The November for-hire trucking ton-mile index (TTMI) showed a seasonally adjusted decline in freight demand compared to October. According to Professor Jason Miller, the index experienced a 0.5% month-over-month decline in November, with a 0.8% decrease year-over-year. Contributing to the decline were poor year-over-year comparisons in several sectors, including quarrying, oil and gas drilling, and motor vehicle manufacturing, performed poorly year-over-year.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Miller notes, “Looking toward 2025, growth in trucking demand is uncertain. A best-case scenario might see a 2.5% year-over-year increase, while a worst-case scenario could result in peaks around Q3 at 0.7%, declining by year-end due to potential trade wars and inflation. Overall, trucking demand will be heavily dictated by government policies, such as tariffs and business tax cuts. Carriers should prepare for multiple scenarios and adjust their plans accordingly”.

Market watch

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

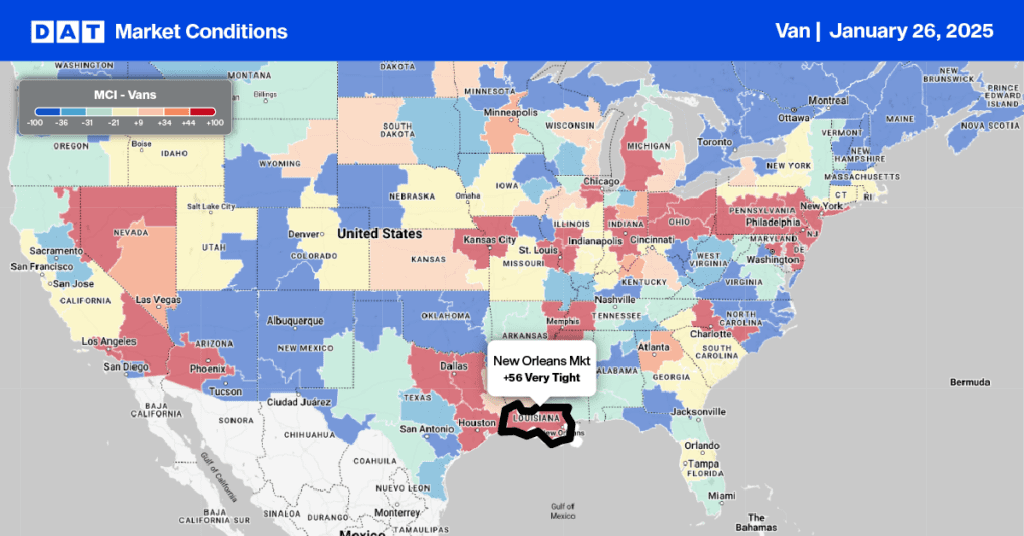

This week, we focus on the New Orleans freight market where Winter Storm Enzo delivered freezing cold temperatures, record snow and ice to major cities and highways. New Orleans picked up 8 inches, making it the heaviest snowfall there in modern day records (since 1948) and the city’s biggest total in over 100 years. Winter Storm Enzo has caused significant disruptions across various modes of freight transportation in New Orleans, leading to delays and operational challenges in the region’s supply chain.

The Port of New Orleans was closed due to the severe weather conditions, leading to the shutdown of major terminals and a declaration of force majeure. This closure halted barge operations, affecting the movement of goods through the port. The heavy snowfall and icy conditions have led to hazardous travel, resulting in road closures and dangerous driving conditions. This has disrupted truck transportation, causing delays in freight deliveries.

The Louisiana Department of Transportation and Development announced that due to deteriorating road conditions as a result of Winter Storm Enzo, Interstate 10 in the east and westbound direction was closed to motorists, from the Louisiana/Texas state line to Baton Rouge. DATs Market Condition Index (MCI) expects outbound dry van capacity to remain tight into next week.

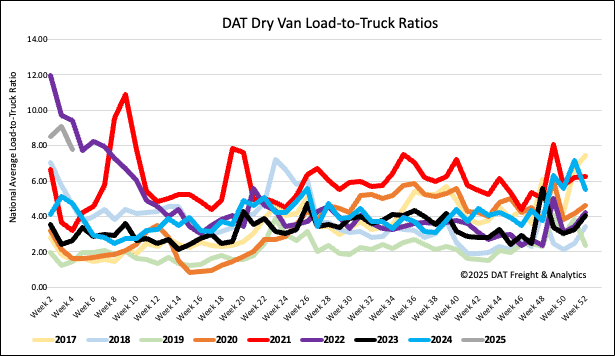

Load-to-Truck Ratio

The freight market slowed last week, most likely impacted by the freezing cold temperatures across the eastern half of the country. Load and equipment posts were both lower resulting in last week’s dry van load-to-truck ratio (LTR) ending the week at 6.27.

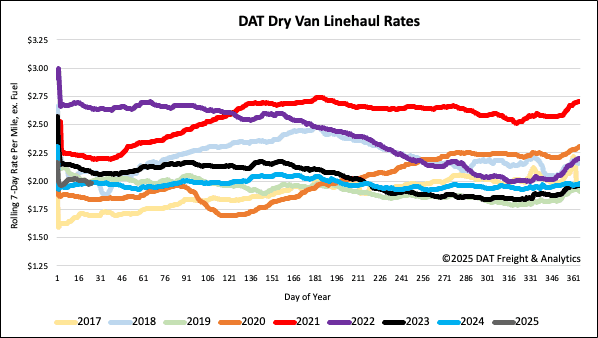

Linehaul spot rates

Despite a decrease in national capacity levels last week, unprecedented Arctic weather in the South and Southeast Region caused capacity to tighten significantly. Along the Gulf Coast, linehaul rates rose by $0.06/mile in Tallahassee, Mobile, and New Orleans. At the national level, the 7-day rolling average ended last week down by $0.05/mile, settling at $1.76/mile. Spot rates are $0.01/mile lower than last year and $0.02/mile lower than in 2019, based on an identical volume of loads compared to last year.

In DAT’s Top 50 lanes, ranked by the volume of loads moved, carriers received an average of $2.09/mile. This is a decrease of $0.05/mile week-over-week and $0.09/mile over the past two weeks. However, this average remains $0.33/mile higher than the national 7-day rolling average spot rate.and remains $0.33/mile higher than the national 7-day rolling average spot rate.