Record-high diesel costs have captured everyone’s attention recently, so this week we’re going to dig a little deeper into fuel efficiency and ways to save money.

Unlike in past years when high diesel prices pushed carriers out of the industry, record-high prices this year follow an extraordinarily profitable 2021. DAT carriers reported having one of the best years in decades as they took advantage of record-high spot rates and relatively low diesel prices in the latter half of the year. As a percentage of trip revenue, diesel averaged 19% in 2021. Still, with recent record-high prices, fuel is currently around 33% of trip revenue for carriers in the DAT freight network. At these levels and based on previous freight cycles, high diesel prices typically send carriers out of the industry crushed under the weight of negative cash flow.

This year it’s different, and here’s why.

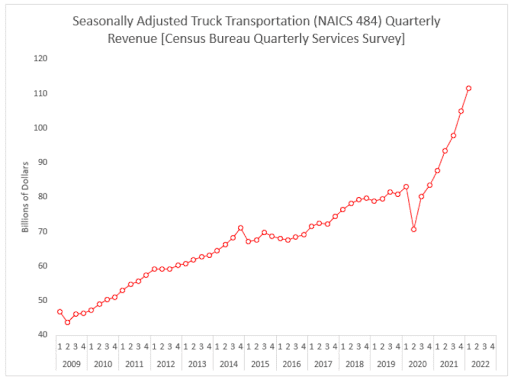

According to Prof. Jason Miller at Michigan State University, “the latest Quarterly Services Survey from the Census Bureau indicates revenue (including fuel surcharges) for truck transportation establishments in the first quarter of 2022 increased 6.2% from Q4 2021 and a 19.3% increase year-over-year. In Q1 2019, seasonally adjusted revenue was $78.85 billion. Q1 2022 was $111.51 billion, a 41% gain.”

Large truckload carrier Werner Enterprises from Omaha, NE, reported strong first-quarter 2022 results in their Truckload Transportation Services and Logistics segments. According to Derek J. Leathers, Chairman, President, and Chief Executive Officer, “This was our seventh consecutive quarter of record quarterly adjusted earnings per share.” Werner’s truckload total revenues for the quarter were $764.6 million, an increase of $148.2 million or 24% compared to the prior-year quarter.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

How have high diesel prices impacted carriers?

DAT has held the view that carriers, especially small ones, are in an excellent financial position to weather the storm due to record-high diesel prices and inflation driving up other operating costs. Of course, that depends on how long prices remain high and how much more spot rates drop in the next few months. Carrier profit margins are plummeting, and for an owner-operator, they could have dropped by as much as 228% in the last year. This time last year, long-haul owner-operators operating profit per mile would have been around $0.31/mile – today, it’s negative $0.35/mile assuming all other costs and utilization metrics remain unchanged.

So what can carriers do to manage fuel costs?

Improve fuel efficiency.

“When drivers are doing well and making a lot of revenue, they tend to not care as much about fuel efficiency”, according to ATBS. Owner-operator clients at ATBS averaged 6.89 MPG, with the best MPG coming in the dry van segment at 7.31.

Understand how the fuel surcharge works

A fuel surcharge is a mechanism in the trucking industry that helps balance the fluctuations in fuel cost. Incorporating a fuel surcharge into transportation pricing became a widely accepted practice years ago. This surcharge allows owner-operators to offset the costs of high fuel prices, especially in times like these. In some cases, depending on fuel efficiency levels, owner-operators can make a profit from the fuel surcharge. According to ATBS, the better a carrier’s MPG, the more they save on fuel, and in most cases, you profit from the fuel surcharge given the 6.5 mpg average used by most in the industry.

Take advantage of fuel discount networks and fuel cards

For leased-on owner-operators hauling freight for a carrier, staying within the carrier’s fuel network offers access to negotiated discounts. Most truckstop chain associations offer fuel cards. For small carriers, the OOIDAs Truckers Advantage fuel card is accepted nationwide at over 8,000 fuel locations, including a 14¢ per gallon discount off the pump price at TA/Petro locations. Another option is to use the DAT One mobile app to find the best fuel prices based on location. DAT One also integrates with DAT fuel cards, highlighting the best prices and allowing drivers to see discounted fuel card prices at any location.

How can carriers modify driving habits to save on fuel?

There are several ways drivers can modify their habits right now that can put extra money in your pocket:

Slow down

According to ATBS, a driver running at 70 mph gets 6.5 mpg, and another running at 60 mph gets 7.5 mpg. Over an hour, driver A is 10 miles further down the road than driver B, but at $5.50/gallon, he or she has spent around $15 more to go those 10 miles in the same amount of time. Based on 110,000 miles per year and an average of 6.5 mpg, a truck will incur $12,410 more in fuel costs than 7.5 mpg.

Idle less

The average truck burns around a gallon per hour when idling at 1,000 RPM. During a 10-hour break, a truck can burn through 10 gallons of fuel or $57 at today’s prices. Even by reducing engine RPMs to 650 when idling, fuel consumption drops by half to just 5 gallons for the 10-hour break. That reduction in engine RPM would reduce fuel costs by almost $200 per week or just over $8,000 per year.

In addition to saving money on these essential cost items, carriers can look for ways to run more loaded miles per week and, in the process, cut down on empty miles where the fuel surcharge doesn’t apply. More strategic load selection and even trying different lanes where a supply/demand imbalance offers higher rates per mile is an easy way to improve margins. Having great business partners like the experts at OOIDA and ATBS would also be a great place to start.