According to the Association of Equipment Manufacturers (AEM), sales of farm tractors and combine harvesters continue to lag the 5-year average by around 10 to 12%, based on the latest numbers. Even though unit sales of 100+ horsepower agricultural tractors increased for the second straight month, up 3.2% year-over-year (y/y), total farm tractor sales were down 12.1% y/y in March. Combine harvester sales fared worse, dropping 23.3% y/y and 20.4% year-to-date (YTD).

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

In the 2WD market, which accounted for 98% of agricultural tractor sales in March, sales dropped 12.2% y/y and 13.4% YTD:

- 2WD tractors less than 40 horsepower (HP) were down 15.8% y/y.

- 2WD tractors 40 HP to 100 HP were down 6.9% y/y.

- 2WD tractors with more than 100 HP were up 3.2% y/y.

According to AEM Senior Vice President Curt Blades, “Unit sales of 100+ horsepower tractor sales also grew in Canada in March, rising 2.7% compared to 2023. 4-wheel-drive ag tractor unit sales jumped 27.3% compared to last year and are up 10.8% year-to-date in Canada.”

Market watch

All rates cited below exclude fuel surcharges unless otherwise noted.

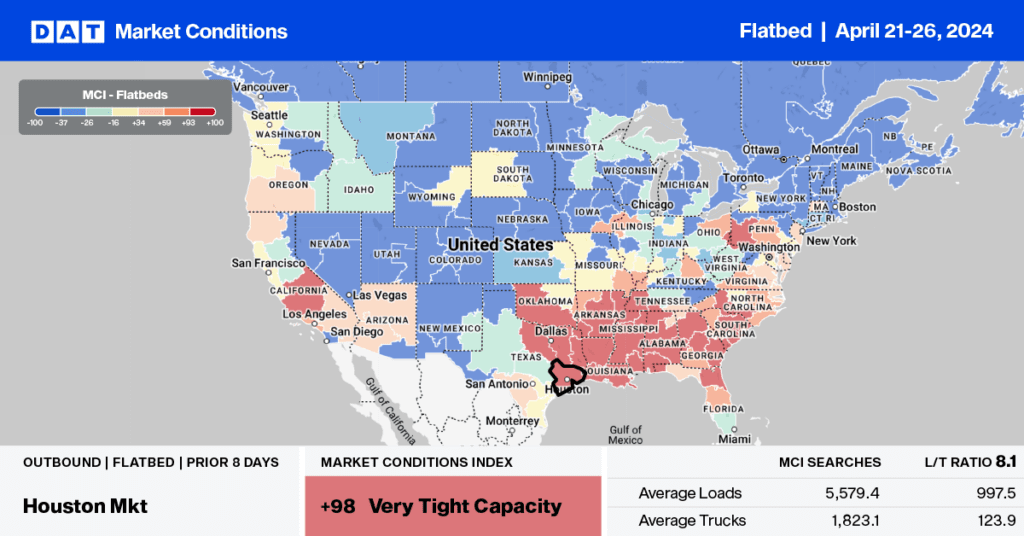

After surging since the Baltimore bridge collapse, outbound flatbed rates cooled last week, dropping by $0.19/mile to $2.28/mile on a 6% higher volume of loads moved. Further south in Lakeland, FL, loads moved increased by 1% w/w while linehaul rates increased by $0.06/mile to $1.33/mile. Demand for regional flatbed loads to Tallahassee was high last week, driving up linehaul rates by $0.13/mile to $1.67/mile.

In Houston, loads moved dropped 9% w/w while capacity remained tight; rates were up $0.04/mile to $2.33/mile. In Pittsburgh, load volumes dropped 2% w/w, forcing down spot rates by $0.05/mile to $2.58/mile. Carriers were paid an average of $2.18/mile, down $0.03/mile w/w for loads to Rock Island, IL, on an 11% higher volume of loads moved.

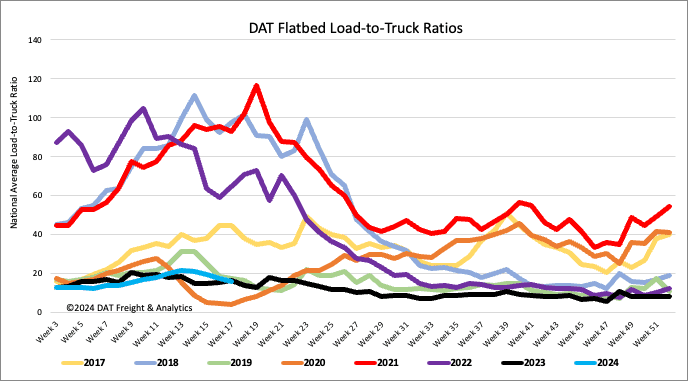

Load-to-Truck Ratio

Flatbed load post volumes continue to fall following last week’s 8% w/w decrease. Volumes are 18% lower than last year and 2% lower than in 2019. Flatbed equipment posts were flat last week, resulting in the load-to-truck ratio decreasing by 7% w/w to 16.12.

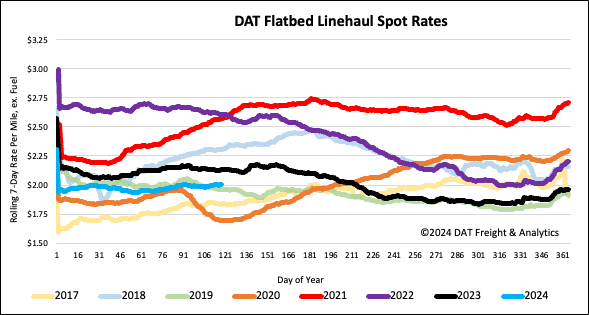

Spot rates

After being flat for the last two weeks, flatbed linehaul rates showed renewed strength following last week’s penny-per-mile increase, averaging just over $2.02/mile. The national average is $0.13/mile lower on an 18% higher volume of loads moved than last year, highlighting the excess capacity in the market.