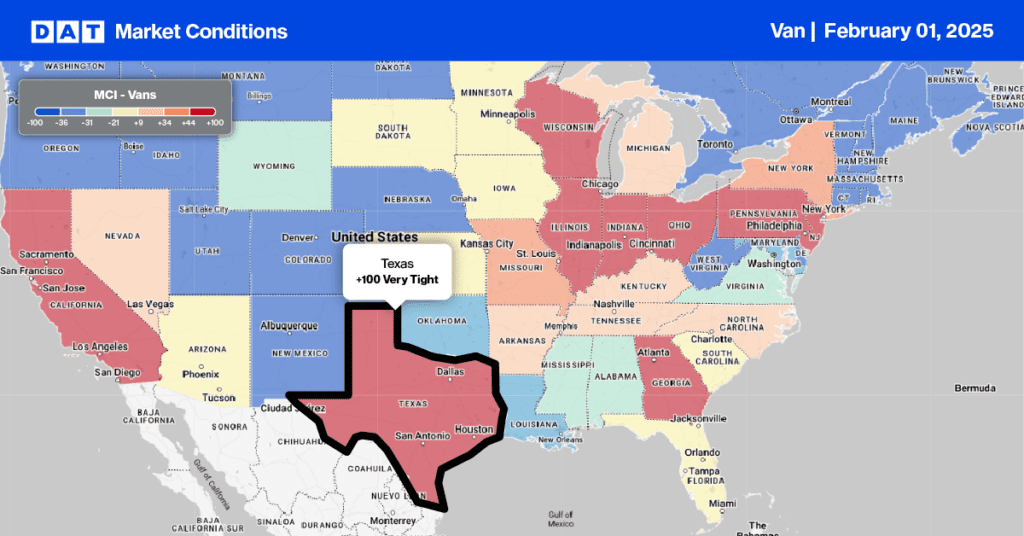

This week, we focus on Ciudad Juárez, located in the northern Mexican state of Chihuahua, where outbound capacity is expected to remain very tight this week. Juarez is a prominent manufacturing hub mainly known for its export-oriented manufacturing facilities, often operated by foreign companies, that assemble goods for export, primarily to the United States. Key Industries include automotive (wiring harnesses, electronics, and metal parts), electronics (consumer electronics, medical devices, and industrial electronics components, aerospace, medical devices (surgical instruments and diagnostic equipment), and textiles and apparel.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Juárez’s location, directly across the border from El Paso, Texas, provides logistical advantages for exporting goods. Strategically and centrally located, Ciudad Juárez has three commercial ports of entry (two in El Paso and one in New Mexico) featuring the dedicated truck lane, FAST (Free and Secure Trade) Lane. Compared to last year, outbound dry van rates in El Paso were up $0.16/mile but increased slightly last week after falling for the previous three. Carriers were paid an average of $1.58/mile last week on a 15% higher volume.

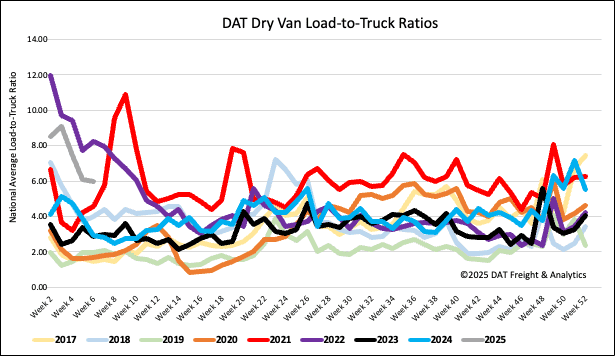

Load-to-Truck Ratio

Month-end typically sees a surge in freight volume and tightening in available capacity as shippers clear their docks. Last week, load post volumes were up 5% w/w, but due to the ongoing oversupplied market, rates fell as more carriers posted their equipment in search of loads. Last week’s dry van load-to-truck ratio (LTR) ended the week mostly unchanged at 5.99.

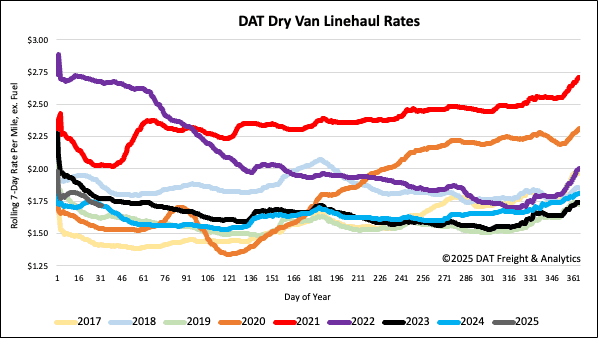

Linehaul spot rates

Available capacity eased at month-end; spot rates dropped $0.04/mile to $1.72/mile on a 12% higher volume of loads moved, highlighting the ongoing oversupplied freight market. On DAT’s Top 50 lanes, ranked by the volume of loads moved, carriers received an average of $2.03/mile. This is another decrease of $0.05/mile week-over-week. However, this average remains $0.31/mile higher than the national 7-day rolling average spot rate.