Dry Van Report: Truckload Faces Headwinds for Some Time to Come

The March reading of The Cass Freight Index shipments component fell 1.0% m/m in March as freight markets continue to

The March reading of The Cass Freight Index shipments component fell 1.0% m/m in March as freight markets continue to

The February 2023 reading of the for-hire trucking ton-mile seasonally adjusted index produced by Yemisi Bolumole and Jason Miller at

The March Logistics Managers’ Index (LMI) came in at 51.1, down -3.6 from February and the lowest reading for the

The alcohol industry produces an estimated 20,000 truckload equivalents each week, hauled mainly by truckload carriers, but it has yet

For some time now, we’ve been wondering if and when Class 1 railroads will take advantage of the shift in

The February Logistics Managers Index (LMI) came in at 54.7 in February, down (-2.9) from January’s reading of 57.6. While

While overall truckload freight volume is holding steady for now, according to the latest ATA Truckload Tonnage Index, recent less-than-truckload

The American Trucking Association’s advanced, seasonally adjusted (SA) For-Hire Truck Tonnage Index rose 0.7% in January following the 1% m/m

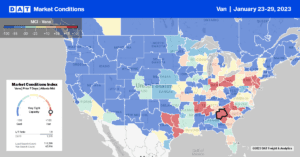

The question most are asking is about the 2023 freight outlook following what can only be described as an unprecedented

“Don’t bet against LA,” was the message from Port of Los Angeles Executive Director Gene Seroka following the steep decline

The latest releases of manufacturing survey data for January are encouraging as we look ahead to what 2023 has in

Intermodal provides a valuable complement to truckload regarding a shipper’s choice of transport mode for long-haul freight. Intermodal is typically