Since 1976, Noble Mountain has been one of the world’s largest wholesale Christmas tree suppliers of Plantation Noble Fir, Douglas Fir, Scotch Pine, and Grand Fir. Their four farms total over 4,000 acres and are strategically located within and on the edge of Oregon’s famed and fertile Willamette Valley. Trees are typically harvested in late fall and helicopter-harvested mere hours before shipment to meet Christmas’s robust demand for fresh, natural trees.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Invented at the Noble Mountain Tree Farm in Oregon, helicopter harvesting involves lifting bundles of trees from the fields and delivering them to centralized locations, such as loading zones for sorting and transportation to end markets. Despite the costs, helicopter harvesting has become a hallmark of large-scale Christmas tree farms, especially in regions where terrain and logistics make traditional transport methods less practical. It’s also a striking visual spectacle and often draws public and media attention during the holiday season.

Market watch

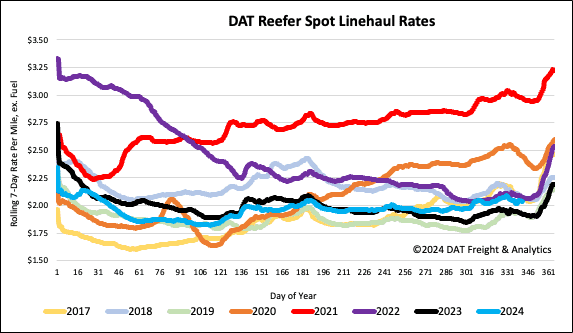

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

This week, we focus on the McAllen freight market, the central southern border crossing for produce imports from Mexico. The Mexican shipping season is just starting, eventually peaking in May each year, accounting for almost a third of North American truckload produce volume. The majority of Mexican produce enters the U.S. in southern Texas via the Pharr International Bridge before entering McAllen, TX. Tomatoes, avocados, and limes accounted for 30% of truckload volume in November.

On the U.S. side of the border, the McAllen reefer market is reporting 34% higher truckload volume compared to last year, while capacity has tightened somewhat, with outbound spot rates up 2% year over year. Almost a third of McAllen’s volume is destined for Dallas/Ft Worth, where truckload volumes are up 32% y/y. At the same time, sufficient available capacity has kept outbound linehaul rates on the lane flat at around $2.60/mile. DATs Ratecast forecasts rates on this lane to peak around $3.00/mile as the peak produce season concludes in May next year, 15% higher than the start of December.

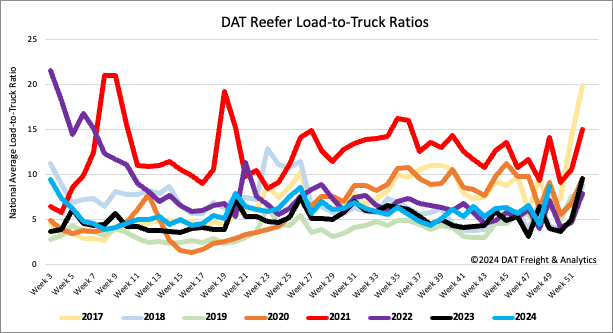

Load-to-Truck Ratio

Compared to last year’s post-Thanksgiving catch-up week, load post volumes were almost identical last week. Reefer carrier equipment posts were 26% lower over the same timeframe, resulting in a 34% year-over-year increase in last week’s reefer load-to-truck ratio (LTR), which stands at 8.67. Last year, the reefer LTR was 6.49.

Spot rates

Reefer rates were flat last week, somewhat surprising compared to last week’s forecast, which, based on prior years’ seasonality, suggested a penny-per-mile decrease would have been more likely post-Thanksgiving. At a national average of $2.05/mile, reefer linehaul rates remained $0.11/mile higher than last year and $0.04/mile lower than in 2022. Reefer linehaul rates are under $0.05/mile higher than the three-month trailing average.