Hurricane Matthew Affects Spot Rates and Freight Volumes

Spot market rates were up last week, but volumes fell. Hurricane Matthew likely played a role in both of those

Spot market rates were up last week, but volumes fell. Hurricane Matthew likely played a role in both of those

The bankruptcy of the world’s 7th largest container carrier, Hanjin Shipping, has led to shippers re-adjusting inventories in the past

Spot market activity often ramps up in the West during the fall season, but there’s added pressure this month. Hanjin

Volumes and rates got a boost heading into the Labor Day weekend, and those prices mostly held steady last week.

Good news, everyone! Freight volume AND RATES got a healthy boost last week for all equipment types. Vans got the

Van and reefer volume increased last week, although rates were unchanged as a national average. Flatbed volume and rates continued

Every week, we seem to report that trends are mixed, that truckload freight volume and rates are in a transition,

Van and reefer rates were mostly in a holding pattern last week. The national averages for both stayed the same

National average van rates are sliding, but they’re still a few cents above the June average, so the typical mid-July

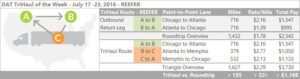

The typical July lull began last week, which is a little later than expected. Load availability and rates dropped from

Rates typically drop after July 4th, but that wasn’t the case last week, when national average rates rose 8¢ per

Rates typically drop after July 4th, but that wasn’t the case last week. Rates climbed higher than the June averages