With a transportation market turn on the horizon, supply chains will be a key area of emphasis for executive leaders in 2024. The urgency is high after pandemic-driven disruptions revealed the fragmented state of the U.S. supply chain and the ramifications of lacking resilience. From steep financial losses to brand reputational damage, lessons learned during COVID-19 have encouraged C-suites to view supply chain performance as a business-critical function.

While we’re not on the brink of another global pandemic, major supply chain disruptions occur every 3.7 years on average according to McKinsey & Company research. The right disruption at the wrong time can wreak havoc on your bottom line, especially considering PwC data shows that supply chain logistics accounts for 10% of the average organization’s overall spend. Executives understand this reality, and are shifting their perspective from viewing the supply chain as a cost center to a key business value driver.

As attention toward supply chain performance rises, shipping leaders must serve as a source of influence that bridges gaps between the boardroom and stockroom. This requires knowing how to justify logistics costs, articulate supply chain risk, and assess network performance to C-suite stakeholders in ways that foster clarity and confidence. Leveraging third-party freight market data as a storytelling mechanism is an effective method for delivering information that not only resonates, but drives action across the organization.

Prioritize cost transparency

It’s no secret that organizations across every major sector are facing severe budget scrutiny amid economic headwinds and record-high inflation in 2023. Any instances of overspending are magnified when margins are low and volatility is high. If a shipper exceeds their annual budget and falls short of revenue projections, you better believe they’re going to hear about it from executive leaders seeking a valid explanation.

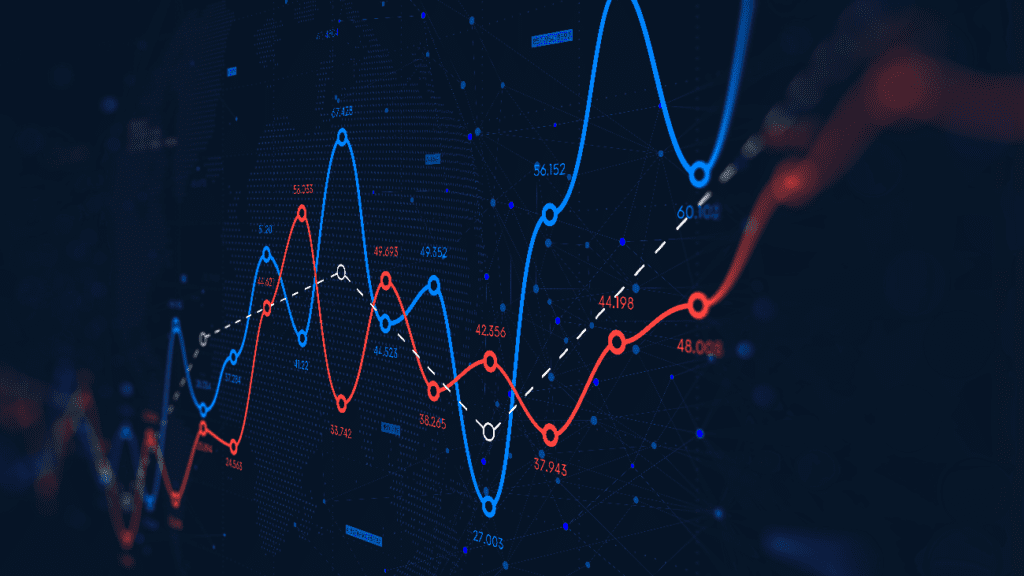

Anecdotal reasoning won’t move the needle in these situations, however data-driven cost transparency will. You can leverage freight analytics to inform executives about the real story behind rate hikes and increased costs. Maybe it was high diesel fuel prices coupled with rising interest rates or a hurricane that disrupted key distribution routes during produce season. Regardless of the root cause, utilizing data-driven insights from the wider freight market shows stakeholders that the spending was justified and outside of your control.

Demystify supply chain complexity

It’s important to remember that most C-suite stakeholders aren’t supply chain experts immersed within the daily workflows of shipping operations, fulfillment centers, and carrier fleets. Without extensive expertise or visibility, you can’t expect them to easily grasp technical logistics challenges like the volatile nature of carrier contracts or the diseconomies of scale for truckload shipping. This makes demystifying supply chain complexity critical to instilling confidence amongst leaders that the organization is prepared to navigate volatility.

Due to the digitized nature of our working world, leading organizations are incorporating AI, machine learning, and advanced analytics into operational functions – manual spreadsheets and paper-based processes are entities of the past. In turn, integrating third-party analytics and personalized benchmarking data into executive reports is an effective way to speak the C-suite’s language when highlighting critical logistics challenges that require additional resources. Whether it’s a request for expanded budget or new digital tools, articulating supply chain risk through advanced data helps ensure your message resonates.

Engage the C-suite with DAT iQ

Executive interest in supply chain performance will only continue to rise in 2024. Now is the time for shippers to adopt the right resources for meeting C-suite demands and navigating tough conversations.

DAT iQ rate and network analytics solutions empower shippers with actionable insights to manage both tactical and executive level transportation planning, evaluation, and optimization. We deliver the deepest, broadest, and most accurate market data in the industry, with over $150 billion in transaction data. Combined with powerful analytics capabilities and a team of experts to provide personalized guidance, we enable shippers to effectively and efficiently drive transportation strategy.

Contact us today to learn more about how DAT iQ’s dynamic freight market intelligence data fosters clarity and confidence amongst organizational leaders.