On the southern shores of Lake Michigan is one of North America’s largest integrated steel mills and generator of a substantial volume of steel for flatbed carriers.

Gary Works is a major steel mill in Gary, IN, on the shore of Lake Michigan, and for many years, it was the world’s largest steel mill. With a raw steelmaking capability of 7.5 million net tons, this mill alone produces the equivalent of 250,000 flatbed steel loads annually. According to the American Iron and Steel Institute (AISI), Indiana accounts for around 25% of annual steel production, with 21.1 million tons of steel in 2022, with the Gary and South Bend freight markets accounting for 70% of outbound flatbed loads moved in the state.

Scott Paul, president of the Alliance for American Manufacturing (AAM), states, “Generally, US mills operate on any given month at about 76-77% of capacity. So, there’s certainly room for growth to meet that demand. That’s entirely possible without having to depend on imports to fill the gap.”

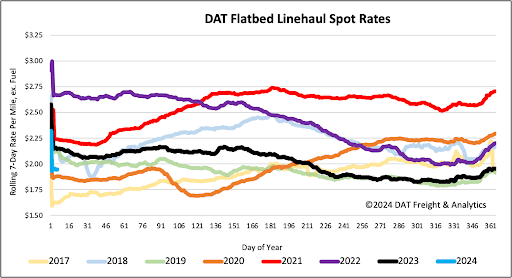

All rates cited below exclude fuel surcharges unless otherwise noted.

On the flatbed spot market in Indiana, DAT is seeing volumes increase significantly in 2023 compared to the prior five years. Loads moved in the combined Gary/South Bend flatbed markets increased by 33% in 2023. Over the same time frame, outbound flatbed spot rates have been flat at $2.62/mile. Regional loads to Cleveland and Columbus paid carriers $2.66/mile and $3.16/mile, respectively, last week, while longer-haul loads to Omaha averaged $2.69/mile.

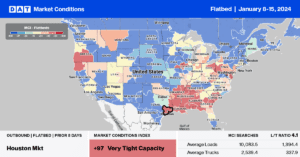

Last week’s overall strength in the flatbed market was led by the Southeast Region, where linehaul rates increased by $0.03/mile to a regional average of $2.16/mile on a 30% higher load post volume. At $2.16/mile, spot rates are almost identical to last year and 2018 and $0.15/mile higher than 2020.

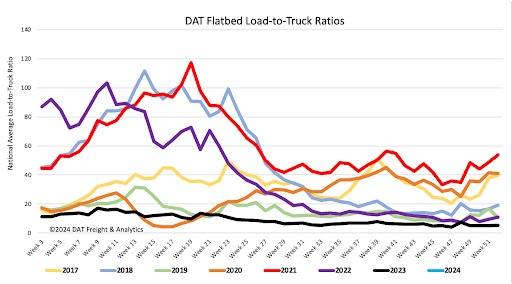

The volume of flatbed load posts (LP) increased by 35% last week but remained just over half compared to this time in 2020 and last year. Carrier equipment posts (EP) almost doubled last as carriers returned on the road, resulting in last week’s flatbed load-to-truck ratio (LTR) ending Week 2 at 8.51.

Flatbed linehaul rates went against trend last week, increasing by $0.02/mile to a national average of $1.99/mile. Compared to Week 2 last year, when rates dropped by $0.02/mile, last week’s linehaul rate was $0.17/mile lower but $0.09/mile higher than in 2020 as the market continued to shed capacity starting that oversupplied year, much the same as it ended in 2019.