The Fannie Mae Home Purchase Sentiment Index (HPSI) increased by 1.8 points in September to 73.9, its highest level in over two years. This was driven by consumers’ increased optimism that mortgage rates will decrease over the next 12 months. In September, 42% of consumers said they expect mortgage rates to decline, up from 39% the previous month and 24% in June.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Mark Palim, Fannie Mae’s Senior Vice President and Chief Economist, noted that consumers are becoming more optimistic about mortgage rates, which has led to the HPSI reaching a 30-month high. However, despite this increased optimism, there has yet to be a significant rise in home sales activity. Instead, existing home sales are on track to hit their lowest annual total since 1995. This suggests that while consumers notice the lower interest rates, they still feel constrained by the substantial increase in home prices over the last four years.

Market watch

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

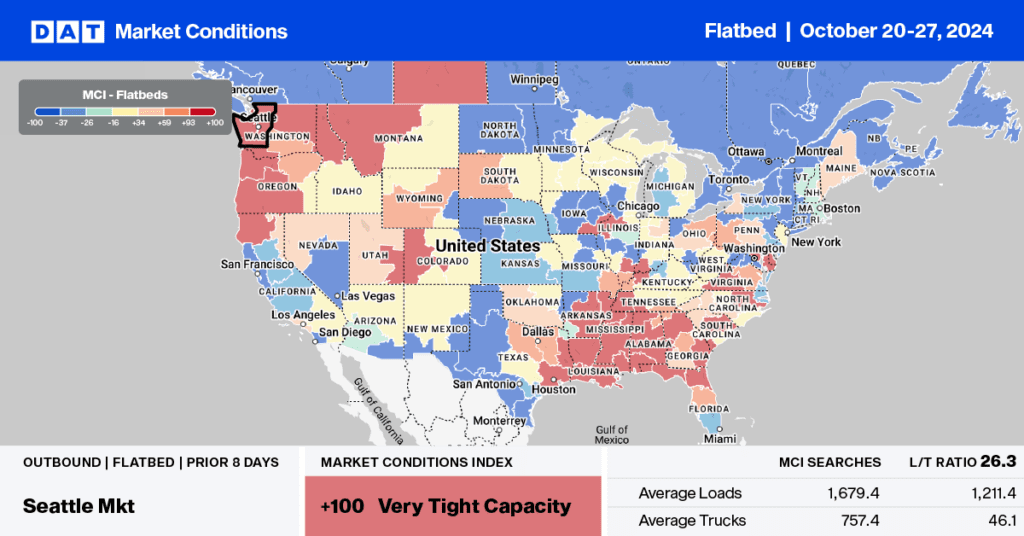

This week, we focus on the Pacific Northwest, specifically Oregon and Washington, the leading regions for Douglas fir production. Douglas fir is a significant and widely harvested softwood in North America, primarily utilized in construction, plywood, and paper production.

Oregon and Washington are the top producers of Douglas fir in the U.S., with Oregon often being the largest. The forests in the western part of Oregon, particularly in the Coast and Cascade Range, contribute significantly to the Medford freight market. Meanwhile, Washington’s forests, especially in areas like the Olympic Peninsula and the Cascade Mountains, play a significant role in the Seattle freight market.

Outbound regional flatbed spot rates are approximately 16% higher than last year, attributed to a 4% increase in load volume. Outbound capacity is very tight and is expected to remain so for the remainder of the year, especially with the Christmas tree shipping season in full swing. Linehaul rates for regional loads from Medford to Stockton are the highest this year, averaging $3.49 per mile. However, according to DAT’s Ratecast, this is the peak.

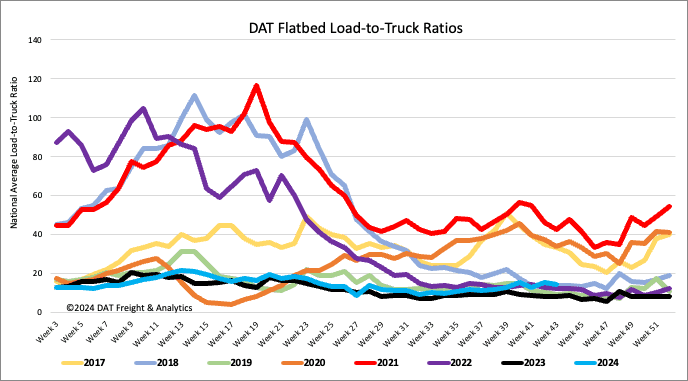

Load-to-Truck Ratio

Last week, the number of national flatbed load postings decreased by 8%. However, they were still 10% higher compared to last month and up 36% from last year. Meanwhile, the number of carriers’ truck posts decreased by 3% week-over-week. As a result, the flatbed load-to-truck ratio dropped by 5%, reaching 14.62. This figure is 77% higher than last year’s load-to-truck ratio for Week 43.

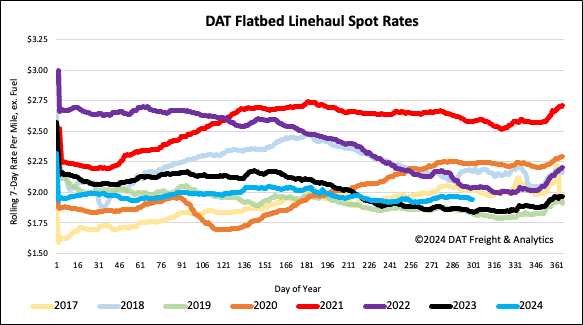

Spot rates

Last week, flatbed linehaul rates continued to decline, dropping by another $0.01 per mile to a national average of $1.97 per mile. Despite this decrease, rates are still $0.11 per mile higher than they were last year, although they are $0.02 per mile lower than the three-month trailing average. The recent declines highlight the excess available capacity in the flatbed market, especially considering the increase in load volume—a rise of 7% week over week and 3% month over month.