Even though U.S. non-residential construction spending has slowed this year, overall construction spending has grown over the past three years, driven by a wave of companies building manufacturing plants, warehouses, and data centers. Since the inflection point in October 2021, when commercial construction spending accelerated, the amount spent has increased by 40%.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

On the other hand, residential construction has encountered a slowdown, largely attributed to the impact of higher interest rates, which have deterred potential buyers from entering the market. Similarly, office construction has taken a sharp downturn, reflecting the challenges posed by the uncertain return of American workers to the office environment. According to Federal Reserve Economic Data (FRED), non-residential construction spending decreased 1% month-over-month (m/m) in March but was 5% higher than last year. Since the residential construction boom peaked in May 2022, spending has decreased by 8%.

Market watch

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

Flatbed capacity was much tighter last week in Washington State, where spot rates surged by $0.15/mile to $2.32/mile for outbound loads. Washington outbound linehaul rates have increased by $0.37/mile in the last month. In Seattle, volume increased by 8% last week, driving up linehaul rates by $0.09/mile to $2.32/mile. A similar trend was reported in nearby Medford, where rates increased by $0.08/mile on a 4% higher volume.

At $2.20/mile, Texas’s outbound average rates are almost identical to last year, with the large Houston dominating last week’s results. Volumes were mostly flat, but capacity was tighter as rates increased by $0.07/mile to $2.35/mile. Carriers were paid an average of $2.57/mile on the number lane west to El Paso, $0.24/mile lower than last year on a 2% higher volume.

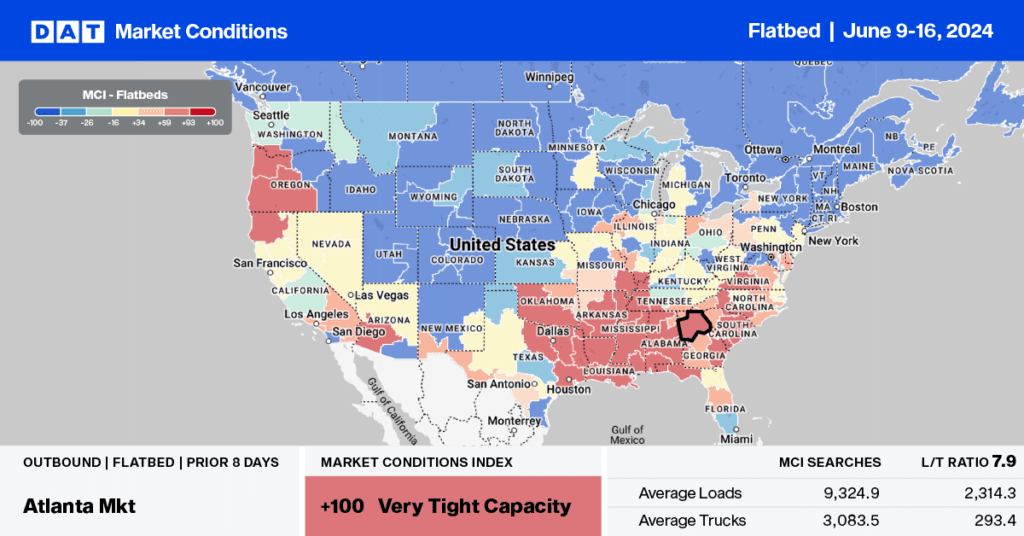

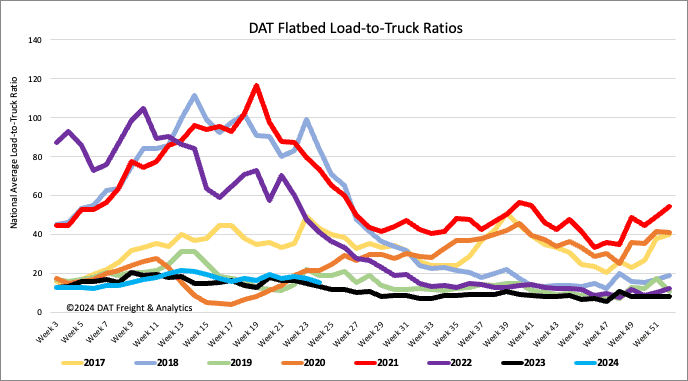

Load-to-Truck Ratio

The gains from the surge in flatbed load post volumes in the first week of June were erased last week, dropping 14% w/w and 13% y/y. Carrier equipment posts were 4% w/w and 25% y/y lower, decreasing last week’s flatbed load-to-truck ratio by 10% to 15.6.

Spot rates

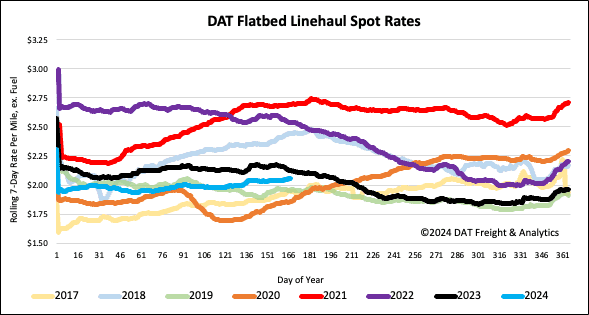

Flatbed linehaul rates remained flat last week, averaging around $2.08/mile. The national average is $0.06/mile lower than last year on a 9% lower volume of loads moved in Week 24 last year.