Truckload capacity is already tight, but with such a short 35-day shipping season, peak Christmas tree harvest volumes will strain a freight network already at its limits.

The traditional need for fresh trees to be available immediately after Thanksgiving adds to the time pressure carriers and brokers are currently experiencing, but as with everything in 2020, retailers have smaller table-top Christmas trees on sale two weeks earlier this season.

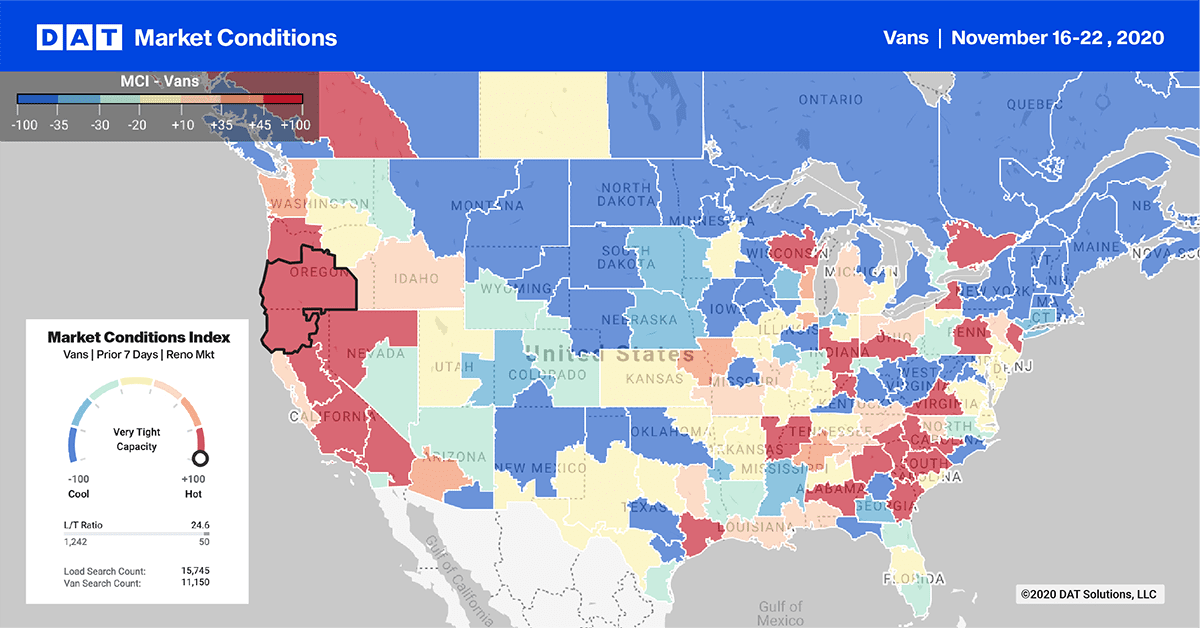

Christmas tree production is heavily concentrated in North Carolina and Oregon where 56% of trees are harvested annually according to the USDA. Over the five-week shipping season, Oregon will average an estimated 420 loads per day with North Carolina close behind at 360 loads per day.

Available capacity varies considerably in both markets based on geography and market imbalance, but at the moment both are competing with peak produce season for sweet potatoes in North Carolina and apples, potatoes, pears and onions in the Pacific Northwest.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Dry van outbound load post volumes are already up 8% w/w and 17% m/m in the Portland market pushing up rates by 6% m/m to $1.90/mile (excluding fuel surcharges). In the reefer sector available capacity is tighter with Portland volumes up 99% m/m and rates up $0.21/mile to $2.29/mile over the last month.

According to Carl Johnson, President of Pac West Transport Services, a freight brokerage that primarily ships trees out of the Pacific Northwest, “Everyone wants fresh trees on their lots the day after Thanksgiving, but the season starts earlier with wreaths moving in October, followed by container loads of Christmas trees destined for Hawaii in the first week of November.”

After that, dry van and reefer loads start shipping to the Midwest, Texas and California where about 45% of loads are destined according to the National Christmas Tree Association.

Even though Christmas trees can be hauled on a flatbed, shorter haul loads to California can go in a dry van, but anything to the Midwest or East Coast requires a reefer to protect the trees from both heat and freezing, according to Pac West. “Most customers want ice blown over the top of the trees to keep them cold and prevent them from drying out,” explained Carl Johnson, “but Pac West does have some customers in Texas who only want vans, even on such a long trip.” They believe the air from the reefer unit dries the trees out and the chute for the air flow limits the number of trees that will fit in the trailer.

According to National Christmas Tree Association President Dugald Kell, Jr., Christmas tree demand for markets west of the Mississippi River is handled by PNW farms while North Carolina handles everything east. He expects demand for real Christmas tree sales will increase this year as people travel less and stay at home doing more decorating in the process. With people anxious for an outing during the pandemic, Dugald expects going to a Christmas tree farm will be a much-anticipated outing for families this year.

Tree growers will literally have some stiff competition this year, though. According to IHS Markit’s PIERS data, 20’ container import volumes of artificial Christmas trees from China for the period July to October are up 80% y/y.

Dry Van

The recent release of the Cass Freight Index reported shipment volumes increased by 0.3% m/m, which was the highest reading since September 2019. Shipments are now up 2.4% y/y. Cass noted, “Feeding the domestic transport machine, imports were also seen growing in October. The Port of Long Beach announced a 19.4% y/y increase in October import volume with November volumes expected to be up y/y as well.”

Top 10 Market Watch

Outbound load volumes in our top 10 freight markets remained largely unchanged last week although there was some significant movement in major markets.

Volumes in Los Angeles (#1) and Ontario (#3) continued to slide dropping by 5% w/w – capacity continues to tighten following four successive weeks of rate increases. Outbound spot rates in Los Angeles hit $3.12/mile this week, with rates in neighboring Ontario higher at $3.19/mile. In Atlanta (#2) gains on the outbound volume side (up 8% w/w) were offset by volume decreases on the inbound side (down 8% w/w) leaving spot rates unchanged at $2.19/mile.

Further north in Charlotte, (#5) volumes continued to climb for the fifth week in succession and are now up 33% m/m although capacity eased slightly as rates dropped $0.02/mile to $2.19/mile.

Reefer

This time of the year we start to see the transition from Salinas, CA to southern desert regions for production of leafy greens including lettuce. The “Winter Salad Bowl” in Yuma, Arizona (#12) began harvesting iceberg lettuce last week with this region slated to meet around 95% of domestic demand.

Outbound volumes are up 17% w/w after five consecutive weeks of gains and capacity is tightening as spot rate jump $0.25/mile w/w to $2.65/mile.

Top 10 Market Watch

Twin Falls, ID, held onto the number one position last week with a 1% w/w increase in outbound refrigerated load volumes. Available capacity tightened again with spot rates moving up $0.11/mile to $2.69 for loads outbound from Twin Falls.

Further south in Los Angeles (#2) and Ontario, (#4) volumes were down 5% and up 5% respectively w/w. Available capacity in southern California is still very tight for outbound loads, moving spot rates up by $0.10/mile w/w to $3.18/mile and $3.31/mile respectively.

In the east, outbound volumes and spot rates for reefer loads in Atlanta (#3) continue to slide for the third week in succession, but capacity remained unchanged last week as rates stayed flat at $2.37/mile.

Flatbed

Total single-family housing starts increased again for the seventh month in succession rising by 6% m/m in October, according to the latest data release from the U.S. Census Bureau. Compared to the previous year, single family housing starts are now up 29% y/y.

In the southeast region where 56% of new homes are built, volumes increased by 7% m/m, and in the west region (24% of new starts) volumes increased by 4% m/m and are now up 28% y/y. According to Yahoo Finance, “Housing starts data published Wednesday showed new homes under construction rose to the fastest pace since February, while permits to build homes are at more than 13-year highs”.

Top 10 Market Watch

Although the national flatbed market appears to be cooling, there were some strong gains in Memphis, which regained the number one position after a 25% w/w increase in outbound volumes. Although inbound Memphis volumes were only up 3% w/w, for every 4 load posts out of the market, only one came in last week putting upward pressure on outbound rates, which increased $0.06 to $2.84/mile.

Volumes in nearby Little Rock (#2) decreased by 7% w/w with a similar trend in the large Alabama market where volumes in Montgomery (#3), Decatur (#4) and Birmingham (#9) dropped by 4%, 8% and 7% respectively w/w.

Any questions on this report or market conditions can be emailed to askIQ@dat.com.