With the threat of new tariffs on Chinese imports, there was uncertainty over how truckload markets will react heading into August. So far, there has been a lack of urgency on the part of shippers, which has lowered rates for dry van shipments. And for now, the threat of tariffs seems to have been delayed.

Overall van volume dipped 3%, while 57 of the top 100 van lanes saw lower prices. Texas and Colorado markets cooled, but the Upper Midwest saw an increase in activity and rates.

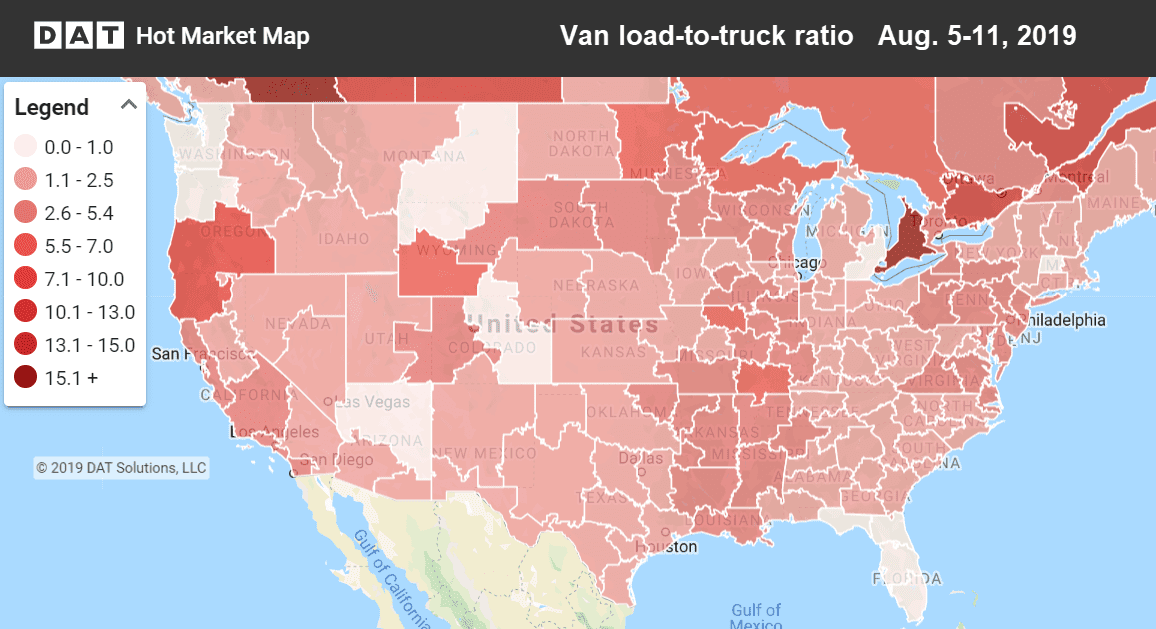

Hot Market Maps show the number of available trucks vs. available loads and are available in the DAT Power load board and DAT RateView.

Rising

Buffalo remained active and rising. Rates in and out of Chicago have seen an increase in pricing power as well.

- Buffalo to Chicago rose 15¢ to $1.67/mi

- Chicago to Buffalo increased 21¢ to $2.64/mi

- Chicago to Atlanta was up 13¢ to $2.01/mi

- Cleveland to Chicago gained 10¢ to $1.91/mi

Falling

While most lanes paid less last week, the declines were relatively slight. The biggest drop was out of Charlotte.

- Charlotte to Allentown slipped 13¢ to $2.26/mi

- Houston to Chicago down 9¢ to $1.47/mi

Find loads, trucks and lane-by-lane rate information in DAT load boards, including rates from DAT RateView.