According to the USDA, national truckload produce volumes are trailing last year by just over 6% impacted in part by the devastating wild fires in California. Raging flames, persistent smoke, and damaging winds are expected to result in significant crop damage for farmers throughout Southern California. Alba Velasquez, the executive director of the Los Angeles Food Policy Council, told ABC News that farmers face two hurdles, namely economic and air quality challenges. Velasquez stated that approximately 24 farms are currently affected by the Eaton Fire, with numbers increasing daily due to air quality issues, flames, and economic impacts.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Strong Santa Ana winds caused damage to avocado groves and vineyards, with one farm reporting a 50% loss of its avocado crop just before harvest. These winds exacerbate wildfires and further threaten crops and air quality across Southern California, highlighting the agricultural community’s vulnerability to natural disasters.

Peter Ansel from the California Farmers Bureau noted that smoke poses distinct threats to people (especially farm workers working in the produce fields), animals, and crops. Meanwhile, other farmers struggle to sell their goods since many farmers markets in Los Angeles County are shut down or have reduced visitors.

Market watch

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

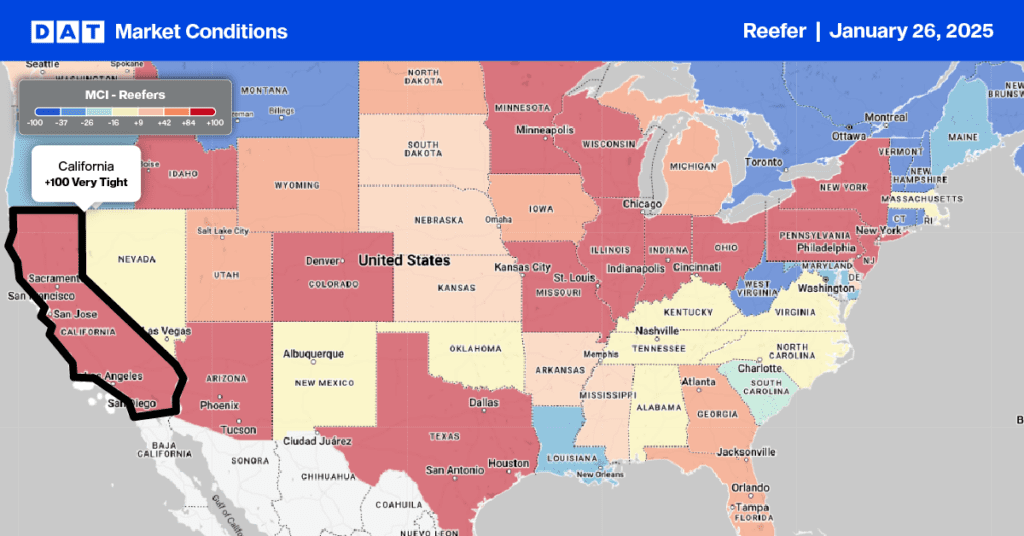

This week, we focus on the California freight market where wild fires continue to rage. Early last week, multiple wildfires broke out in San Diego County, prompting evacuation orders, school closures and power shutoffs, while further north in Los Angeles, strong winds and dry conditions kept everyone on high alert. Produce growers are concerned about the post-fire damage caused by “smoke taint” on grape crops, imparting undesirable flavors and rendering them unmarketable.

According to the USDA, outbound California produce volumes were slightly lower than last year, noting this is typically the low point in the shipping season before ramping up in March. California only accounts for around 10% of national truckload produce volume in January, but grows to as much as 40% by the time the season peaks on July 4. Whilst the impact of fires isn’t immediately evident in truckload volumes, it’s expected that the longer-term effects are expected to reduce volumes during peak season. According to IMPLAN, vegetable, melon, fruit and tree nut production are expected to be impacted the most. DATs Market Condition Index (MCI) expects outbound reefer capacity to remain tight into next week.

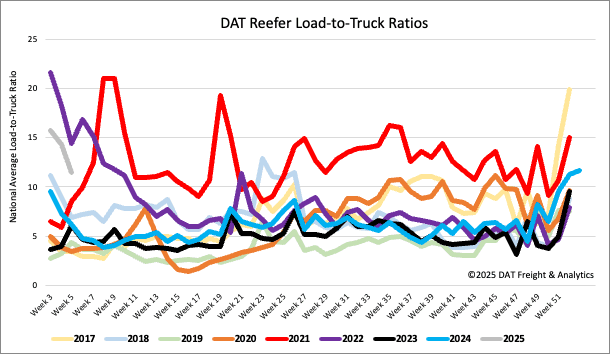

Load-to-Truck Ratio

Reefer capacity loosened last week as a result of fewer load and equipment posts. Last week’s reefer load-to-truck ratio (LTR) ended at 10.69.

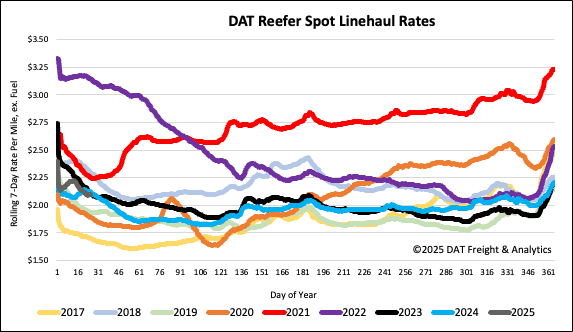

Spot rates

Reefer spot rates continue to cool, following another $0.05/mile decrease last week, which has led to a national average linehaul rate of $2.11/mile. Reefer linehaul rates are $0.02/mile lower than last year. Looking back to 2016 and excluding the pandemic-influenced freight markets, last week’s 7-day rolling average reefer rate was $0.12/mile higher than the long-term Week 4 average of $2.01/mile.