Dry van report: “Blah” conditions for the immediate future

According to Professor Jason Miller, a supply chain expert at Michigan State University, trucking companies need more good news as

According to Professor Jason Miller, a supply chain expert at Michigan State University, trucking companies need more good news as

The Logistics Manager’s Index (LMI), produced by Zac Rogers at Colorado State University, came in at 58.2 in March 2024,

The same week, U.S. Treasury Secretary Janet Yellen warned China that Washington would not accept new industries being decimated by

Based on the operating status data supplied by the Federal Motor Carrier Safety Administration (FMCSA), the rate of interstate carrier

Baltimore has 110 million people, or ⅓ of the US population, within a 500-mile radius or a day’s drive by

The shipments component of the Cass Freight Index increased by 7.3% m/m in February, impacted by weather impacts on freight

As they typically do each February, U.S. containerized import volumes dropped following the multi-week closure of factories during Chinese New Year celebrations.

The Logistics Manager’s Index (LMI), produced by Zac Rogers at Colorado State University, came in at 56.5 in February 2024,

The contract freight market continues to soften following last month’s 3.5% m/m drop in the American Trucking Associations’ (ATA) advanced

According to Professor Jason Miller, a supply chain expert at Michigan State University, there’s some good and bad news for

According to ISH Markit/PIERS data, January containerized import volumes were 5% higher than in December, growing fastest in seven years.

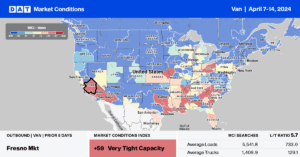

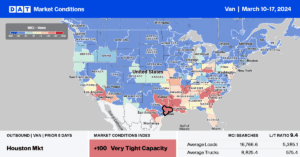

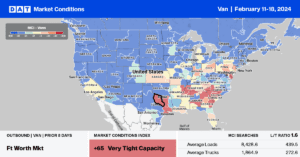

Inbound truckload spot market volumes into Ft. Worth, TX, have increased by 23% since 2019, driven primarily by the surge