Whether you’re a carrier or an owner-operator, effective planning and strategizing are crucial for maximizing profits in your trucking business. One fundamental way to boost profits is having a plan for handling backhauls.

Understanding the difference between headhaul and backhaul loads is important for carriers and owner-operators. The rate for a load is determined not only by factors like distance or cargo type but also by whether it’s a headhaul or backhaul, which can influence the rate offered.

Successful truckers can manage both types of loads to improve their business. Let’s examine each type of load, their main differences, and how you can utilize each type to increase your rates and business success.

What is headhaul in trucking?

A headhaul market is where the freight rate is higher on the outbound leg of the trip than the return leg for specific round-trip origin and destination zip code pairings. Headhaul freight markets are created when there is an imbalance in a lane, with shippers’ demand for the lane greater than freight providers’ supply of freight capacity.

In simple terms, a headhaul is the load that takes a truck from point A to point B, representing the highest-paying portion of a roundtrip. For example, a dry van load from Los Angeles to Denver typically pays a higher rate than loads from Denver to Los Angeles due to the supply and demand for trucks in each market. In this case, only one load moves outbound in the Denver freight market for every 1.5 inbound loads in the spot market.

For carriers, a headhaul freight market typically means more load choices; carriers can usually demand a higher price and may even deadhead into the market to take advantage of higher outbound rates.

What is a backhaul in trucking?

Backhauls are loads delivered on the return trip from point B to point A or to a location near the starting point. For instance, loads hauled from Denver to Los Angeles typically pay backhaul rates lower than headhaul rates.

Backhaul freight markets are markets where the capacity imbalance occurs when there is less demand from shippers than from carriers. Shippers have pricing power because carriers are willing to negotiate a price to exit the market with freight instead of deadheading to another market.

Backhaul loads allow carriers to avoid deadhead miles but are usually less profitable. Considering the entire roundtrip when choosing a headhaul load and negotiating rates is essential to avoid higher operating costs from deadheading when finding the next load.

What are deadhead miles?

After delivering a headhaul load, carriers and owner-operators typically have two options: take a backhaul on the return trip or deadhead back home. Deadheading is when you make a trip without a load for zero revenue.

Deadheading can be a worst-case scenario for carriers, which means the business is actively losing money unless the deadhead miles position the truck into a higher-paying headhaul market. In addition to financial obstacles, deadheading can also be more risky due to the drastic change in the weight of the trailer, potentially leading to accidents.

The most and least balanced freight markets.

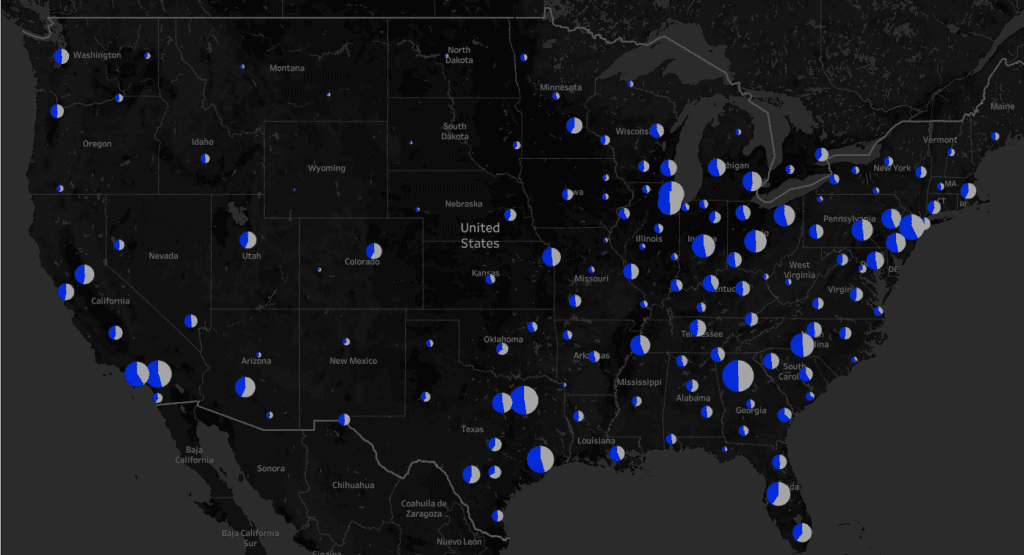

DAT routinely studies inbound and outbound loads moved weekly to create a dry van heatmap (see Fig 1 below) for each market. In this case, blue represents outbound loads, and grey represents inbound loads.

- Out of 138 markets, the Top 10 account for 28% of outbound and 24% of inbound loads.

- Of the Top 10 markets, Los Angeles is the least balanced, with 1.42 loads outbound for every load inbound.

- Elizabeth, NJ, is the second least balanced Top 10 market, with 1.37 loads outbound for every load inbound.

- Billings, MT, is the least balanced backhaul market; for every 2.19 loads in, only one goes out.

- Green River, WY, is the least balanced headhaul market; for every load inbound, 2.61 loads go out.

- Atlanta, GA, is the most balanced market, with an equal numberof inbound and outbound loads.