In addition to being the fifth largest port for containerized import volume on the East Coast, Port of Miami is also known as PortMiami and the Cruise Capital of the World, welcoming more cruise passengers to its terminals than any other port in the world. Last year the port handled over 8.2 million passengers.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Fruit, vegetables, seafood, groceries, and beverages rank highly in the Top 10 imported menu items in PortMiami, with 48% of containerized trade volume arriving from Latin America and The Caribbean. The cruise business is a major reason for the amount of food and beverages imported into the area.

Miami is a gateway to some of the most popular cruise destinations, including the Bahamas, Mexico, and the broader Caribbean attracting travelers from the United States, Latin America, and beyond. Located at the crossroads of north-south and east-west trade lanes, PortMiami can accommodate some of the world’s largest cruise ships including major cruise lines like Carnival, Royal Caribbean, Norwegian, and MSC, who operate out of PortMiami.

Turnaround day logistics

A turnaround day at Port Miami, refers to the day when a cruise ship arrives to disembark passengers and crew, restocks supplies, and embarks new passengers before setting sail again, typically every seven days. This process is tightly choreographed and typically takes 8-12 hours to complete, starting in the morning (around 7–8 AM) and lasts 3–5 hours. Most ships aim to leave PortMiami by late afternoon or early evening, often around 4–6 PM.

In the interim, though, thousands of passengers leave the ship, with customs and immigration processing taking place, new passengers begin boarding in the early afternoon, and restocking food, beverages, fuel, and other supplies (often referred to as provisioning) gets underway.

Dockside, there’s a flurry of activity as 70-80 tractor-trailers unload their cargo alongside any one of 8-10 cruise ships lining the docks. All cargo is security-screened and checked for quality before loading.

Cruise ships consume an immense amount of food each week to cater to thousands of passengers and crew members. The exact quantities depend on the ship’s size and passenger capacity, but for a large cruise ship carrying around 5,000 passengers and crew, here are some approximate weekly numbers:

- Beef: Around 25,000 lbs

- Chicken: 15,000 lbs

- Seafood: 10,000 lbs

- Fruits and Vegetables: 100,000 lbs

- Eggs: 50,000 eggs (6,250lb)

- Dairy: 8,000 gallons of milk (70,000 lbs)

- Cheese and Butter: 3,000 lbs

- Bread and Pastries: 20,000 to 30,000 pieces (20,000lb)

- Coffee: 1,500 gallons (12,500 lbs)

- Alcohol: Over 20,000 bottles of beer (23,000lb)

- Wine: 5,000 bottles of wine (13,250lb)

- Estimated total – 297,000 lbs per cruise ship.

In truckload equivalent terms, that’s roughly 7-8 trucks per cruise ship assuming each are full. In reality, though, most trailers are not loaded fully and doing multiple stops per load, resulting in 10-12 trucks dockside being unloaded. Along the docks of PortMiami, it’s not unusual to see approximately 100 tractor-trailers delivering supplies to cruise ships on a Saturday morning in Miami.

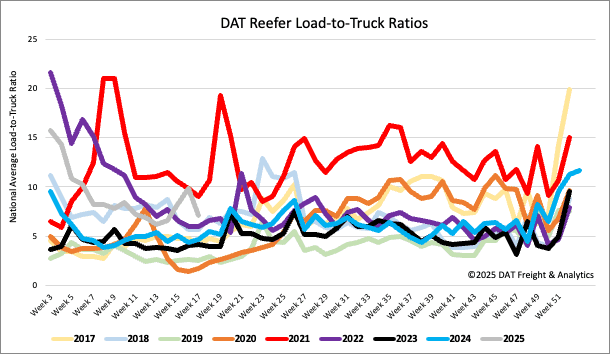

Load-to-Truck Ratio

After surging by 22% the week prior, reefer load post volumes cooled last week, dropping by 27% on the back of a 16% drop in North American produce volumes last week. Following the surge in Mexican produce imports last month, produce volumes on the southern border dropped by 32% last week. As a result, the national reefer load-to-truck ratio (LTR) was down 27% last week to 7.11.

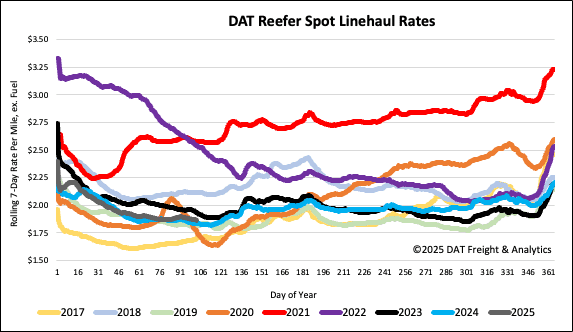

Spot rates

Available reefer capacity loosened slightly last week, pushing down linehaul rates by just over a penny-per-mile to $1.88/mile on an 11% higher volume of loads moved. Reefer spot rates are $0.03/mile higher than last year and $0.04/mile higher than 2019.