The Port of Savannah consistently ranks as the fourth largest port for U.S. imports, accounting for 9.3% of the national total. However, it ranks number two for refrigerated exports (10.1%), behind Oakland, CA, with 14.7%. Besides its proximity to Atlanta, the Port of Savannah enjoys superior road and rail connections, with Interstates 95 and 16 converging approximately five miles from the port. No other port on the U.S. East Coast offers such direct interstate connections.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

The Top 10 refrigerated commodities exported in Savannah include fresh and frozen poultry (86%), followed by meat (8.3%) and dairy products (2%). Just over a third of the export volume is destined for Northeast Asia, followed by Africa (12.3%) and the Mediterranean (11.5%). The average number of inbound truckloads in 2023 was almost double the pre-pandemic average in 2019 and early 2020, with a third of the truckload volume arriving each from Atlanta and Birmingham, AL.

According to IHS Markit/PIERS, containerized export volume in December 2023 had decreased by 10% y/y, while import volume increased by 3.1% m/m in January and 7.2% y/y. At just over 200,000 TEU (twenty-foot equivalent units), import volumes last month were the third highest in seven years, surpassed only by the pandemic-influenced years of 2021 and 2022.

Market watch

All rates cited below exclude fuel surcharges unless otherwise noted.

According to the USDA, truckload volumes of produce outbound in Florida have been flat in the last few weeks, 31% lower than last year, just as the Plant City Strawberry Festival starts this week. Between now and Mother’s Day, produce volumes typically double in Florida, but with major crops, including tomatoes and strawberries, down 18% and 38% y/y, there’s an excess of reefer capacity, resulting in linehaul rates dropping $0.14/mile to $1.37/mile last week.

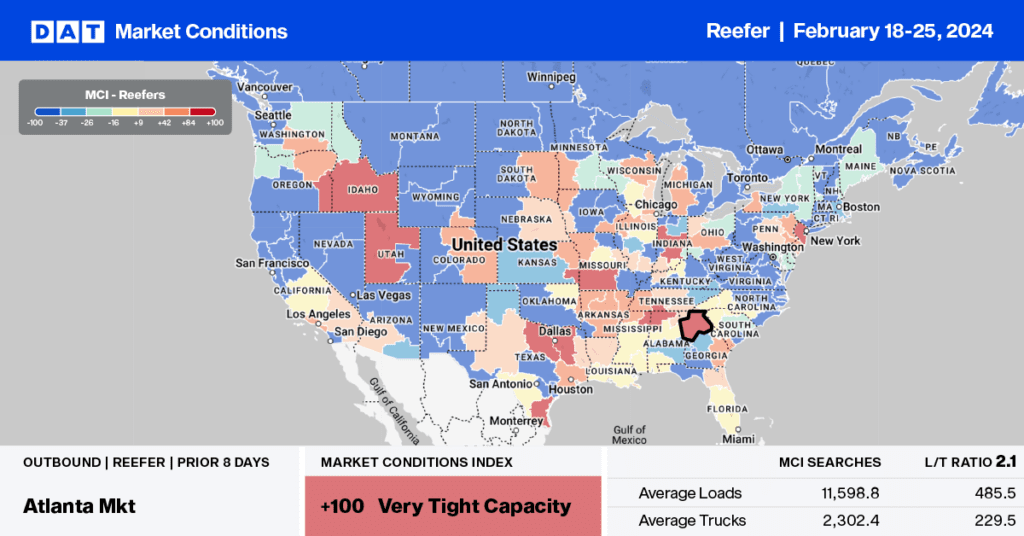

Truckload volumes on the number one reefer lane northbound to Atlanta from Lakeland, the largest reefer spot market in the state, were flat last week, averaging $0.82/mile. This is the lowest in 12 months and $0.51/mile lower than last February’s average. On the number one reefer lane in the Southeast, double the volume of loads moved last week between Atlanta and Lakeland compared to the opposite direction. Atlanta to Lakeland loads paid carriers an average of $2.76/mile last week, and for carriers hauling between both markets, round-trip rates averaged $1.80/mile, almost $0.30/mile lower than last year’s round-trip average.

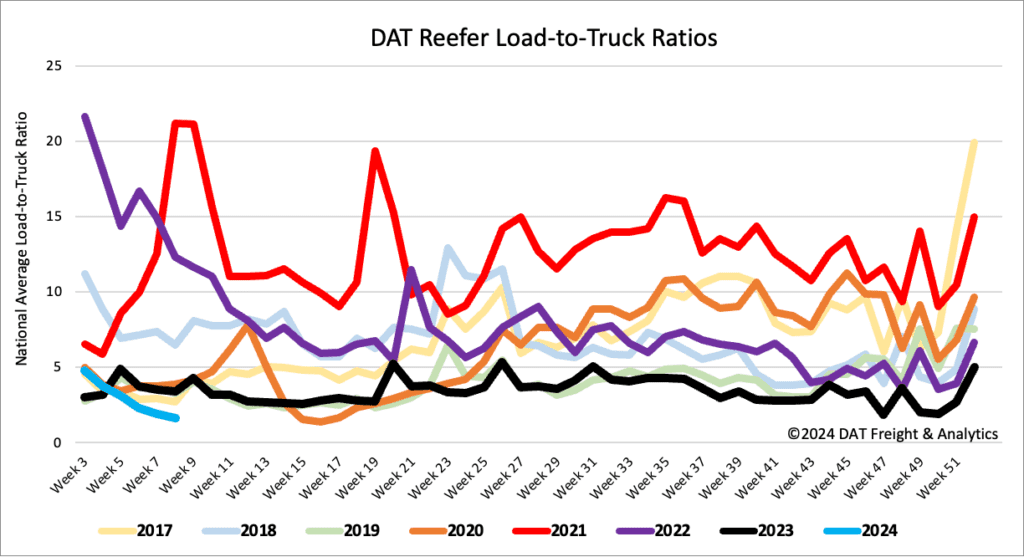

Load to Truck Ratio (LTR)

National spot market load post (LP) volumes dropped for the fifth consecutive week following last week’s 17% week-over-week (w/w) decline. LP volumes have remained at their lowest in eight years and 64% lower than last year. The volume of produce moving nationally is at the lowest level in ten years, down 18% y/y last week, contributing to lower spot market volumes. Carrier equipment posts were down 4%, resulting in last week’s reefer load-to-truck ratio (LTR) decreasing by 13% w/w to 1.63, 21% above the previous low of 1.35 recorded at the start of the pandemic in 2020.

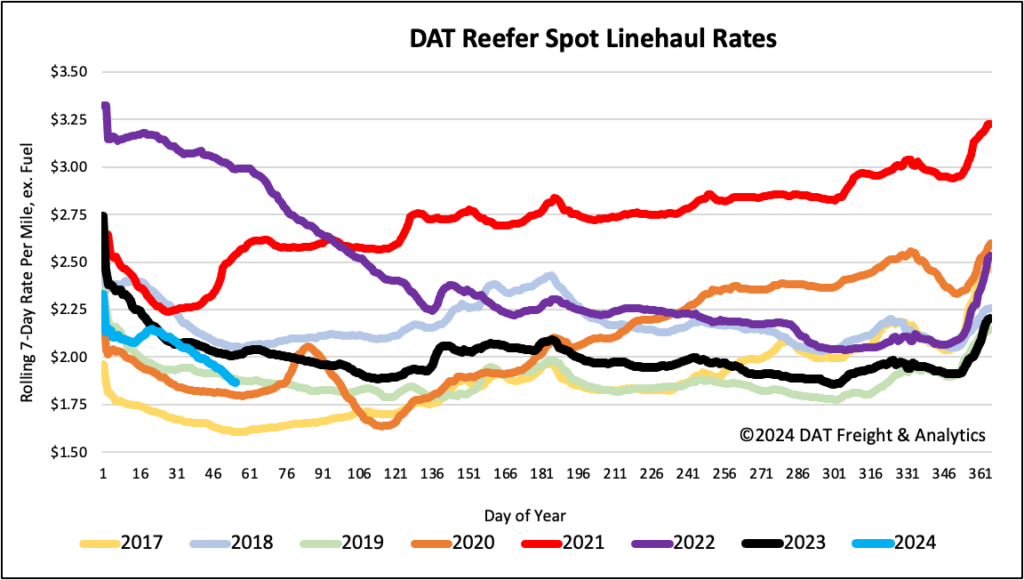

Spot rates

National average reefer spot rates dropped for the fifth week following another $0.06/mile week-over-week (w/w) decrease. At $1.89/mile, reefer linehaul rates have dropped $0.20/mile in the last four weeks and are $0.15/mile lower than last year. Compared to 2020, as the freight market continued to soften before the pandemic, last week’s national average was $0.07/mile higher.