The title of this entry is a common road trip question and one of the most frequent at DAT Freight & Analytics. Of course, the question concerns the bottom of the freight market. Low freight rates are dragging on for far too long, according to brokers and carriers. On the other hand, shippers have enjoyed pricing power for over 18 months and are still benefiting from lower contract rates based on recent RFPs (requests for proposals).

DAT held its DATCON23 user conference last week. At the Shipper Summit portion of the conference, DAT’s Chief Scientist, Prof. Chris Caplice, said, “Shippers are acutely aware of the storm on the horizon and are repairing their collective roofs now.” The “storm” in reference is the shortage of trucks that seems inevitable when the market turns sometime in 2024.

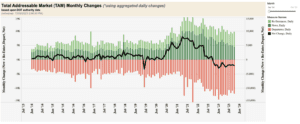

As we reach the end of October, interstate carriers are still exiting the industry, burdened by 2019-level spot rates (2019 was a lousy year for carriers), a soft freight market, already high fuel prices, and the fear the Middle East crisis could expand regionally – driving crude oil and diesel prices even higher. The long-haul sector has been losing around 10,000 carriers monthly since July (see Figure 1), and is on track to lose the most number of carriers monthly since May. Based on DAT data, most of these carriers start out in the spot market, with 83% of new entrants in the last year being DAT spot market customers.

At some point, spot market supply and demand reach an equilibrium, and while spot rates are showing signs of having bottomed out – and slowly beginning to rise – the rebalancing of long-haul carrier supply could accelerate, judging by the rise in Class 8 trucks sold at auction. According to Chris Visser at J.D. Power in the Commercial Vehicle Market Update, the volume of the three most common sleeper tractors (3 to 7 years old) sold through the two largest nationwide non-reserve auctions almost doubled in September from the month before.

Looking back even further, spot rates decreased, and diesel prices surged following the Russian invasion of Ukraine in early 2022. Since then, the volume of trucks sold monthly at auction has almost quadrupled. For context, September’s auction data is around 12% higher than the worst month in 2019, a year that saw a record number of motor carrier bankruptcies amidst an over-supplied and soft freight market.

We are at the bottom of a very soft freight market.

Spot market capacity is rapidly decreasing, and rising spot rates typically signal the market has turned. That may be short-lived, though. The market will undoubtedly see a boost in demand heading into Thanksgiving and the Christmas shopping season. However, what follows in the “quiet season” during the first quarter of next year is of the most concern, particularly if it lasts longer – past the second quarter and even into the third.

Jason Miller, supply chain professor at Michigan State University, summed up the truckload outlook best when he said, “I continue to believe that we will exit the current freight recession in a much slower, more progressive manner than the past two cycles, (which saw the balance of supply and demand turn in just a few months). Assuming the Federal Reserve’s Open Market Committee keeps interest rates elevated longer, we may look at a soft demand environment for at least nine more months.”

We can only hope that Miller’s analysis is wrong, or the bad news will continue.

Figure 1: The change in interstate carrier authorizations from the FMCSA.