The California citrus season has been challenging, with the crop size decreasing from 10 to 20% due to thrip issues (tiny insects that can damage produce) on most citrus items. “Fortunately, thrip hasn’t been as widespread as previously thought,” says Krista Beckstead with Mountain View Fruit Sales. Markon, a supplier of fresh fruits, vegetables, and juices to food service companies in North America, reported that California’s available Valencia orange supply continues to diminish. Markon expects California to experience an orange supply gap in October that will persist until the Navel season begins in late October/early November.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

The most current USDA data reports citrus volumes in California are 18% lower than last year. Oranges accounted for 52% of California truckloads and were down 6% year-to-date (YTD), while lemon production was down 35% year-to-date (YTD). California is a leading producer of lemons, supplying more than 90% of the nation’s lemons.

Market watch

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

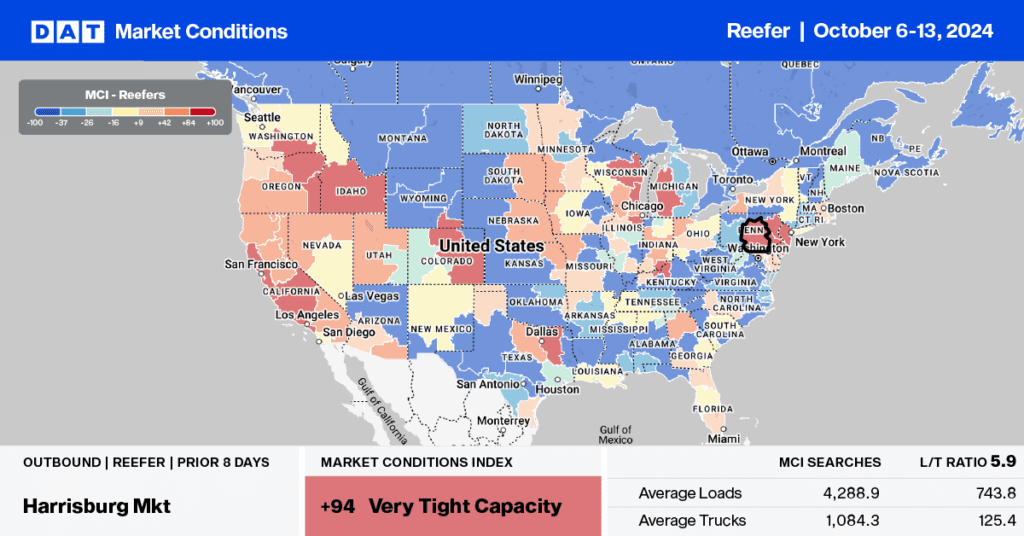

This week, we are concentrating on the inbound capacity in Southeastern freight markets, particularly in Georgia and Florida. Hurricane Milton is expected to have damaged the Florida citrus industry, which is still recovering from Hurricane Ian in September 2022. Hurricanes have caused billion-dollar damages to the state’s agriculture in the past. In 2022, the University of Florida found that Hurricane Ian caused damages of $1.03 billion in the total value of seasonal crops, livestock, nurseries, and aquaculture products.

The Florida citrus season, best known for producing juicing oranges, typically runs from October through June, but the exact timing and availability of different varieties can vary each year. The most significant quantities of Florida oranges are available from December through May, but they are plentiful from October through June. Although it is still too early to fully assess the extent of Hurricane Milton’s impact on Florida’s agriculture, local farmers have been preparing for the worst. Most of the citrus farms are located in the center-south part of the state, where Milton crossed the state.

The Florida Department of Transportation has suspended size and weight restrictions for vehicles transporting emergency equipment, services, supplies, and agricultural commodities, including citrus. This emergency measure allows these vehicles to travel at all hours and will expire on Oct. 21 or upon the rescission of the executive orders.

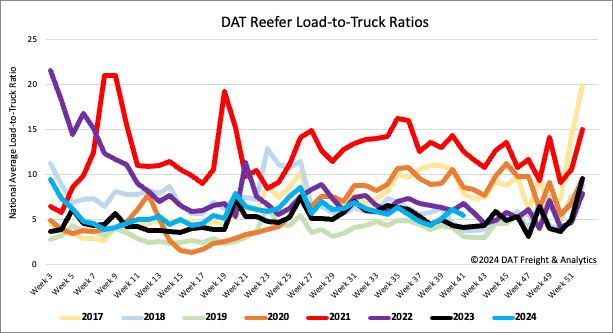

Load-to-Truck Ratio

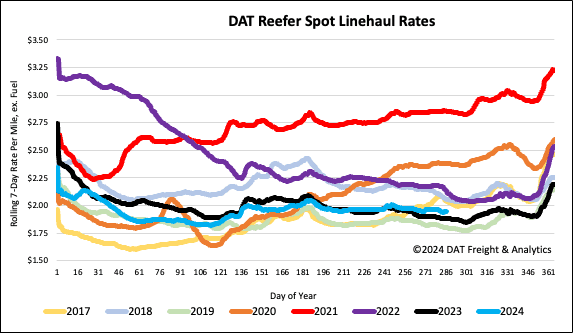

The number of national reefer load postings decreased by 14% last week and 3% compared to last year. Carrier equipment postings decreased by 3%, causing the reefer load-to-truck ratio (LTR) to decrease by 11% to 5.42. This is 31% higher than last year and 11% higher than the long-term average for Week 41.

Spot rates

The national average reefer linehaul rate decreased by one cent per mile, undoing the previous week’s increase as carriers re-entered the market and roads in the Southeast became accessible. Currently at $1.96/mile, linehaul rates are $0.06/mile higher than last year. In the larger Atlanta freight market, spot rates fell by $0.14/mile to $1.97/mile, with a 4% increase in volume.

On the top reefer lane between Atlanta and Lakeland, where Hurricane Milton hit, volumes decreased by 34% week over week (w/w), leading to a $0.22 per mile drop in spot rates. Volumes between Lakeland and Atlanta also dropped by 33% w/w while capacity tightened, causing linehaul rates to increase by $0.05/mile to $1.19/mile.