Outbound flatbed volumes in the New Orleans freight market are currently running around 36% higher than last year, boosted by a surge in breakbulk imports into the Port of New Orleans (Port NOLA). Despite NOLA’s position just outside the top 20 for containerized imports, it stands out as the third-highest port for breakbulk import tonnage and the fifth-highest for exports.

This underscores the port’s significant role in the industry for flatbed carriers. The Gulf Coast handles around 40% of breakbulk tonnage monthly, with NOLA number one for import tonnage and five for exports. Outside petroleum, crude oil, coal, and coke imports, steel and timber products generate a lot of flatbed demand.

Breakbulk steel imports are spread along the entire Gulf Coast from Brownsville, TX, to Mobile, AL, and New Orleans. According to IHS Markit/PIERS data, imported steel bar tonnage totaled 851,000 in March, or the equivalent of 28,000 flatbed loads in New Orleans. Of course, not all steel imports travel by road, but for those loads that do, around a quarter are destined for Houston, 350 miles to the west along I-10. Loads moved on this lane are almost triple compared to last year, with linehaul rates up 14% year-over-year (y/y), averaging $2.44/mile last week.

With the exciting news that NOLA was awarded an additional $226m in federal grant dollars to support the Louisiana International Terminal (LIT) construction, breakbulk volume is poised to soar in the coming years. The new, cutting-edge container terminal, to be situated in Violet, Louisiana, will harness Port NOLA’s connectivity via four critical interstate systems, six Class I railroads, 14,500 miles of inland waterways, and 30+ inland hubs to significantly boost Louisiana’s import and export capacity, opening up unprecedented opportunities. Construction on this multi-year, phased project is set to commence in 2025, with the first ship wharf opening in 2028.

All rates cited below exclude fuel surcharges unless otherwise noted.

Across the Southeast, the volume of loads moving is almost 30% higher than last year, with linehaul rates up $0.04/mile last week, averaging $2.52/mile. Atlanta outbound loads paid carriers an average of $2.49/mile, $0.08/mile higher than last year on a 24% higher volume. Most outbound Atlanta flatbed volume is destined for Lakeland, FL, where linehaul rates averaged $2.63/mile last week, $0.05/mile higher than last year.

Along the Gulf Coast in New Orleans, higher imports of breakbulk steel tonnage are boosting load volume, up 2% w/w. However, with sufficient available capacity, linehaul rates dropped by $0.03/mile to $2.46/mile for all outbound loads. On the high-volume New Orleans to Houston lane, loads were the highest in 12 months, averaging $2.77/mile on an 18% higher volume of loads moved last week. On the New Orleans to Dallas lane, rates dropped $0.15/mile to $2.38/mile last week.

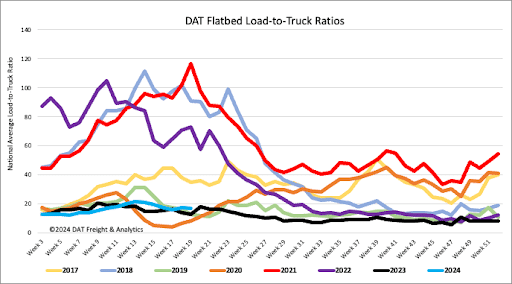

Flatbed load posts were flat last week, almost identical to last year’s, and 20% higher than in 2019. Flatbed equipment posts increased by 3% last week, decreasing the load-to-truck ratio by 17.0.

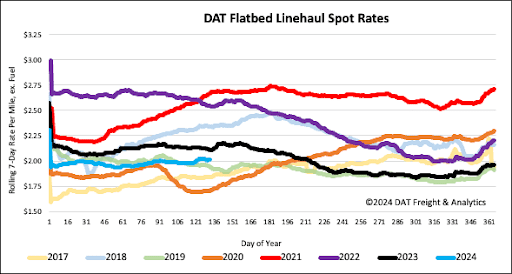

Flatbed linehaul rates remained mostly flat for the third week, averaging just under $2.03/mile last week. The national average is $0.10/mile lower due to an 8% higher volume of loads moved than last year.