All Hammonton, NJ, blueberry farmers will answer the same regarding weather and geographic location. The blueberry picking and packing season usually begins around mid-June and ends in early August, punctuated by the annual Red, White & Blueberry Festival in the Blueberry Capital on June 30, 2024. Hammonton, NJ, a town that we can all be proud of, is regarded as the self-proclaimed blueberry capital of the world, being the largest producer of fresh blueberries. However, other states, including Michigan, Oregon, Georgia, and Washington, produce more volume but are more process-oriented for canned and freeze-dried juice and pureed products.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

According to the Blueberry Association, “Blueberry bushes can grow all over the U.S., and farmers in 26 states produce blueberries commercially. More than 98% of that production happens in just ten states, spanning the country from coast to coast: Oregon, Washington, Georgia, Michigan, California, New Jersey, North Carolina, Florida, Texas, and Minnesota.”

Blueberries are quick to perish, and for growers to obtain the best prices at the market, reefer capacity is required to handle loads delicately and fast to overnight markets like Hunts Point in The Bronx, NY. This requires a carrier with the right equipment and driver (hence a premium rate).

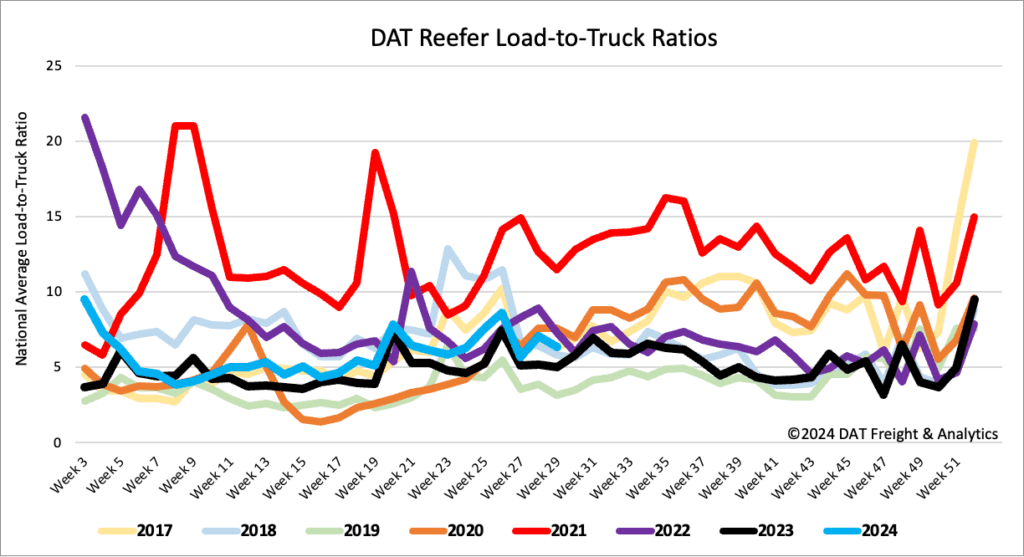

Load-to-Truck Ratio

Reefer load post volume dropped 13% w/w and 5% y/y following a slower week reported by the USDA. Last week’s truckload produce volumes were 5% lower than last year, with California’s volume down by a similar amount. This is significant because the state currently produces around 40% of the national weekly volume. Carrier equipment posts were 2% lower last week and 25% lower y/y, decreasing the reefer load-to-truck ratio (LTR) by 10% w/w to 6.33.

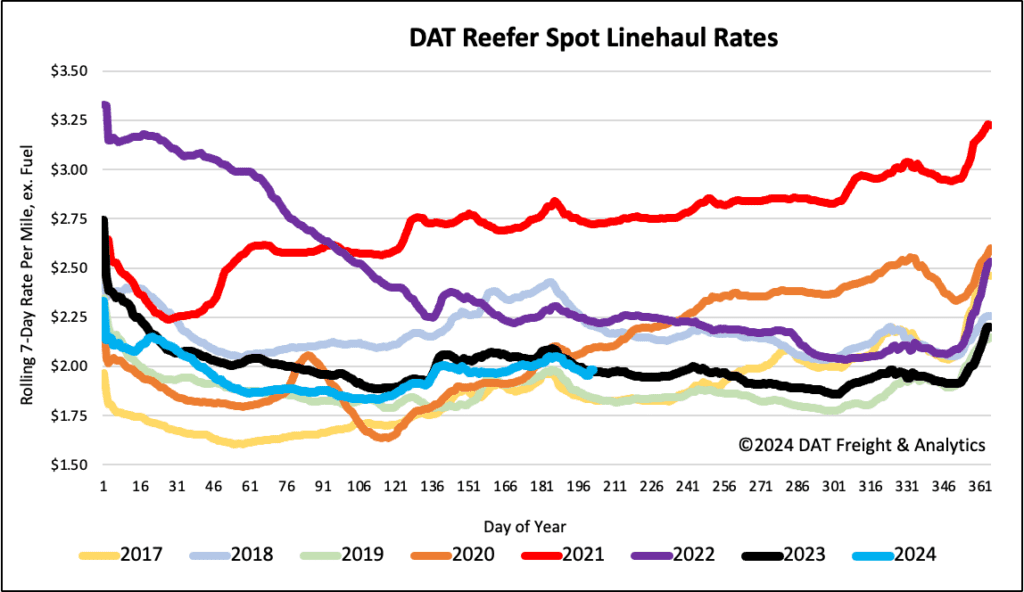

Spot rates

Usually following the annual July 4 peak, the national average reefer linehaul rate decreases consistently as produce volumes trail off over the summer. Last week, though, reefer linehaul rates were flat at $2.00/mile for the second week, a penny per mile higher than last year and $0.03/mile higher than the 3-month trailing average.