Mexico is the largest avocado producer in the world, accounting for 30% of global production. But due to a greater need for trees to recover following last year’s record productivity and production, avocado production for the 2021/22 season is forecasted to be 8% lower this year.

Find loads and trucks on the largest load board network in North America.

Note: All rates exclude fuel unless otherwise noted.

Total avocado production for 2021/22 is 2.33 million metric tons (equivalent to 115,000 truckloads). Reduced tree productivity and yield forecasts were due to insufficient rainfall along with high temperatures, which are contributing to reduced production and yield forecasts.

Michoacán is the top producing state in Mexico, with 75% of national production and is the only state with certification to export avocados to the U.S. Mexico accounts for 81% of avocados imported into the U.S. with 98% crossing in Texas alone.

According to 2021 USDA data, the following saw the most avocado import volume:

- Pharr, TX at 54%

- Laredo, TX at 43%

- Progresso, TX at 1%

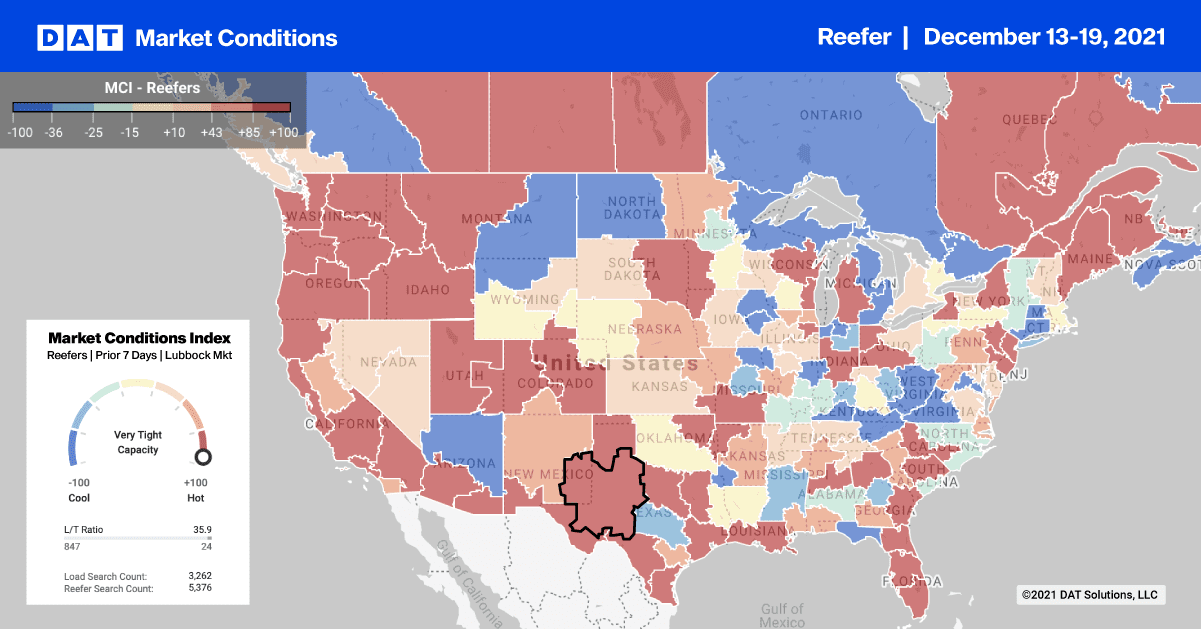

Although peak import volume isn’t until next month, December truckload volumes are typically the fourth highest on the shipping calendar. Last December just over 4,500 truckloads of avocados crossed into the U.S. in Texas with that number growing to almost 6,000 by the end of January.

Reefer spot rates for loads from Laredo to Dallas are already $0.75/mile higher than this time last year at $3.25/mile this week. Contract rates on the same lane are even higher at $4.55/mile, which is just $2.00/mile higher than this time last year. This makes this coming avocado season something to celebrate if you’re a carrier, but the opposite if you’re a shipper trying to get goods to market in time.

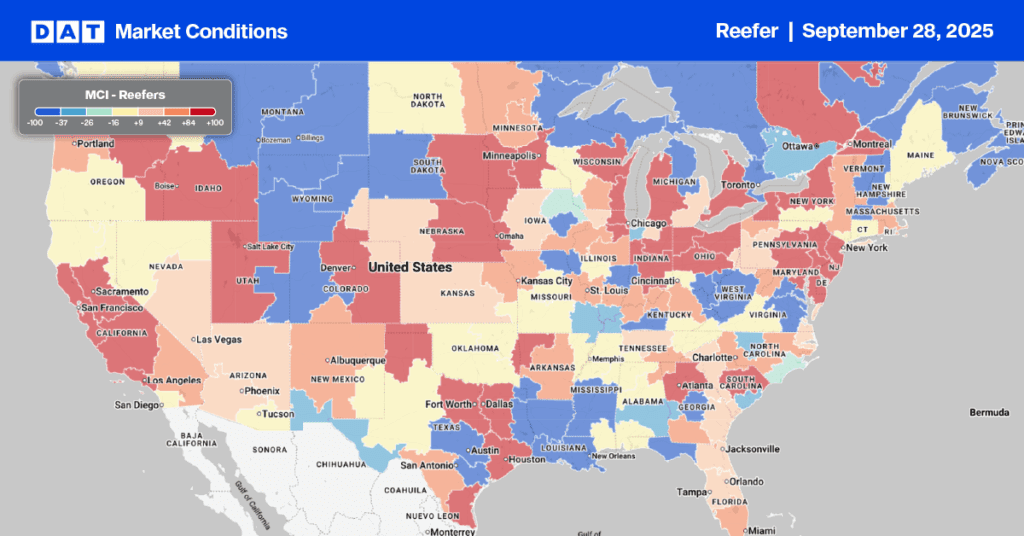

Reefer spot rates in Pharr, TX in the McAllen freight market increased by $0.09/mile to an average outbound rate of $2.67/mile. Further north in Laredo, spot rates jumped by $0.21/mile to $2.73/mile last week. Load post volumes in both markets combined increased by 7% following last week’s 10% increase in imported produce from Mexico.

Further east in Florida, reefer capacity continues to tighten as winter produce volumes begin to climb. Spot rates in Miami and Lakeland increased by $0.11/mile last week to an outbound average of $1.62/mile.

In the Upper Midwest markets of Green Bay, Madison and Milwaukee, reefer spot rates increased by $0.14/mile to an average of $3.83/mile with a similar effect on outbound rates across Lake Michigan. In the Grand Rapids and Detroit freight markets, reefer spot rates were up $0.09/mile last week to an average of $3.77/mile, the fourth week in a row capacity has been tightening.

Spot rates

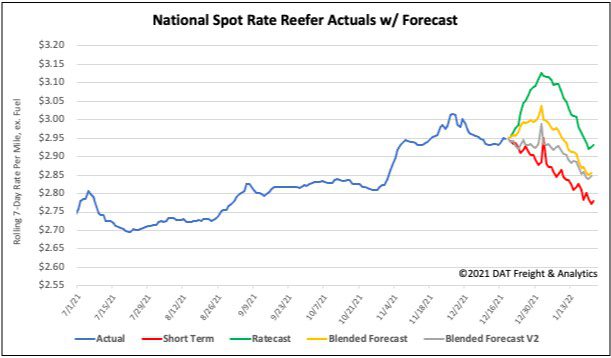

Despite higher volumes of freight in the temperature-controlled sector last week, reefer capacity is showing signs of loosening as the national average reefer spot rates remained unchanged at $2.95/mile. Compared to the same week last year, spot rates are still 21% or $0.61/mile higher and $0.87/mile higher than the same period in 2018.

How to interpret the rate forecast:

- Ratecast: DAT’s core forecasting model

- Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset

- Blended Scenario: More heavily weighted towards the longer-term models

- Blended Scenario v2: More heavily weighted towards the shorter-term models