Rates stayed low for truckload freight in Q1, and seasonal cargo is not giving rates much of a lift. That’s because capacity is still readily available, especially for dry and refrigerated van segments. Flatbed is rebounding, which is a positive signal, but the overwhelming majority of trucks are pulling box-type trailers, and those trucks are getting paid less than they have in at least three years.

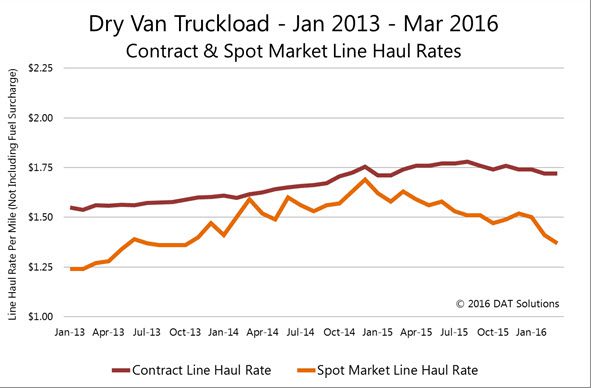

Everyone blames the fuel surcharge, which admittedly is very low, at 15¢ per mile for vans. But even van line haul rates, excluding fuel, illustrate that broker-to-carrier spot market rates continue to trend down. At the same time, contract rates — paid directly by the shipper to the carrier — have been relatively stable since early 2015.

Everyone blames the fuel surcharge, which admittedly is very low, at 15¢ per mile for vans. But even van line haul rates, excluding fuel, illustrate that broker-to-carrier spot market rates continue to trend down. At the same time, contract rates — paid directly by the shipper to the carrier — have been relatively stable since early 2015.

Mind the Gap

As they say in the London Tube stations: “Mind the Gap.” The gap between contract and spot rates is widening. On the line haul rate, it’s 35¢ per mile, or 26%. If you include the fuel surcharge, the gap is still 23%. That gap represents opportunity for freight brokers and 3PLs, who can procure capacity on the spot market and price it competitively.

Photo by Ell Brown

Shippers typically consider spot market capacity to be expensive. But in this environment, even the most price-sensitive shippers might prefer a freight broker or 3PL over a core carrier in some cases. In fact, you might secure a coveted spot on the shipper’s routing guide.

Contract rates don’t decline very often, but this year could prove to be an exception. Keep an eye on rate trends in DAT RateView, so you know where and when to press your advantage.

When fuel surcharges are included, the picture is a bit different. There is still a significant gap between contract and spot market rates, when you include fuel. In the end, however, the carrier is making less money now than in previous years, whether there is broker involvement or a direct relationship between the shipper and the carrier.

With lower revenue per mile, carriers are looking to increase their loaded miles. Shippers are gaining an upper hand in these negotiations, and most will ask the carrier for additional price concessions.

Plus, freight growth has been disappointing. Inventories are still high, and consumers are not consuming. Economists had hoped that the savings on gas would prompt consumers to increase spending on goods and services that generate freight. It’s just not happening. GDP growth is tepid, at best. New car sales are up, but many other economic sectors are nearly stagnant.

Plus, freight growth has been disappointing. Inventories are still high, and consumers are not consuming. Economists had hoped that the savings on gas would prompt consumers to increase spending on goods and services that generate freight. It’s just not happening. GDP growth is tepid, at best. New car sales are up, but many other economic sectors are nearly stagnant.

Good News for Brokers

It’s not all gloom and doom. If you’re a freight broker or 3PL, you have an opportunity to compete with contract carriers, and get a bigger share of the shipper’s business. In many cases, you may be able to preserve your gross margin and still remain price-competitive. This is an unusual pricing environment, so take advantage of it while it lasts.

Rates are derived from DAT RateView, a database of actual rate agreements between freight brokers and carriers, as well as shipper-to-carrier contract rates based on actual freight bills.