For the first time since 2012, the national average van rate was lower in December than it was in November. While this past December might have been slower than expected, 2018 ended much the same way it started: Not enough trucks to keep up with demand.

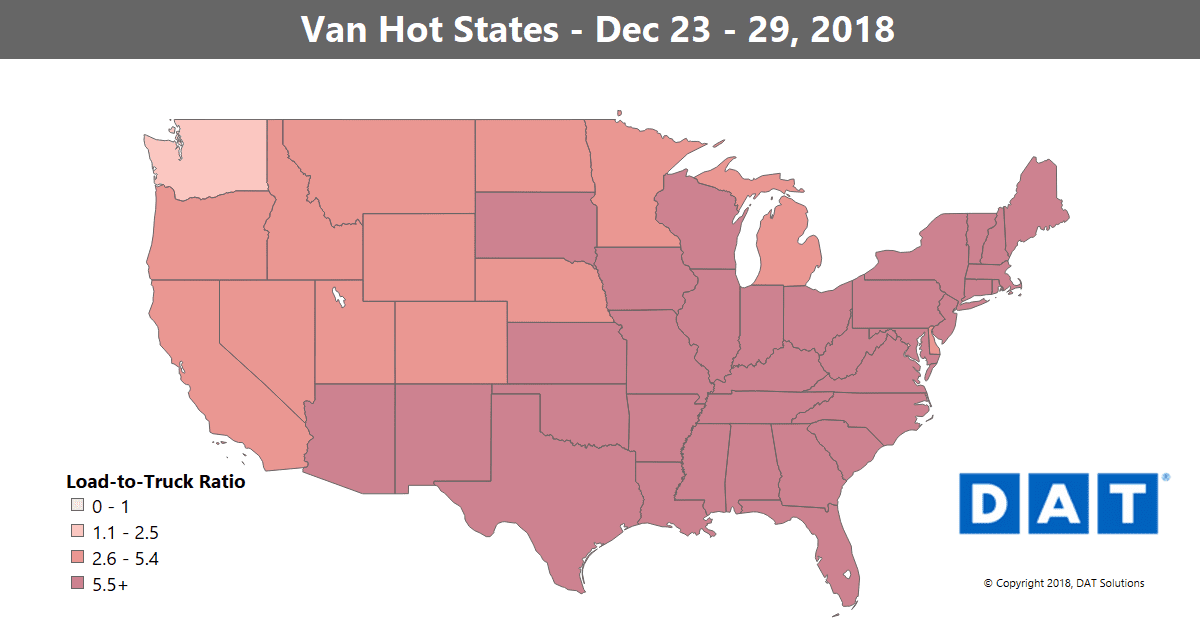

Less freight moved last week, as businesses shut down for Christmas. But for the loads that did need to move, freight brokers and shippers had a hard time finding trucks, as evidenced by the soaring load-to-truck ratios across the country.

Load posts on the DAT Load Board were down 21% compared to the previous week — right around what you’d expect for a week that includes a major holiday. Compare that to truck posts during the same week, which fell off 47%, and it looks like a lot more truckers worked a 3-day week.

In a short holiday week, carriers and drivers were reluctant to accept long hauls that took them away from home, so those loads paid a premium.

On the top 100 van lanes, 70 of them paid higher rates last week. You don’t often see that many lanes move up at once.

All rates below include fuel surcharges and are based on real transactions between brokers and carriers.

RISING

Apparently, carriers don’t want to go to Buffalo right now, so shippers and brokers had to pony up to get loads delivered there.

- Charlotte to Buffalo, up 52¢ to $2.59/mile

- Columbus to Buffalo, up 20¢ to $3.68/mile

- Allentown, PA, was still a busy hub, and the lane to Cleveland rose 22¢ to $2.03/mile

- Same for Atlanta, with the lane to Charlotte up 23¢ to $2.74/mile

FALLING

Buffalo was the only market with falling prices last week, but there were a few other individual lanes worth noting.

- Denver to Houston, fell 52¢ to $2.59/mile, giving back increases from the previous week

- Los Angeles to Seattle was down 14¢ to $2.65/mile

- One inbound Buffalo lane actually fell: Philly to Buffalo was down 17¢ to $2.74/mile

Find loads, trucks and lane-by-lane rate information in DAT load boards, including rates from DAT RateView.