California motor carriers now face another challenge on top of requirements to meet zero-emission standards in the next decade and recent changes in labor law defining independent contractor status. If that wasn’t enough, effective January 1, 2024, intrastate motor carriers and drivers in California must use an electronic logging device (ELD) to record a driver’s record of duty status (RODS). Previously, RODS could be paper-based and far less costly for carriers. California joins most others who have already adopted their own intrastate ELD mandates.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Drivers meeting any of the following conditions are not required to use an ELD:

- The driver operates a commercial motor vehicle (CMV) less than eight days per month,

- The driver operates a tow transporting empty vehicles for sale, lease, or repair,

- The vehicle was manufactured before the model year 2000,

- Drivers utilizing the California 100 Air-Mile (Local) Driver Radius Exemption.

For more information, carriers and drivers are advised to visit the official CCR website at https://govt.westlaw.com/calregs. Additional information is available on the CHP’s Regulatory Actions webpage at www.chp.ca.gov/News-Alerts/Regulatory-Actions. Questions regarding the ELD regulations may be directed to the CHP, Commercial Vehicle Section, at (916) 843-3400.

Market watch

All rates cited below exclude fuel surcharges unless otherwise noted.

Winter Storm Indigo brought cold temperatures, heavy snowfall, and significant ice accumulations in the Pacific Northwest (PNW) before moving across the country last week. Reports indicated ice accumulations of up to half an inch near Eugene, Oregon, with Portland, Oregon, and Vancouver, Washington, experiencing ice accumulations ranging from a quarter-inch to three-quarters of an inch. As in most markets impacted by cold temperatures last week, volumes dropped, and rates increased. In Washington, outbound linehaul rates increased by 3% w/w, while loads moved decreased by 13% last week.

The moved load volume in the Midwest Missouri freight market dropped 14% last week, while spot rates increased by 2% to $0.03/mile to all destinations, averaging $2.03/mile. Loads from Kansas City, KS, to Chicago paid carriers $1.45/mile, up $0.10/mile in the last week and the highest since last July. Linehaul rates across the Midwest Region increased by $0.10/mile last week, averaging $2.31/mile, almost identical to last year’s regional average. Outbound Chicago linehaul rates increased by $0.07/mile to $2.12/mile last week on a 17% lower volume of loads moved.

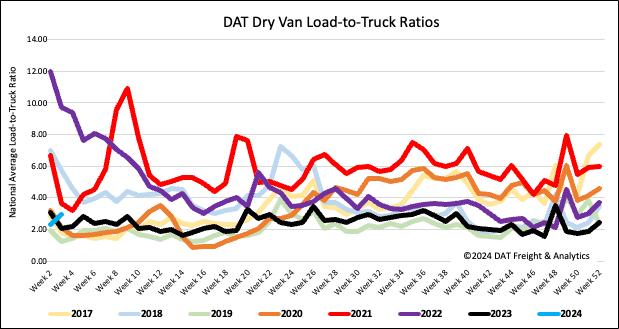

Load-to-Truck Ratio (LTR)

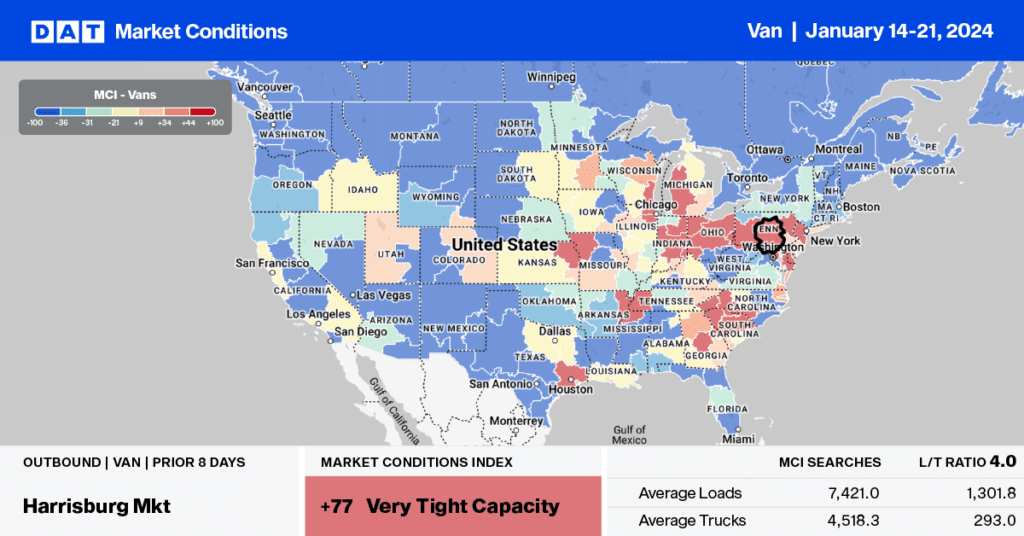

The extreme cold across the U.S. last week resulted in spot market load post (LP) volumes increasing by 15% last week, within 11% of volumes last year. Carrier equipment posts (EP) dropped by 8% as the miles became harder, trips took much longer to complete, and available capacity reduced, resulting in last week’s dry van load-to-truck ratio (LTR) increasing by 25% to 2.91.

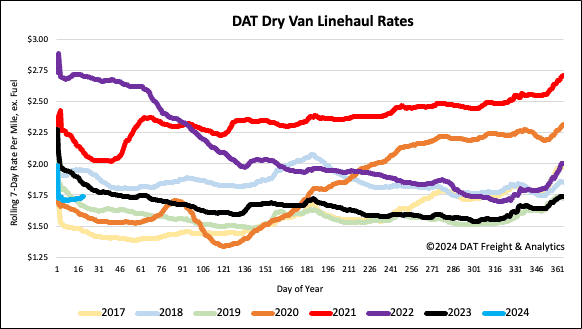

Linehaul spot rates

Dry van linehaul rates increased last week as available capacity tightened, and carriers looked for higher rates to compensate for the longer trip duration as roads increasingly became impassible in many states. Linehaul rates increased by $0.03/mile last week to a national average of $1.74/mile, $0.10/mile lower than last year. Based on the volume of loads moved DAT’s Top 50 lanes averaged $2.04/mile last week, $0.30/mile higher than the national average.