Flatbed Report: Home Purchasing Consumer Confidence at All-Time Lows

The Fannie Mae Home Purchase Sentiment Index (HPSI) increased 3.3 points in March to 61.3, it remains only slightly above

The Fannie Mae Home Purchase Sentiment Index (HPSI) increased 3.3 points in March to 61.3, it remains only slightly above

According to the nation’s supply chain executives in the latest Institute for Supply Management (ISM) Manufacturing Purchasing Managers Index (PMI),

It’s not peak season for tractor sales until April, coinciding with planting season, and although volumes typically decrease in February,

The Port of Baltimore’s six public marine terminals handles autos, roll-on/roll-off (RoRo), containers, forest products, and project cargo. The port

For the week ending on March 11, 2023, domestic steel mills made 1,677,000 net tons representing a decrease of 2%

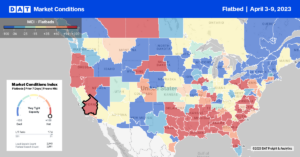

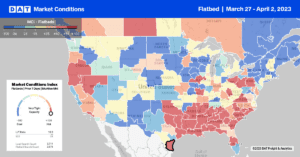

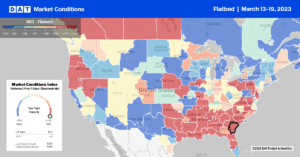

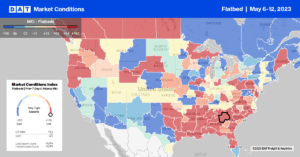

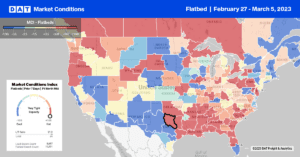

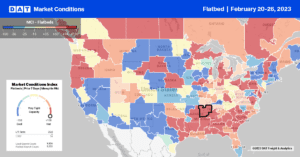

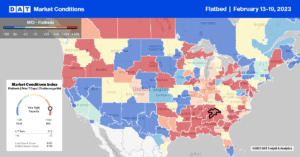

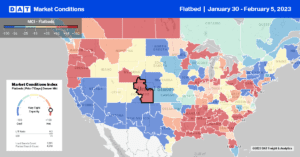

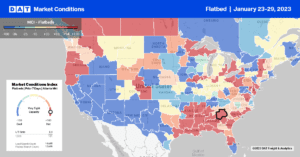

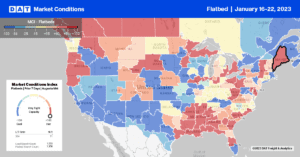

The flatbed sector is off to a bustling start in 2023, boosted by significant projects resulting from the Infrastructure Bill

According to the Association of Equipment Manufacturers (AEM), U.S. agriculture tractor sales finished January 2023 in the negative, while in

Home builders feel more confident as the year progresses based on The National Association of Home Builders/Wells Fargo Housing Market

Fastmarkets report a record-setting surge in Southern Pine exports to Mexico propelled total U.S. softwood lumber shipments to a 30-year

Last week’s release of the U.S. Bank National Shipments Index reported contracted a 4.6% decline during the final quarter of

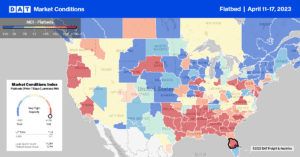

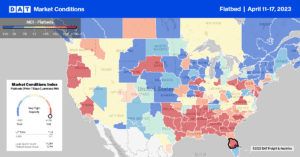

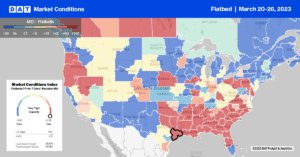

Texas flatbed carriers are enjoying some of the best outbound spot rates in the past seven years. At an average

On top of the solid report on mortgage volume earlier today comes another hopeful report from the construction industry. The