September sales of tractors and combines continue their growth above an already-hot pace set in 2020. Sales of U.S. total farm tractor sales are up 2.5% compared to last September, although the 4WD category recorded a 1.3% decrease.

Find loads and trucks on the largest load board network in North America.

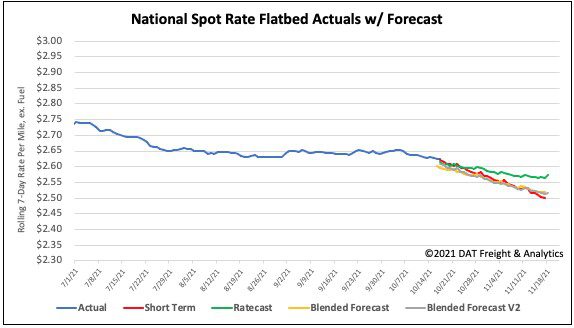

Note: All rates exclude fuel unless otherwise noted.

The self-propelled combine harvester category remains hot following three months of successive gains. It’s now up 34.6% year-over-year and 17.3% year-to-date. Sales in the 100+ horsepower category continue to dominate growth rates after recording a 23% Y/Y and 26.2% YTD increase.

On the imported RoRo (roll-on/roll-off) front, construction and building equipment accounted for 83% of tonnage imported in September followed by 16% for the tractor category according to PIERS. Both categories reported sequential monthly declines (down 14% and 25% respectively) but remained up 29% and 43% y/y respectively.

Savannah, GA was the number one port for construction equipment (21%) followed by Baltimore at 14%. The situation was reversed for tractors, where Baltimore was the top port for imported units at 23% followed by Savannah at 21%. Houston came in number three for tractors imported in September at 11%.

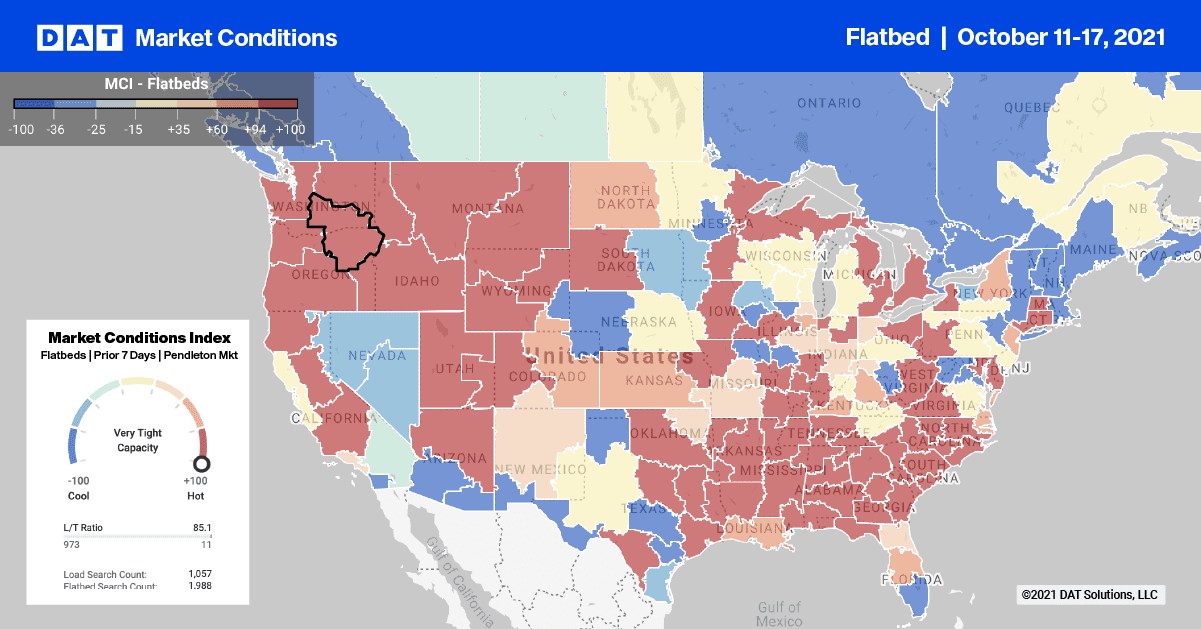

Flatbed trucks were in scarce supply deep in Florida last week as spot rates jumped $0.58/mile to an outbound average of $2.92/mile. Inbound load volumes were down 3% last week. This contributed to fewer trucks being available, especially for loads north to Jacksonville where spot rates were averaging $1.95/mile. That’s a new 12-month high and almost $0.50/mile higher than this time last year.

Capacity was also tight in the Pacific Northwest markets of Portland and Medford where spot rates increased by 13% to an outbound average of $3.10/mile (up $0.25/mile) last week. On the 629-mile haul from Portland to Stockton CA, spot rates were up $0.52/mile last week to an average of $2.80/mile. This partly offset declining rates in the opposite direction, which were down $0.04/mile last week.

Spot rates

Flatbed capacity continues to ease as flatbed spot rates drift slowly downward. Last week’s decrease of $0.02/mile brings the national average flatbed spot rate to $2.63/mile. However, it’s still 15% or $0.39/mile higher than the same week last year. Compared to the same time in 2018, flatbed spot rates are $0.49/mile higher and $0.16/mile higher than the peak in June that year.

How to interpret the rate forecast:

- Ratecast: DAT’s core forecasting model

- Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset

- Blended Scenario: More heavily weighted towards the longer-term models

- Blended Scenario v2: More heavily weighted towards the shorter-term models