U.S. single-family homebuilding rebounded sharply in August, up 16% month-over-month (m/m) and 5% compared to last year. Building permits, however, a leading indicator of demand, reported a moderate 3% m/m and 2% y/y gain. The jump in single-family housing starts reported by the Commerce Department last week also reflected the catch-up in building activity following Hurricane Beryl, which had depressed homebuilding in the South, where starts jumped 19% m/m in August.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

The recent 0.5% cut in interest rates by the Federal Open Market Committee (FOMC) provided a much-needed boost in demand. Builders now have a favorable view for future new home sales and lower construction costs, which is critical to removing persistent challenges to housing affordability.

According to a National Association of Home Builders (NAHB) survey, “Builder confidence in the market for newly-built single-family homes was 41 in September, up two points from a reading of 39 in August; this breaks a string of four consecutive monthly declines. NAHB homebuilder sentiment improved marginally in September, noting “builders will face competition from rising existing home inventory in many markets as the mortgage rate ‘lock-in’ effect softens with lower mortgage rates.”

Market watch

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

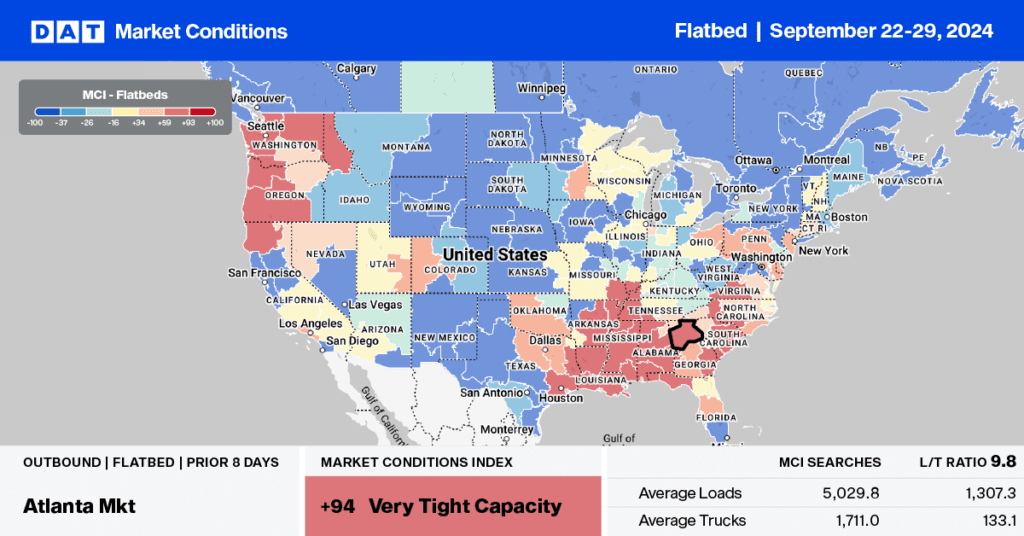

This week, our focus is on the Florida flatbed market, which was impacted by Hurricane Helene last week as a Category 4 hurricane. According to the DAT Market Condition Index (MCI), truckload capacity will be tight as carriers work to navigate back into regions affected by flood, wind, and power outages. Outbound volumes decreased by 11% week over week, and linehaul rates increased by $0.02/mile to $1.80/mile. Inbound volumes also decreased by 3% week over week, and spot rates remained steady at $2.36/mile.

In Tallahassee, the hardest-hit freight market, outbound volumes decreased by 9% week over week, while inbound volumes saw a significant drop of 33% last week. Outbound capacity tightened, leading to an 8% increase in rates to $2.39/mile, while inbound loads paid carriers an average of $2.21/mile, reflecting a 4% increase week over week. In the largest flatbed spot market in the state, outbound volumes decreased by 6% in Lakeland, and on the main route north to Atlanta, rates dropped by 4% week over week due to a 19% decrease in volume.

Load-to-Truck Ratio

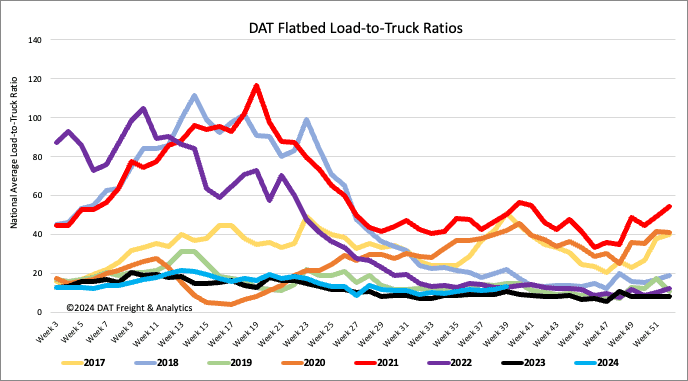

The number of flatbed load posts increased by 6% last week, bringing the volume close to the levels of last year, with just a 2% difference. Meanwhile, carriers’ equipment decreased by 6% week-over-week. This resulted in a 13% increase in the flatbed load-to-truck ratio, which now stands at 13.35. This marks the sixth consecutive week of gains in this ratio.

Flatbed load posts were flat in the Southeast Region, up 5% w along Florida’s Big Bend, and jumped by 81% w/w in Tallahassee, where Hurricane Helene made landfall as a Category 4 event.

Spot rates

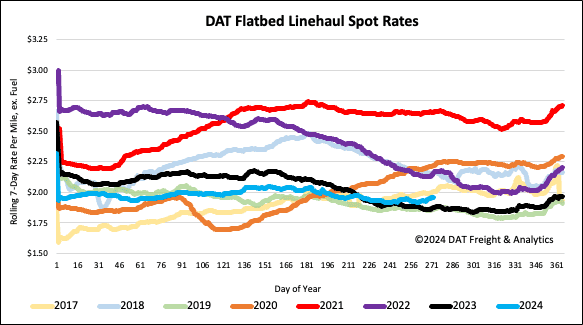

After remaining flat for the prior two weeks, flatbed linehaul rates increased by just over a penny per mile last week, paying carriers an average of $1.99/mile. Flatbed linehaul rates are $0.08/mile higher than last year, $0.10/mile higher than 2019, and $0.02/mile lower than the three-month trailing average. Compared to 2017, when the flatbed rate rally started and continued well into 2018, last week’s linehaul rate was $0.05/mile lower.