The U.S. Census Bureau released the latest residential statistics for October 2024, reporting housing starts, recording a seasonally adjusted annual rate of 1.311 million, 3.1% lower than the previous month and a 4% decline compared to last year. Single-family housing starts, the most freight-intensive residential construction, fell 7% m/m and 0.4% y/y. In contrast, a leading indicator of future housing starts, single-family permits saw a slight increase of 0.5%, suggesting build sentiment has turned positive.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

According to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released last week, “Builder sentiment improved for the third straight month, and builders expect market conditions to continue improving with Republicans winning control of the White House and Congress.”

“While builder confidence is improving, the industry still faces many headwinds, such as an ongoing labor shortage and buildable lots along with elevated building material prices,” said NAHB Chief Economist Robert Dietz.

Market watch

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

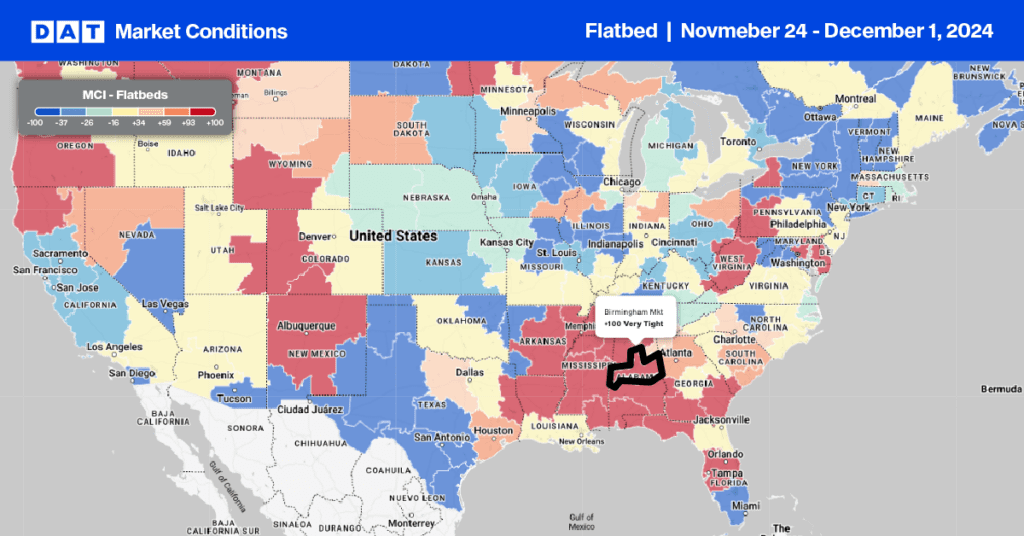

This week, we focus on the Birmingham, AL market in the Southeast Region, the nation’s tenth-largest flatbed freight market. Due to its historic ties to steel production, Birmingham is known as the “Pittsburgh of the South.”Birmingham’s industrial roots trace back to the late 19th and early 20th centuries when it became a significant steel producer due to its proximity to abundant natural resources, including iron ore, coal, and limestone.

Today, Birmingham is home to a growing automotive industry that supports major automakers like Mercedes-Benz, Hyundai, and Honda. It also has a strong base of Tier-1 and Tier-2 suppliers, parts manufacturers, chemical manufacturing facilities, food processing, and beverage manufacturing. This makes Birmingham a slight backhaul market where only one goes out for every 1.23 loads inbound. Truckload volumes into the Birmingham market are 36% higher than last year, while outbound volumes are 68% higher.

Load-to-Truck Ratio

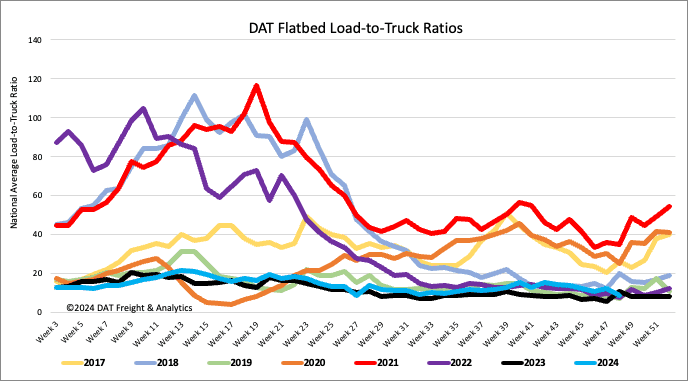

Last week, national flatbed load postings decreased on the short workweek before Thanksgiving but were still 17% higher than last year. Meanwhile, carrier equipment postings decreased by 26% y/y, decreasing the flatbed load-to-truck ratio by 28% w/w to 8.87.

Spot rates

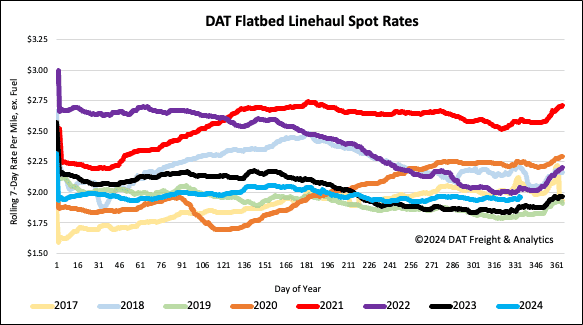

Last week, flatbed linehaul rates increased by another penny per mile to a national average of $1.98/mile. Spot rates are $0.08/mile higher than last year and 2022, identical to the three-month trailing average.