The United States is one of the world’s top five producers of crude steel, and as of November 2024, the country’s steel industry produced over 74 million net tons of steel annually. In the week ending January 4, 2025, the US produced 1,635,000 net tons of raw steel, representing a 1.3% decrease from the same period in 2024 and around 7% lower than the 5-year average. In Indiana where most raw steel is manufactured, production volumes were down almost 7% in November adding to the lackluster demand being experienced by open deck carriers.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

According to the latest data from S&P Platts, US steel production by region in the week ending January 4, 2025, was:

- North East: 124,000 net tons down 4.9% m/m

- Great Lakes: 544,000 net tons down 4% m/m

- Midwest: 220,000 net tons down 0.3% m/m

- Southern: 693,000 net tons down 0.6%

- Western: 54,000 net tons down 3.4% m/m.

Market watch

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

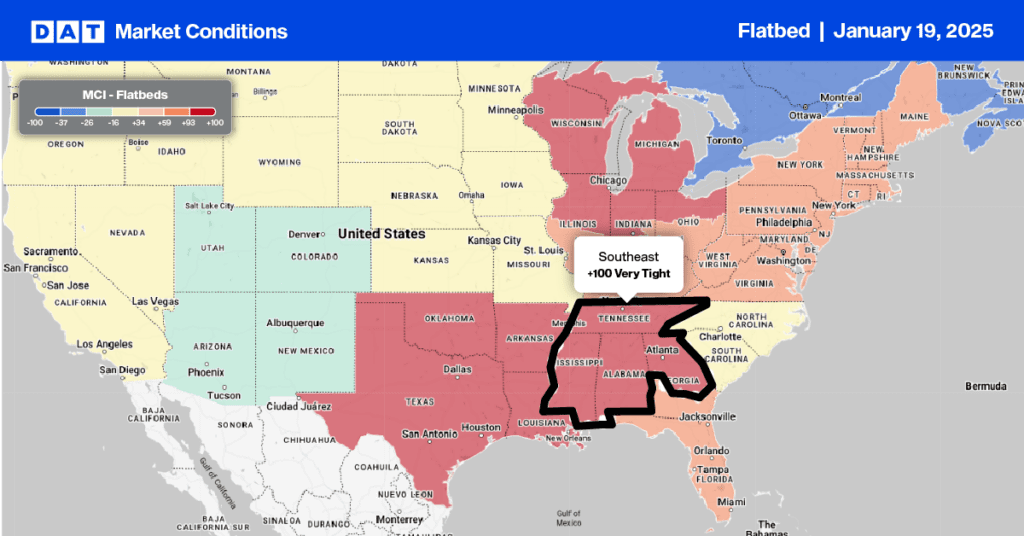

This week, we focus on the Southeast Region freight market, a major hub for steel production with facilities in cities like Birmingham and Mobile, where major companies like U.S. Steel and Nucor operate. The region is also well-known for its steel fabrication and processing facilities, which support the automotive, aerospace, and construction industries. The region was also hit by an extremely rare winter storm last week in parts of the Deep South, Southeast, and even the Gulf Coast. Events like this occur only every 5-10 years, according to WeatherOptics, causing significant freight disruptions in San Antonio, Houston, New Orleans, Jackson, Mobile, Atlanta, Jacksonville, Savannah, Charleston.

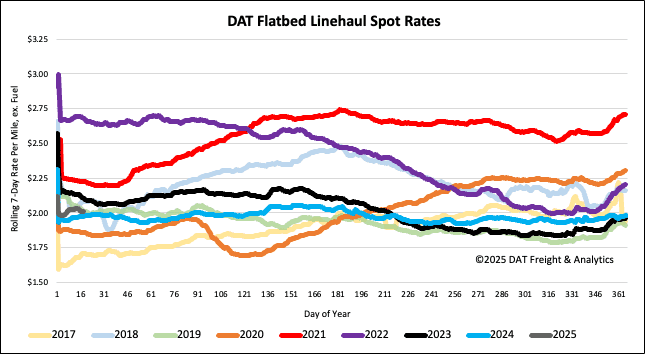

At $2.39/mile for outbound flatbed loads, carriers are being paid $0.13/mile higher than last year and the third-highest since 2018, surpassed only by the record-breaking 2021 and 2022 freight markets. Outbound regional volumes are 11% higher than the third week of 2024. On high-volume regional lanes, including Jackson, MS, to Houston, spot rates are 16% higher y/y, paying carriers an average of $2.46/mile. According to DATs Ratecast, linehaul rates are expected to rise by $0.45/mile between now and mid-May, when they reach a summer peak of $3.00/mile.

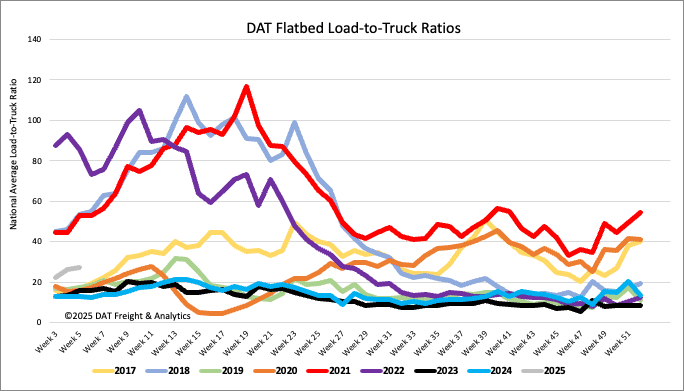

Load-to-Truck Ratio

Even though flatbed load post volumes were 8% higher than last week and 17% higher than the same week last year, they are within 6% of the long-term average for week three of the shipping year. As a result, last week’s flatbed load-to-truck ratio (LTR) increased by 4% to 27.41.

Spot rates

Available flatbed capacity eased following last week’s penny-per-mile decrease to a national average of $2.03/mile. Spot rates are $0.03/mile (2%) higher than in Week 3 of 2024, $0.08/mile lower than in 2018, and identical to where they were in 2019.