The outlook for freight-centric sectors of U.S. manufacturing continues to perform poorly relative to peak freight demand in the first half of 2022. Manufacturing production has been down 1.2% since the three-year high in March 2022 and has been mostly flat since then. Other important truckload freight-generating sectors include:

- Wood products: down 7% y/y

- Paper: up 1.2% y/y

- Plastic & rubber down 3% y/y

- Nonmetallic mineral products: down 4% y/y

- Machinery: down 4%

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

According to Professor Jason Miller at Michigan State University, “It will take time for manufacturing activity in these industries to rebound. I expect late Q1 to early Q2 2025 when I genuinely expect demand conditions to get strong enough for spot rates to show the sustained increase needed to pressure contract rates”.

Market watch

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

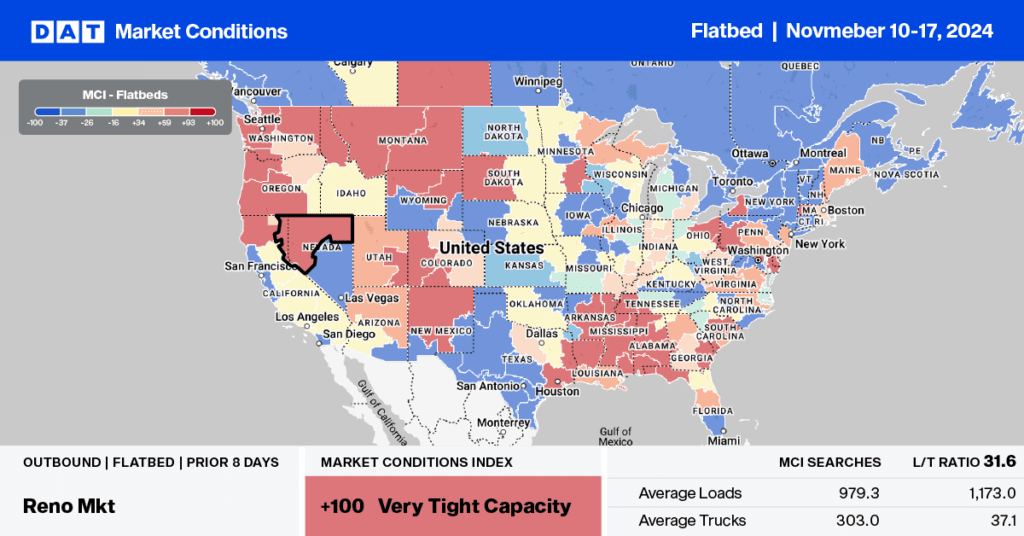

This week, we focus on the Great Lakes Region, including the Gary and South Bend, Indiana freight markets. Indiana is the state that produces the most steel in the U.S. Specifically, the northwestern part of Indiana, around the city of Gary, has the highest concentration of steel production, primarily due to its proximity to the Great Lakes, which facilitates the transportation of raw materials and finished products. According to S & P Platts data, monthly steel production in the Great Lakes Region was down 4.7% in September and 6% compared to the 5-year average.

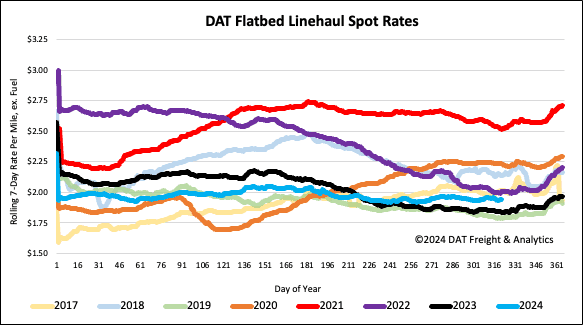

As a result, flatbed carriers are seeing 7% fewer outbound truckloads in the Gary freight market than last year, while outbound spot rates are 1.3% lower ($0.03/mile) at an average of $2.35/mile. At this level, linehaul rates are typically at their lowest each year, and after reaching a record-high of $4.00/mile in March 2022, rates have fallen 41% since.

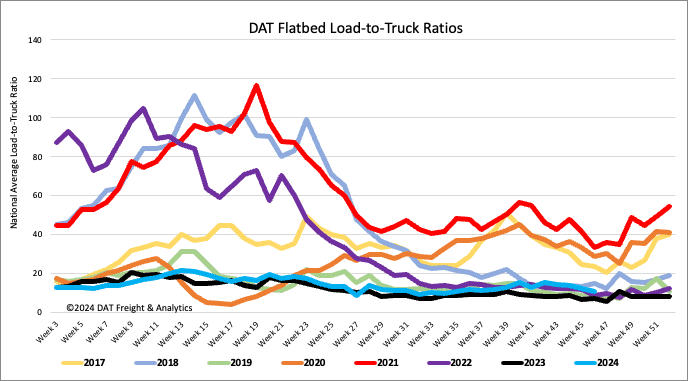

Load-to-Truck Ratio

Last week, national flatbed load postings fell for the fourth successive week following last week’s 12% w/w decrease. Compared to last year, volumes are 18% lower. Meanwhile, the number of carrier truck postings remained unchanged for the second week, resulting in the flatbed load-to-truck ratio decreasing by 12% w/w to 11.01.

Spot rates

Last week, flatbed linehaul rates dropped by $0.03/mile to a national average of $1.96/mile, erasing the prior two week’s gains despite a 4% increase in the volume of loads moved. Spot rates are $0.10/mile higher than last year, $0.06/mile lower than in 2022, and $0.02/mile lower than the three-month trailing average.