We could be witnessing a reversal of last year’s diversion of import volumes away from the West Coast to the East and Gulf Coasts. Shippers fearful of labor disruptions and port congestion diverted imports to ports like Houston and Savannah via the Panama Canal in 2021 and 2022. The 2024 International Longshoremen’s Association (ILA) labor contract renewal on the East Coast may have the same effect but in the opposite direction. Adding to the likelihood that West Coast import volumes could bounce back to pre-pandemic levels are the ongoing drought conditions in the Panama Canal and resulting cargo vessel draft restrictions.

DAT Freight & Analytics spoke to international shipping expert John McCown, who speculated:

“…some volume is shifting back to the West Coast. West Coast ports were much stronger in September, with an increase of 16.7%, while East/Gulf Coast ports had a 13.4% volume decrease. The West Coast was buoyed by the ports in Seattle/Tacoma, which had a 31.8% gain.”

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Peter Tirschwell from The Journal of Commerce (JOC) reports that the president of the union representing dockworkers on the U.S. East and Gulf coasts told his members on Saturday to be prepared for a strike next year, raising the possibility of what would be the first significant labor disruption on those coasts since 1977.

Market watch

All rates cited below exclude fuel surcharges unless otherwise noted.

Except for New Jersey, where linehaul rates increased by a penny per mile to $1.41/mile last week, the remaining Top 5 spot market states (California, Illinois, Georgia, and Texas) dropped by a combined $0.03/mile, and averaged $1.72/mile last week. That’s just $0.03/mile higher than in 2019.

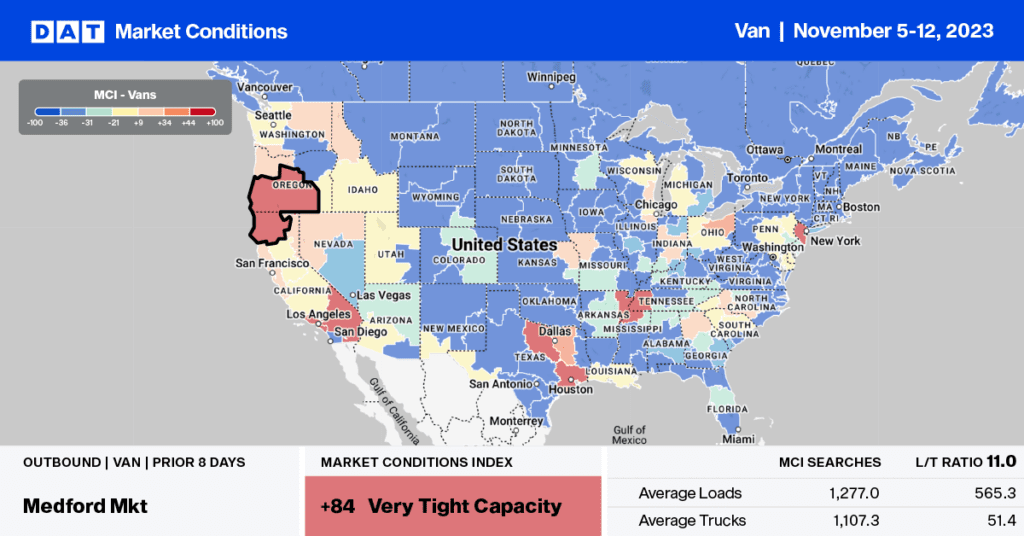

In contrast, solid gains were reported in the Pacific Northwest (PNW), where Fall produce and Christmas tree shipping seasons are in full swing. Outbound rates in Washington and Oregon spiked last week, increasing by $0.10/mile to an outbound average of $1.47/mile. Last week’s increase follows seasonal trends, and based on prior years, spot rates have another $0.25/mile to $0.35/mile to go before peaking at the end of the year.

The Seattle market reported a $0.22/mile increase last week, averaging $1.96/mile for outbound loads, while in neighboring Portland, carriers were paid on average $2.04/mile last week. In Indiana, spot rates were identical to 2019 at $1.91/mile following last week’s $0.03/mile gain.

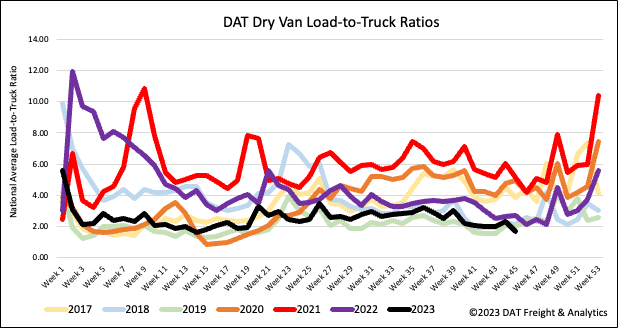

Load-to-Truck Ratio (LTR)

Following the prior week’s pre-Thanksgiving increase in volume, dry van spot market load post (LP) volume dropped against the typical seasonal upward trend. LP volume recorded the largest single-week decrease in seven years following last week’s 20% week-over-week (w/w) negative result. Carrier equipment posts increased 8% w/w as capacity loosened, resulting in last week’s dry van load-to-truck ratio (LTR) dropping by 28% to 1.65, the lowest LTR in the last seven years for Week 45.

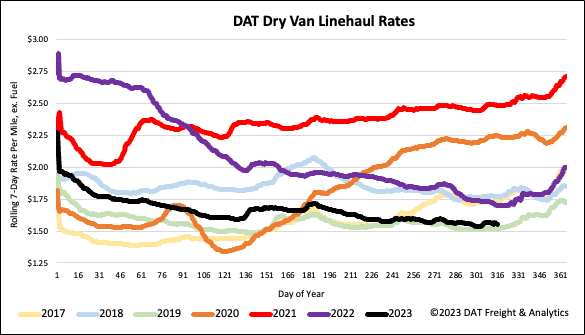

Linehaul Spot Rates

At $1.57/mile, dry van linehaul rates have been primarily flat for the last seven weeks. Compared to last year, linehaul rates are $0.15/mile lower, but remained $0.04/mile higher than 2019. Compared to DAT’s Top 50 lanes based on the volume of loads moved, which averaged $1.86/mile last week, the national average is around $0.29/mile lower.