The October Logistics Manager’s Index reads in at 58.4, down slightly (-0.5) from October’s reading of 58.9, the fastest expansion rate since September 2022. The overall index has increased for twelve consecutive months, marking a full year of expansion since November 2023’s reading of 49.4. Growth has been highly consistent over the past three months, proving that the logistics industry has expanded steadily and sustainably.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

The overall index is up 9.0 points compared to November last year, as the logistics industry has had a healthy, organic recovery in 2024 based on steady improvements in the economy’s fundamentals. According to Associate Professor at Colorado State University, Zac Rogers, “The most notable movements in the LMI this month is the predicted slowdown in the expansion of Inventory Levels, which dipped (-3.3) to 56.1, keeping with typical seasonality patterns. Overall Inventory Levels are lower because there is less inventory in the system than in October. Still, costs are higher because a more significant percentage of the remaining inventory is being held by retailers, whose costs are often higher due to their location closer to consumers”.

The LMI score combines eight unique components of the logistics industry, including inventory levels and costs, warehousing capacity, utilization, and prices, as well as transportation capacity, utilization, and prices. The LMI is calculated using a diffusion index, in which any reading above 50.0 indicates that logistics is expanding; a reading below 50.0 indicates a shrinking logistics industry.

Market watch

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

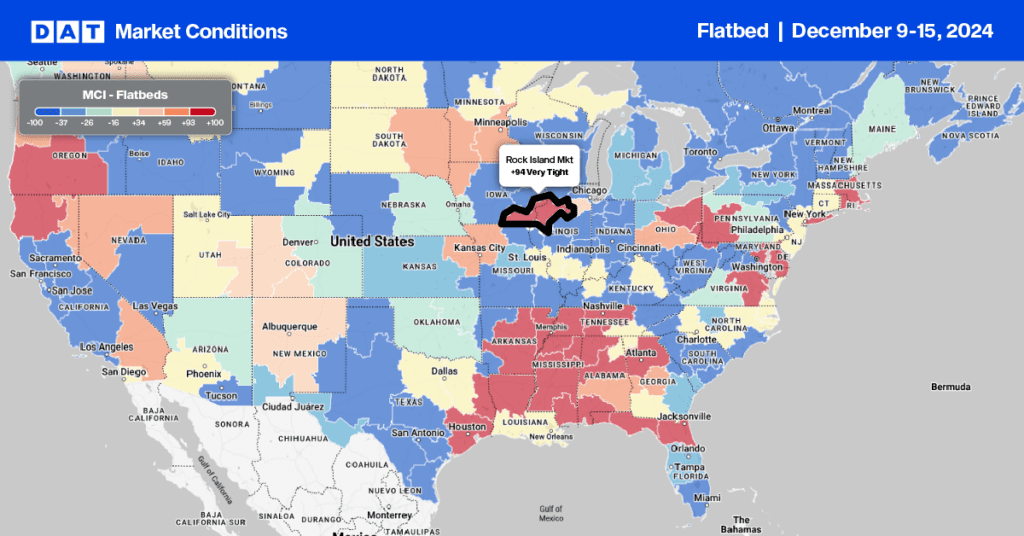

This week, we focus on the Quad Cities region’s Rock Island, IL, freight market. Manufacturing is a cornerstone of the Quad Cities’ economy, a metropolitan area straddling the Mississippi River between Iowa and Illinois (comprising Davenport and Bettendorf in Iowa and Rock Island, Moline, and East Moline in Illinois).

The Quad Cities is known as the global headquarters of agricultural and construction equipment manufacturing giant John Deere and the Rock Island Arsenal. This central U.S. Army installation specializes in producing military equipment and providing logistics and engineering support. The region also hosts many small—to mid-sized companies specializing in metalworking, machining, custom fabrication, and food and beverage manufacturing.

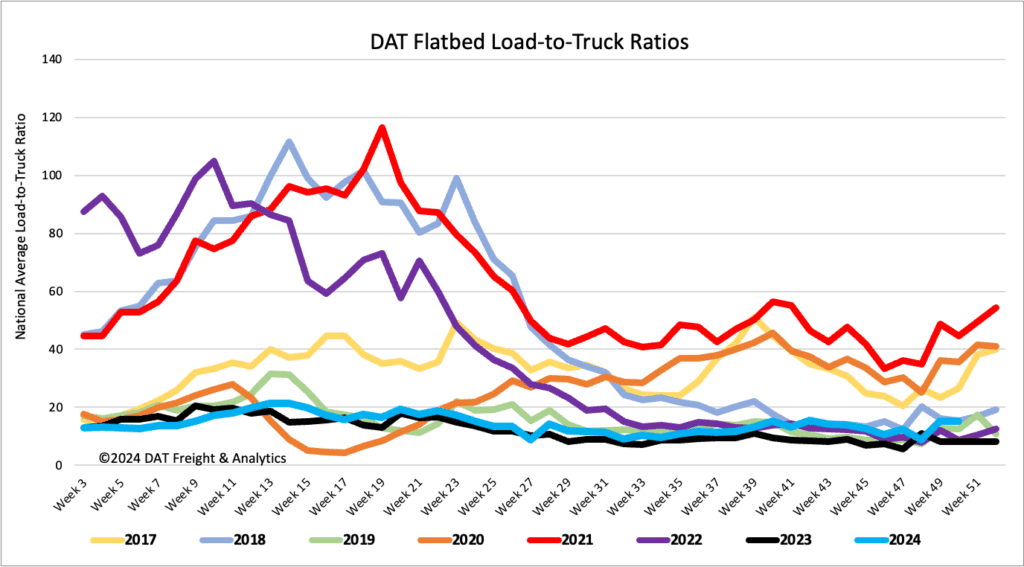

Load-to-Truck Ratio

Last week, national flatbed load postings decreased by 10% week-overe-week but remained 13% higher than last year. Meanwhile, carrier equipment postings decreased by 39% y/y, resulting in the flatbed load-to-truck remaining mostly unchanged at 15.30. Last year the Week 50 LTR was 8.29.

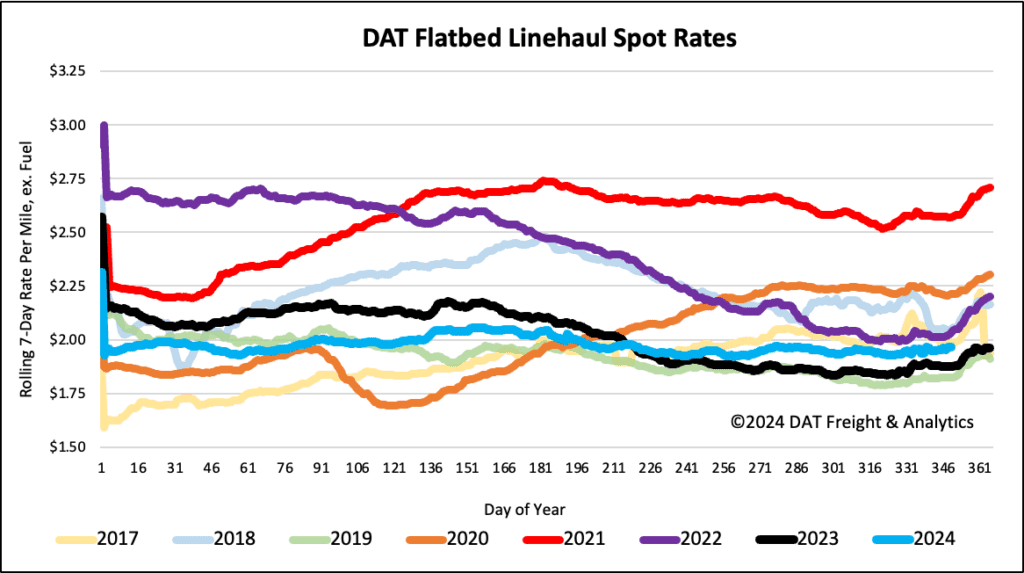

Spot rates

Last week, flatbed linehaul rates increased by $0.02/mile to a national average of $1.99/mile. Spot rates are $0.09/mile higher than last year and remained $0.06/mile lower than in 2022 and a penny-per-mile lower than the three-month trailing average.