By Christina Ellington

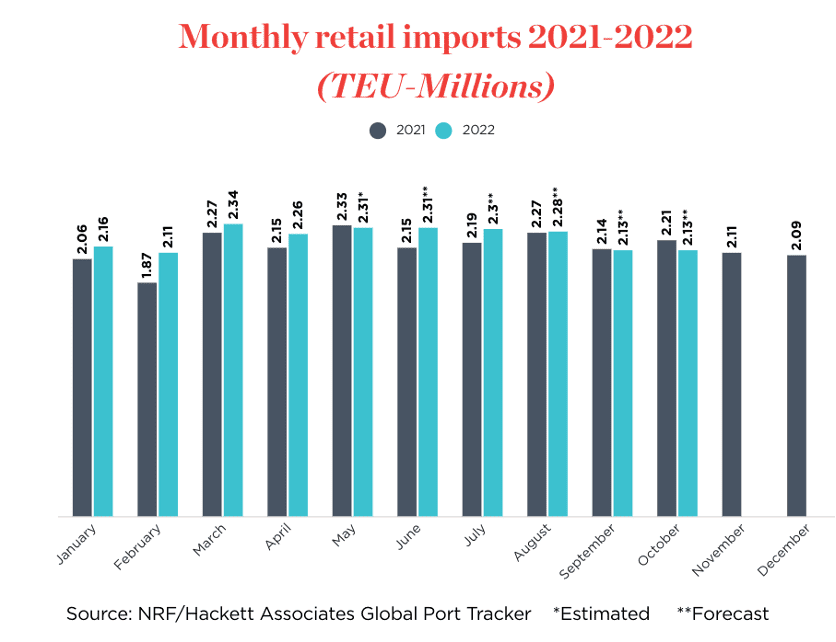

Summer holidays are about to start and retailers are already talking about the back-to-school season. Why so early? According to Jonathan Gold, National Retail Federation (NRF) Vice President for Supply Chain and Customs Policy, “We’re in for a busy summer at the ports. Back-to-school supplies are already arriving, and holiday merchandise will be right behind them. And the big wild card is what will happen with West Coast labor negotiations with the current contract set to expire on July 1. We continue to encourage the parties to remain at the table until a deal is done, but some of the surges we’ve seen may be a safeguard against any problems that might arise.”

The NRF expects imports at the nation’s major retail container ports should see near-record volume again this month based on the latest data. Retailers are working to meet still-strong consumer demand and protect themselves against potential disruptions at West Coast ports, according to the monthly Global Port Tracker report released today by the National Retail Federation and Hackett Associates. Hackett Associates Founder Ben Hackett said, “…the anticipation is that the Chinese manufacturing and transportation sectors will quickly get back to normal. China’s recovery will need the government’s support in order to get the supply chain functioning normally again to provide the input required by the manufacturing sector.”

Market Watch

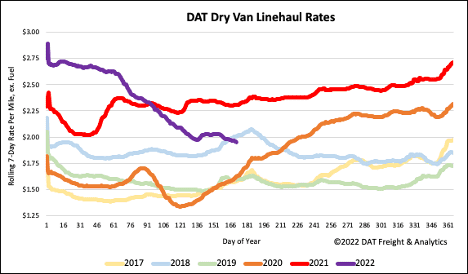

All rates cited below exclude fuel surcharges unless otherwise noted.

The volume of loads moving between Los Angeles and Chicago is up 13% m/m and 16% y/y and may soon start to see a surge in volumes based on JOCs Intermodal Savings Index. This index, which compares truckload and intermodal rates on 115 US lanes, indicates the average shipper saved 10% nationally in May shipping via rail, down from 30% in January. When domestic intermodal savings for shippers are 10% or less, trucking becomes more attractive because the premium over rail is only a couple of hundred dollars, and trucks provide a faster and more reliable service than trains. Spot rates on the Los Angeles to Chicago lane are trending up, averaging $1.80/mile this week, and while that’s $0.16/mile higher than the May average, it’s still $0.94/mile lower y/y.

According to Jon Krystek, chief operating officer with Knichel Logistics, an Intermodal Marketing Company (IMC), truckload rates are cheaper from Bethlehem, PA, to Dallas and less than $100 more into Salt Lake City. In DAT’s Rateview, loads on this lane are averaging $1.08/mile this week or $0.60/mile lower than the previous year. On another high-volume intermodal lane between Los Angeles and Dallas, loads moved are up 23% m/m, with most of those gains occurring in the last few weeks. Spot rates are averaging $1.82/mile this week, which is $1.27/mile lower y/y. From Chicago to New Orleans, linehaul rates have dropped by $0.66/mile in the last year to an average of $1.97/mile this week.

Load-to-Truck Ratio (LTR)

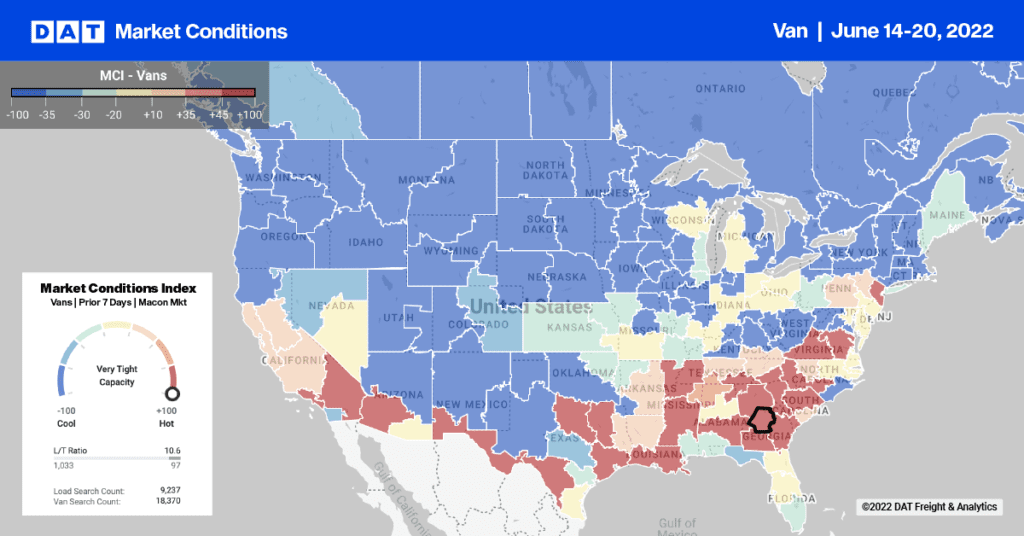

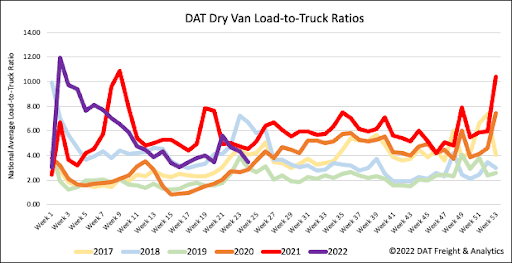

Both load and equipment post volumes in the DAT freight network were relatively flat last week, leaving the load-to-truck ratio (LTR) almost identical to this time in 2020, right after demand had crashed at the start of the pandemic. Looking at the LTR components, loads posted are now 12% lower than 2018 levels but equipment post volumes are the highest they’ve been in six years for the third week of June. As a result, last week’s dry van LTR increased slightly to 3.53.

Load-to-Truck Ratio (LTR)

Both load and equipment post volumes in the DAT freight network were relatively flat last week, leaving the load-to-truck ratio (LTR) almost identical to this time in 2020, right after demand had crashed at the start of the pandemic. Looking at the LTR components, loads posted are now 12% lower than 2018 levels but equipment post volumes are the highest they’ve been in six years for the third week of June. As a result, last week’s dry van LTR increased slightly to 3.53.