Miami is the epicenter of dozens of 747 Jumbo jets loaded with flowers arriving from South America, including Colombia and Ecuador. According to the USDA, 90% of roses, carnations, tulips, and orchids arrived from these flower powerhouses last year. Both are just 3.5 hours from Miami by air freighter, making it the ideal distribution for Valentine’s Day flowers nationwide. Colombia produces the largest volume, accounting for 58% of annual imports last year, with Ecuador second at 32%.

Miami has a sizeable perishables-handling infrastructure and is ideally located to handle domestic air-to-truck logistics and international air-to-air transfers. For brokers and carriers, this is peak floral season, with 91% of the annual volume of roses and carnations landing in Miami in the first six weeks of the year. According to the USDA, in the week leading up to Valentine’s Day, the volume of floral shipments increased by 78% compared to the prior week.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

The volume of loads moved by DAT’s freight network of brokers and carriers out of Miami increased on average by 47% month-over-month (m/m) in February, with reefer linehaul…. rates increasing on average by 28% m/m. This year, truckload reefer volumes in Miami are on track to surpass last year, although with sufficient available capacity in the market, spot rates are currently 6% lower than last year.

Market watch

All rates cited below exclude fuel surcharges unless otherwise noted.

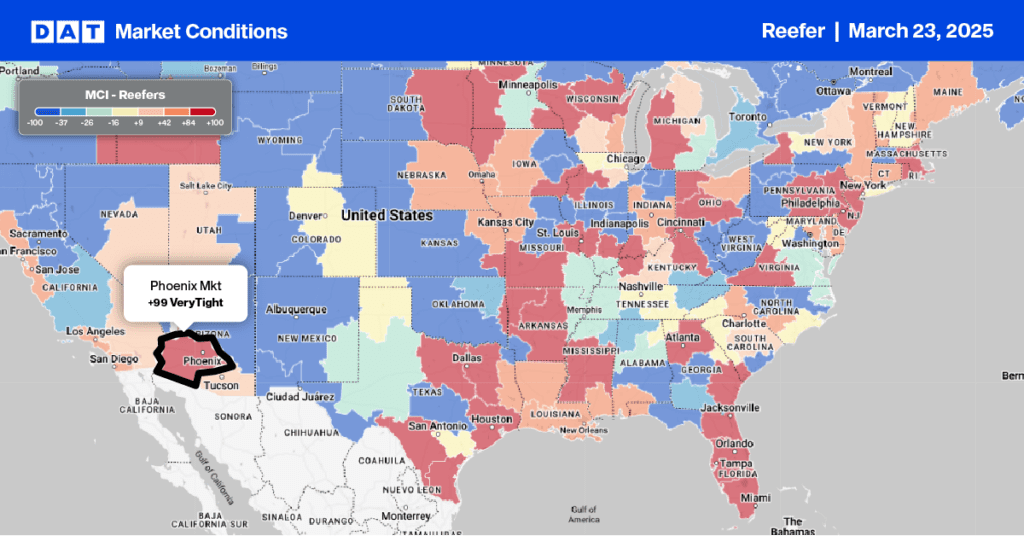

This week focuses on the Southeast, where the Florida produce season is underway and peak shipping ahead of Valentine’s Day occurs. Demand is so high for outbound floral loads that large contract carriers typically place a 20% surcharge on all products shipped from Florida to allow repositioned equipment to meet higher demand. Outbound state truckload volume was higher on the spot market last week–loads moved increased by 28% w/w while linehaul rates jumped by 13% to $1.46/mile.

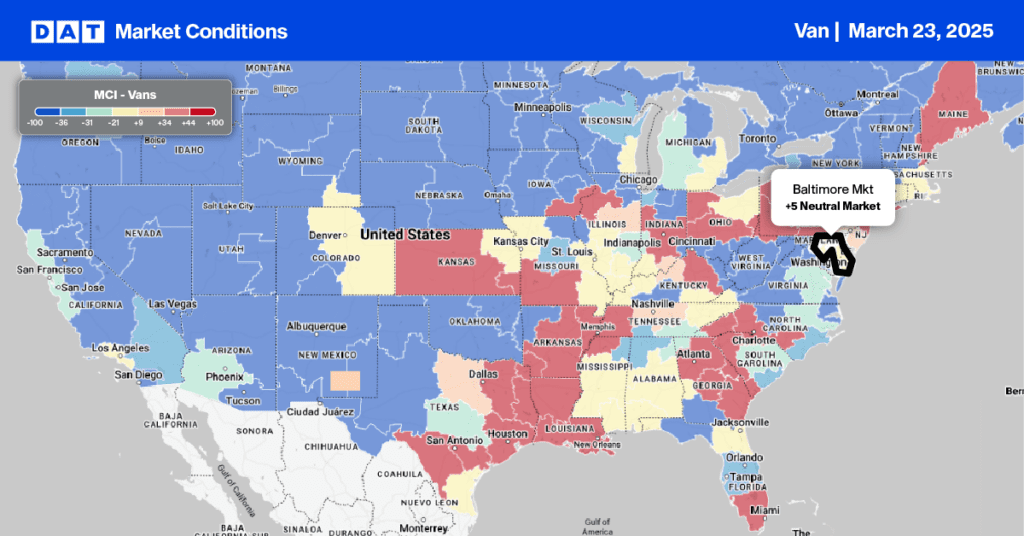

The Miami market’s rates increased by $0.15/mile to $1.44/mile for outbound loads, while on the high-volume lane to Atlanta, spot rates were the same but around $0.08/mile lower than last year. Avocados, tomatoes, and limes made up the top three commodities imported from Mexico last week, driving up load volumes by 16% w/w in the McAllen market. Reefer carriers were paid an average of $2.14/mile for outbound loads, up $0.10/mile after dropping for the prior three weeks. On the number one lane north to Ft Worth, McAllen carriers were paid $2.82/mile, which is around $0.15/mile lower than last year.

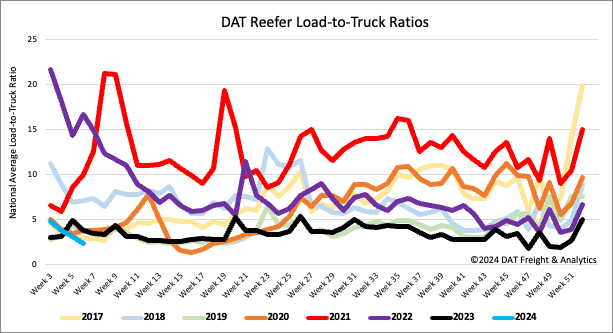

Load to Truck Ratio (LTR)

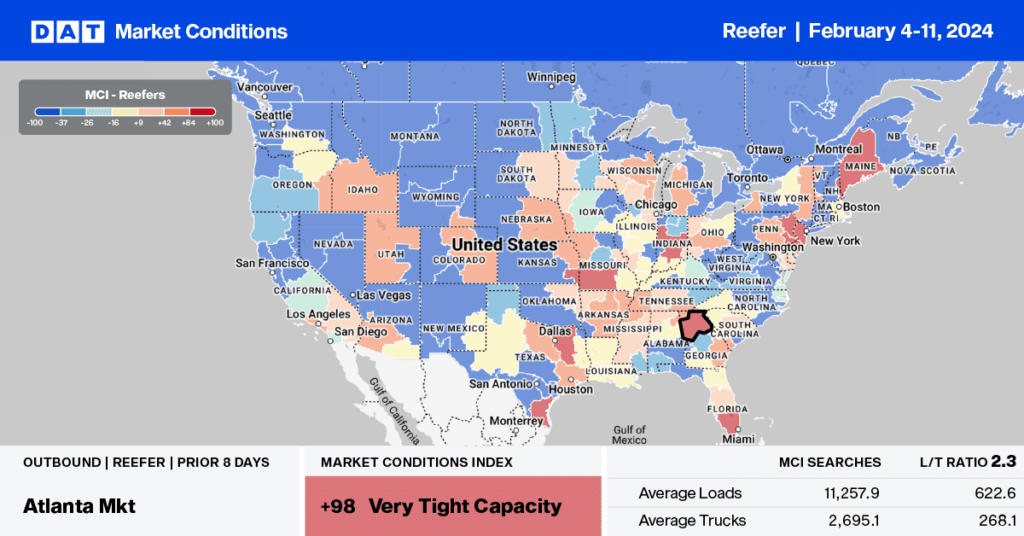

Reefer load post (LP) volumes continue to cool following last week’s 23% w/w decline. Volumes are 53% lower than last year, impacted by lower truckloads of produce moving nationally, which were 17% lower than last year, according to the USDA. Carrier equipment posts were up slightly, resulting in last week’s reefer load-to-truck ratio (LTR) decreasing by 23% w/w to 2.39, the lowest in eight years.

Spot rates

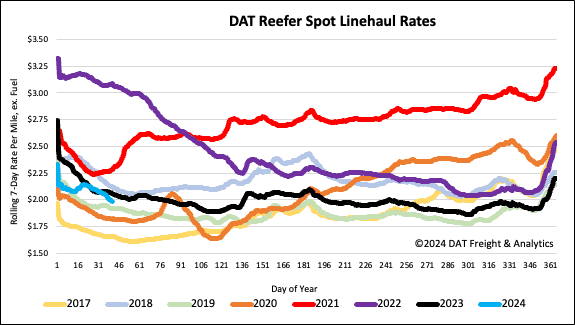

The decline in the national average reefer spot rate continues to accelerate following last week’s $0.06/mile decrease. At $2.00/mile, linehaul rates have decreased by $0.08/mile in the last month and, compared to last year, are $0.07/mile lower.