Notebooks, paper, pencils and crayons have been featured in retail displays since July, but back-to-school merchandise also includes food, clothing and household items. The National Federation of Retailers predicted a 14% increase in back-to-school purchases. Up to an average of $688 per family with school-age children. However, the association cautions against interpreting this seemingly positive growth as a sign of consumer confidence. They caution that families who have scrimped for the past several years must replace more items this year because they just can’t be re-used any more.

Retailers replenished school-related inventories throughout the late summer, and now they are turning their attention to Halloween — which, in the retail world, is now second only to Christmas.

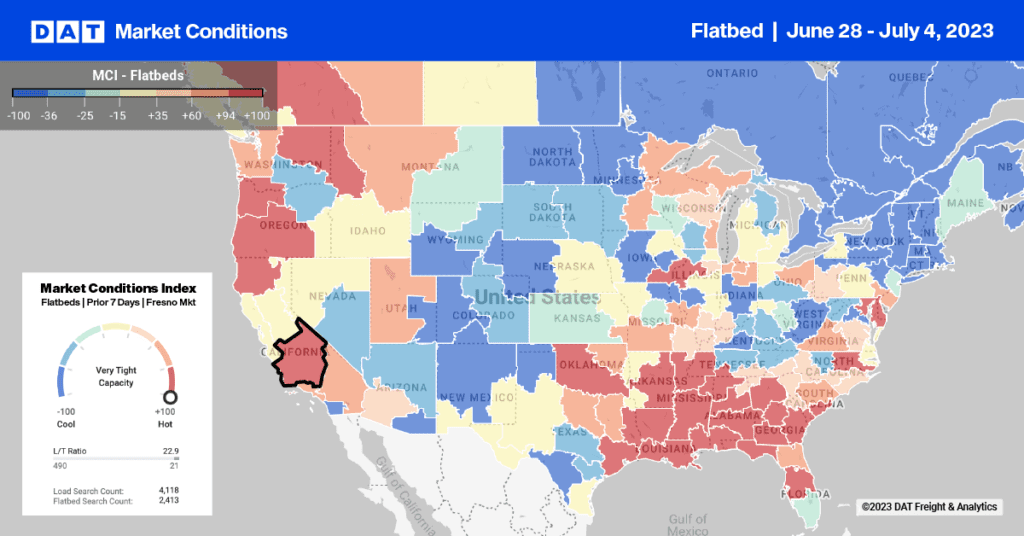

All that school stuff contributed to an increase in freight volume for the month of August, but truckload rates in most major lanes continued their seasonal decline from a June peak. Fuel prices rose throughout the month, however, and the rising fuel surcharges offset some of the decline in the line haul portion. So the decline is there, but it’s not as steep as you might expect for the season. Carriers’ costs rose with the fuel prices, though — as I discussed in last week’s blog post. In most cases, the end result could be a higher price for the shipper, a lower profit for the carrier and a mixed bag for the broker. Not exactly a win-win.

For details on the week’s rates, look at the Rate Trend of the Week web page. For more information on DAT Truckload Rate Index, go to the product information page or call 800-551-8847.