Avocado import volumes from Mexico have more than quadrupled since the U.S. market was fully opened to Mexican imports in 2007.

According to the USDA, 2.6 million pounds (or 88%) of all avocados consumed in the U.S. in the last 12 months have been imported from Mexico, Peru, Chile and the Dominican Republic. Mexico alone supplied 2.4 million pounds (81%).

Mexican avocado production is concentrated in the state of Michoacán where rich volcanic soils and natural irrigation allow for year-round harvesting of avocados. From the time avocados are harvested, packed and shipped, they are on consumer tables within a week.

Find loads and trucks on the largest load board network in North America.

Note: All rates exclude fuel unless otherwise noted.

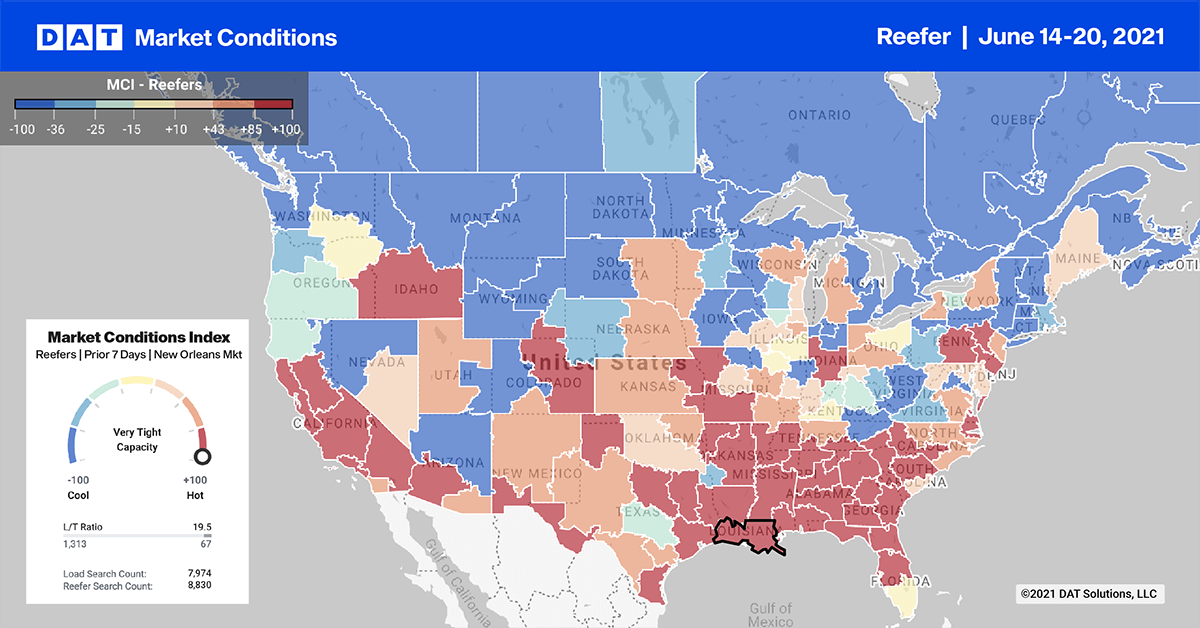

More than 54% of avocados arrive from Mexico to Pharr, TX, DAT’s McAllen freight market. Another 44% arrive further north in Laredo, TX. Between the two ports, just under 3,500 truckloads of avocados will enter the U.S. this month.

Capacity has been tightening for the last 12-months and on the 1,500-mile run to Chicago, reefer spot rates are up $0.75/mile since last year to $2.51/mile this week. Loads to Brooklyn, NY from Pharr are also up and have increased by $0.77/mile over the last year to reach $3.04/mile this week. On the number one spot market volume lane out of the McAllen market, loads to Dallas, TX have been steadily climbing since last November and have increased by $0.56/mile to $3.06/mile since then.

Top 10 outbound load posts in the reefer sector increased by 4% last week. And unlike the dry van sector where rates plateaued, spot rates increased by an average of $0.02/mile to $3.16/mile.

Loads on the 664-mile run from Atlanta, GA to Miami, FL were also up last week, reaching $3.32/mile after averaging around $3.30/mile since last September. Loads jumped close to $0.30/mile since last month to compensate for the end of produce season and lower volumes in southern Florida.

Just up the road in Lakeland, FL, spot volumes dropped 9% last week and capacity loosened quickly, dropping rates by $0.13/mile to $2.01/mile.

Reefer capacity was tight again last week in California on lower reefer volumes. In Ontario, CA, volumes were down 9% while spot rates headed in the other direction and increased by $0.02/mile to $3.69/mile. Next door in Fresno, CA spot rates remained unchanged at $3.36/mile on 6% lower volumes.

Spot rates

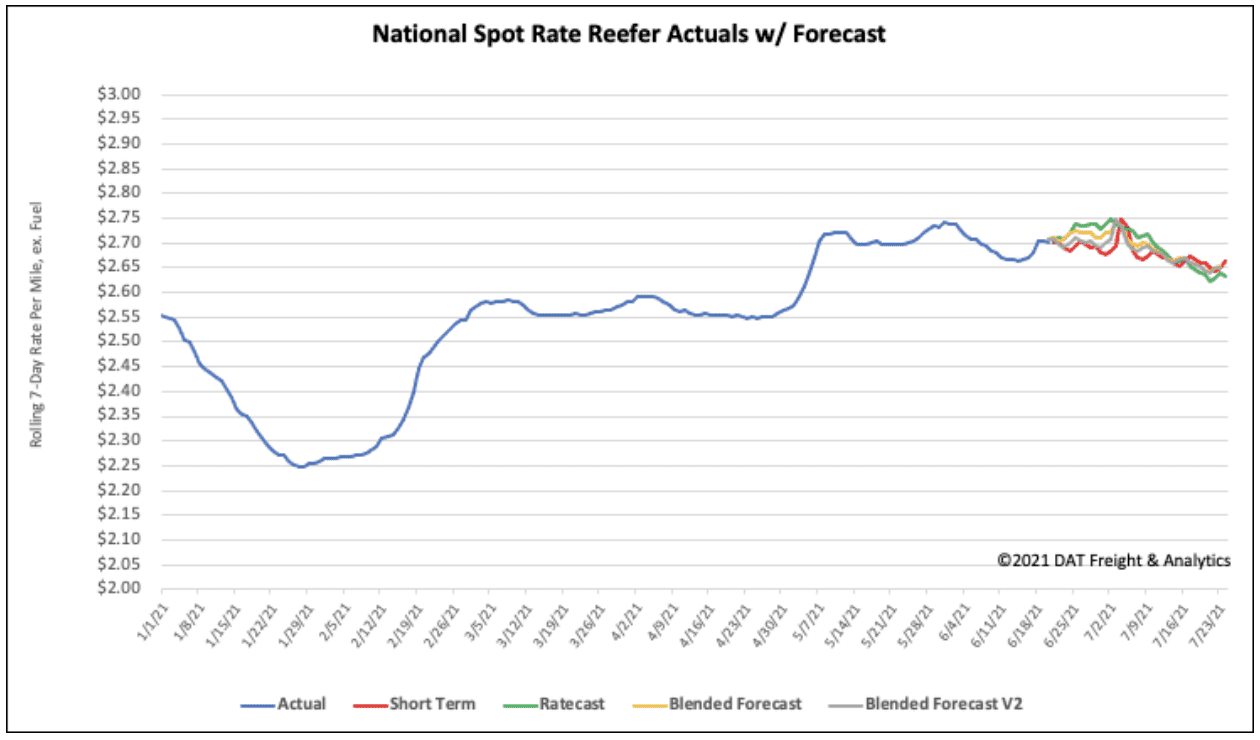

Reefer spot rates also stayed at the same level last week despite higher spot market volumes. Rates ended the week at $2.70/mile and are still at all-time record-high levels heading into the July 4th seasonal peak. Reefer rates are now $0.79/mile higher this time last year and $0.36/mile higher than this time in 2018.

How to interpret the rate forecast:

- Ratecast: DAT’s core forecasting model

- Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset

- Blended Scenario: More heavily weighted towards the longer-term models

- Blended Scenario v2: More heavily weighted towards the shorter-term models

> Learn more about rate forecasts from DAT iQ