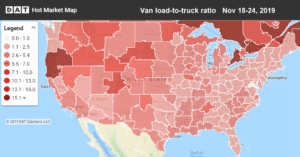

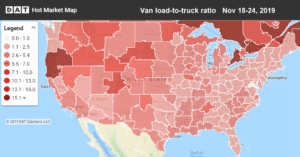

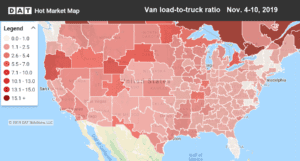

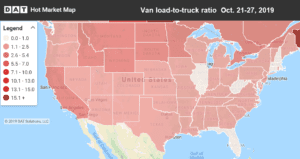

Pre-holiday rush pushes van rates higher

Holiday freight continues to move, and van rates have risen in three of the past four weeks. In the top 100

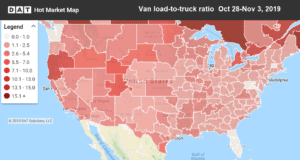

Holiday freight continues to move, and van rates have risen in three of the past four weeks. In the top 100

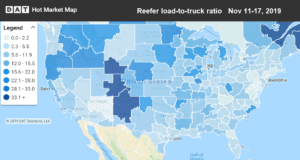

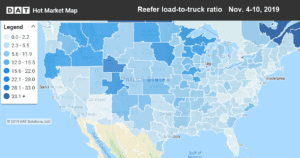

Thanksgiving is less than two weeks away, and there’s an urgency to get fresh and frozen goods to supermarkets before

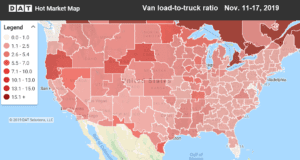

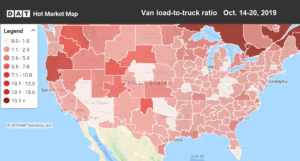

Freight volumes have been building for weeks, but sufficient capacity has kept rates in check so far this fall. The

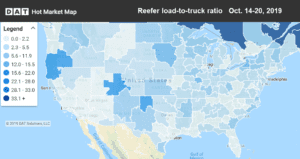

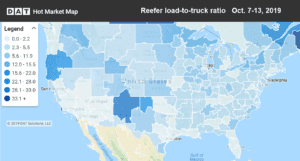

We’re currently in that transitional season between the end of fall harvests and the beginning of the holiday rush. For

Load volumes have been rising since mid-October, but rates have not responded until now. For November so far, both van

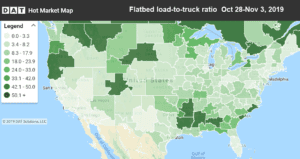

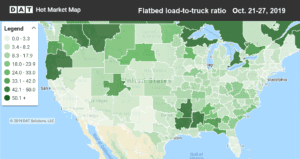

Flatbed rates and load-to-truck ratios trended down last month. The average flatbed rate for October was $2.12 per mile, 3¢ lower

Over the past few weeks, freight volumes have been building, but there was enough capacity to keep rates from rising.

September finished strong for flatbed freight, but load counts have drifted down during the month of October. Flatbed rates have also

Truckload van shipments on the top 100 van lanes nearly hit a record high last week. In past years, a

Domestic goods, combined with produce moving into the U.S. from Mexico and South America, provided a big boost to the reefer

Van volumes got a bit of a boost late last week. Three of the most important van markets — Chicago, Dallas, and

After a brief surge in reefer rates at the end of September, rates have moved lower in October. Last week