12% w/w along with outbound reefer spot rates, which increased $0.03/mile last week to $2.89/mile after being flat for the prior two weeks. Loads to Lakeland, FL, paid carriers $2.90/mile, with loads further south to Miami the highest in almost 12 months at $2.83/mile. Capacity also tightened along the southern border from McAllen, TX, to Yuma, AZ, following last week’s $0.03/mile increase to $1.67/mile.

In the more significant border crossing produce market between Sonora and Arizona via Nogales, produce volumes are starting to increase, increasing load post volumes by 37% last week. Reefer capacity shows signs of tightening in the poultry belt in markets including Joplin and Minneapolis, where spot rates increased to $2.18/mile and $2.23/mile, respectively, last week. In the second largest turkey-producing state in North Carolina, reefer spot rates increased $0.06/mile last week to $1.98/mile.

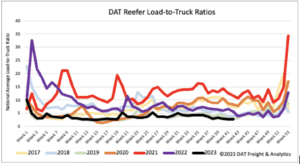

Load to Truck Ratio (LTR)

The volume of Reefer load posts (LP) remained flat for the second week and was 55% lower than last year. Carrier equipment posts (EP) were also flat and slightly below the average weekly LP volume for 2023, resulting in last week’s reefer load-to-truck ratio (LTR) remaining primarily flat at 2.78.

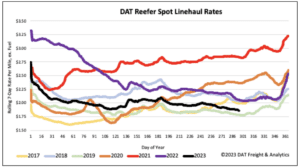

Spot Rates

At just over $1.89/mile, reefer linehaul spot market rates are $0.20/mile lower than last year and just $0.07/mile higher than in 2019. Reefer rates increased by almost a penny per mile last week as the market transitioned into Fall produce season, Xmas tree, and Thanksgiving fresh turkey shipping.