It’s potato harvest season in the Pacific Northwest, which produces nearly one-third of all potatoes grown in the U.S. This region hosts significant food processing companies, including global leaders like McCain Foods, Lamb Weston, and Simplot, all of which operate large-scale French fry processing plants.

According to the USDA, Idaho produced approximately 145 million cwt of potatoes in 2023, the highest output of any state. The primary location for potato production in Idaho is the Snake River Valley in Eastern Idaho (Twin Falls freight market). Washington followed with about 99.7 million cwt of potatoes, mainly from central Washington’s Skagit Valley and Columbia Basin (Pendleton market). The region’s climate, soil, and water availability are ideal for growing high-quality potatoes, primarily for French fries, potato chips, and other processed products.

Data from the National Potato Council indicates that roughly 70% of potatoes in the United States are processed, while the remaining 30% are consumed fresh. Due to the growth of fast food consumption, most processed potatoes are used for frozen French fries, a trend that has remained steady since the 1950s. The foodservice industry is a significant outlet for potatoes, particularly in the form of frozen fries.

Although most potatoes grown in the U.S. are consumed domestically, foreign trade plays an important role. Approximately 20% of the potatoes grown or processed in the U.S. are exported as fresh or processed products, while the U.S. imports various fresh and processed potato products.

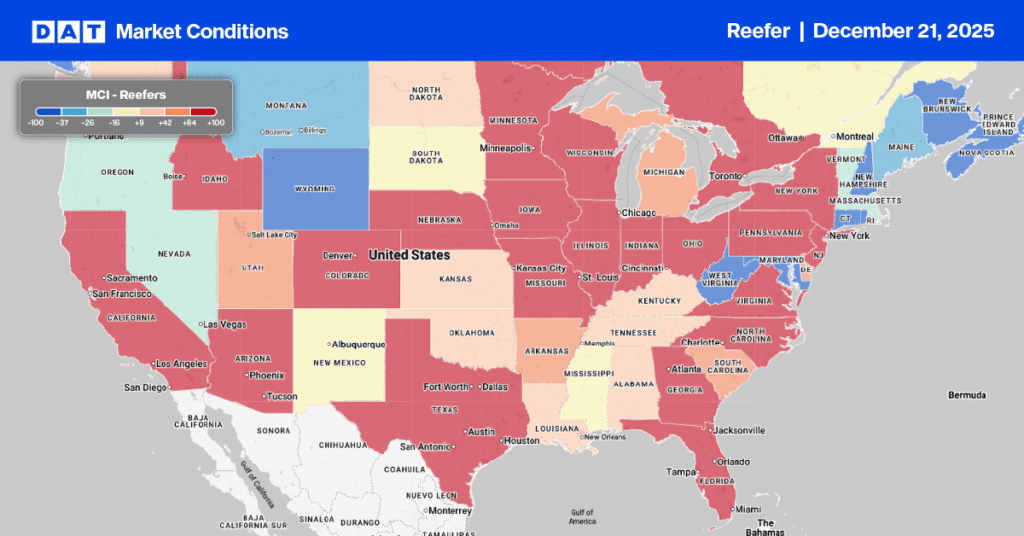

Stormclouds are on the horizon for reefer carriers

However, reefer carriers face challenges. Lamb Weston, which supplies around 80% of French fries sold at fast food outlets in the U.S. and nearly 13% of McDonald’s annual French fry sales, announced layoffs and plant closures in its most recent earnings call. Persistently high inflation has pushed fast food items, including French fries, into the luxury food category, making them less accessible for many consumers.

Lamb Weston revealed it would cut 4% of its global workforce—approximately 428 jobs—curtail production lines and close its processing facility in Connell, Washington. This announcement came alongside declining first-quarter results for fiscal 2024, which included a 1% drop in sales and a staggering 46% drop in net income. CEO Tom Werner stated, “That recalibration isn’t because Americans have gone cold on hot fries. Instead, a rising number of diners are no longer willing to pay the higher prices for them—and other increasingly expensive menu items—at sit-down restaurants and fast-food chains.” He does not anticipate this situation changing soon, suggesting that restaurant traffic and frozen potato demand will remain soft through the remainder of fiscal 2025.

The impact extends beyond fast food, impacting reefer carriers in general

Dive Insight reported that several companies are revising their manufacturing networks in 2024 to cut costs and strategize for growth. For instance, Flowers Foods, the maker of Wonder Bread, announced plans to close a bun-making plant in Louisiana. Simultaneously, Bimbo Bakeries USA, which manages Entenmann’s and Sara Lee brands, will shut down two facilities in New York and another in Texas. Additionally, Dr. Pepper has revealed plans to close manufacturing plants in Virginia and Vermont while investing in its coffee roasting facility in South Carolina.

In May, Campbell Soup announced the closure of one plant and a reduction in size for another facility. Darden Restaurants also reported a same-store sales dip of 1.1% for the most recent quarter and noted a 2.9% decline in traffic to its Olive Garden brand.