Controlling operating costs will be the key to surviving this tough freight market for brokers and carriers alike, but for carriers, slowing down may be the fastest way to better margins.

Embracing the ‘Plus one, minus ten’ strategy, as suggested by Todd Amen at ATBS, truckers can significantly boost their bottom line in this challenging market. By adding just one more monthly load and reducing their speed by ten miles per hour, carriers could substantially increase their annual profits by nearly $20,000.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

“Plus one” means doing an extra load per month. Adding another 1,000 loaded miles per month or 12,000 miles/year with dry van rates around $2.00/mile adds $24,000 to the business’s top-line revenue. After allowing for fixed and variable costs, this equates to an additional income of just over $10,000/year.

“Minus 10” means slowing down 10 miles per hour and increasing fuel economy from 6.5 to 7.5 MPG. Based on 100,000 loaded and 15,000 empty miles per year, operating costs drop by $0.08/mile from $1.81/mile to $1.73/mile. Diesel as a percentage of operating costs drops from $0.61/mile to $0.53/mile, adding roughly $9,300 to the bottom line.

Combined, slowing down and adding another monthly trip turns a business losing around $8,000/year into one making $20,000/year. At the very least, if carriers can’t add another trip per month, given how soft the market is, slowing down and improving fuel economy by 1 MPG will turn an unprofitable business into a profitable one. That’s something that truckers can control even if they can’t control rates and freight demand.

Market watch

All rates cited below exclude fuel surcharges unless otherwise noted.

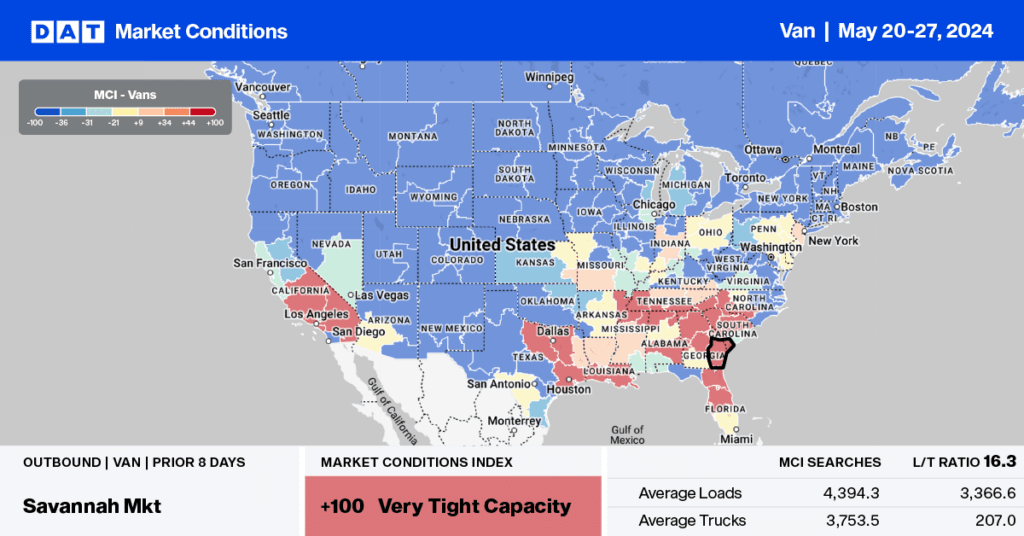

Following the capacity crunch from International Roadcheck Week, capacity tightness remained in key markets as shippers moved 5% more loads than the prior week ahead of the Memorial Day long weekend. In the Top 5 states in the dry van spot market (California, Texas, Illinois, New Jersey, and Georgia), volumes were up 6% w/w, while linehaul rates increased by $0.03/mile to a five-state average of $1.83/mile.

Carriers were paid an average of $1.96/mile in Atlanta, up $0.09/mile w/w on a 6% higher volume of loads moved. The high-volume lane south to Lakeland averaged $2.60/mile, up $0.02/mile w/w on a 19% higher volume. In Los Angeles, rates increased for the fourth week in a row, averaging $1.82/mile, up $0.02/mile w/w on a 7% higher w/w volume. In Dallas, rates were up $0.04/mile to $1.55/mile on a 5% higher volume of loads moved.

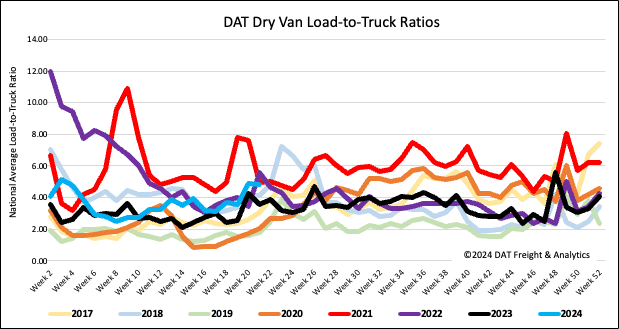

Load-to-Truck ratio

Following the prior week’s capacity crunch resulting from International Roadcheck Week, the dry van market settled slightly – load posts decreased by 2% w/w, and equipment posts remained flat. Compared to last year, load post volume is 4% higher, while 22% fewer carriers posted their trucks in search of loads. The net result was the dry van load-to-truck ratio decreased slightly to 4.80.

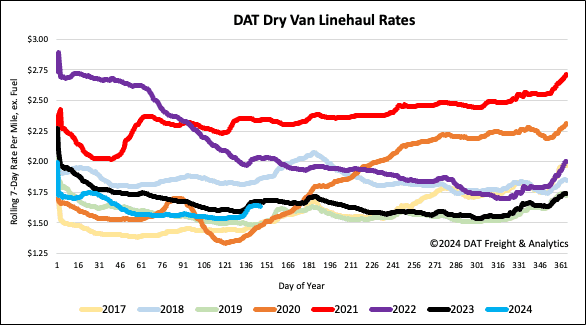

Linehaul spot rates

The national average dry van linehaul rate was flat last week, remaining around $1.64/mile. Compared to last year, linehaul rates are $0.04/mile lower on a 21% higher volume of loads moved in Week 21. DAT’s Top 50 lanes, based on the volume of loads moved, averaged $1.97/mile last week, up $0.01/mile w/w and $0.33/mile higher than the national average.