Freight tonnage climbed sequentially for the second consecutive month in August, signaling a potential upward trend in the trucking industry, American Trucking Associations reported Sept. 24. The ATA For-Hire Truck Tonnage Index rose 1.8% to 115.8 from the prior month and showed a 0.7% year-over-year increase compared with August 2023. This marked the second year-over-year gain in the last 18 months, with the other occurring in May.

“August tonnage levels rose to the highest since February 2023,” said ATA Chief Economist Bob Costello. “Not only does the latest robust gain show freight levels are coming off the bottom, but so does the sequential pattern over the last eight months. Starting earlier this year, every time tonnage falls, it is higher than the previous low. This month-to-month pattern is more important than looking at the year-over-year percent changes since we are at an inflection point in the freight market.”

Find dry van loads and trucks on DAT One, North America’s largest on-demand freight marketplace.

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

This week, we focus on port markets impacted by the three-day strike by the International Longshoremen’s Association (ILA) union. The ILA, representing 45,000 port workers at 36 ports from Maine to Texas, walked off at midnight on Oct. 2, 2024, after negotiations failed for a new six-year contract between dock workers and the United States Maritime Alliance (USMX) employer group.

The 36 ports were located in 20 freight markets along the East and Gulf Coasts, accounting for approximately 18% of weekly load posts on the DAT One network (dry van 17%, reefer 18%, and flatbed 16%). Elizabeth, NJ; Philadelphia, and Houston were the top three ports ranked by load posts. In the week leading up to the strike, East and Gulf Coast combined load post volumes jumped 8% week-over-week; last week’s increase was five points lower.

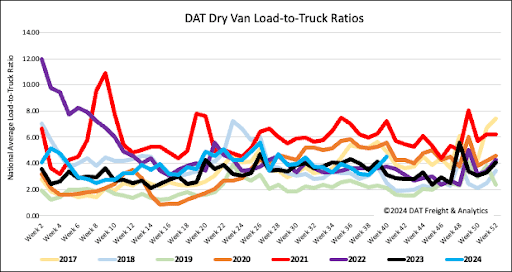

The ILA)strike and the devastating Hurricane Helene caused a surge in load post volumes last week, increasing by 17%. Carrier equipment posts were down 22% week-over-week (w/w), increasing the dry van load-to-truck ratio (LTR) by 20% to 4.51.

The 20 freight markets adjacent to ports where ILA dockworkers walked off the job last week saw a 5% reduction in load post volumes. In Savannah, the second largest port on the East Coast, where container vessels at anchor record the highest on the East Coast at 17, load posts dropped 6% w/w.

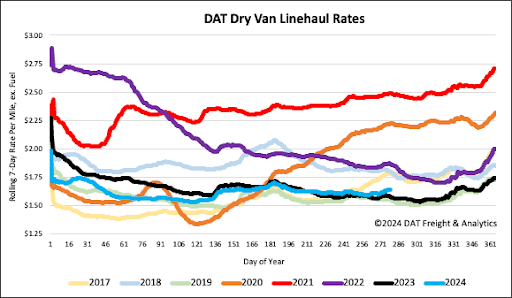

Last week, dry van linehaul rates increased nationally by $0.03/mile to $1.65/mile due to decreased available capacity in the Southeast. In the larger Atlanta freight distribution market, linehaul rates increased by $0.07/mile to $1.53/mile despite a 3% decrease in load volumes compared to the previous week. In the Southeast Region, mainly affected by Hurricane Helene, inbound and outbound regional rates increased by $0.10/mile w/w.

The ILA port strike led to a 7% decrease in volume at the largest port on the East Coast in Elizabeth, NJ, where spot rates rose by 3% week over week. According to DAT’s Top 50 lanes, spot rates increased by $0.04/mile to $1.99/mile based on the volume of loads moved, which is $0.34/mile higher than the national average.